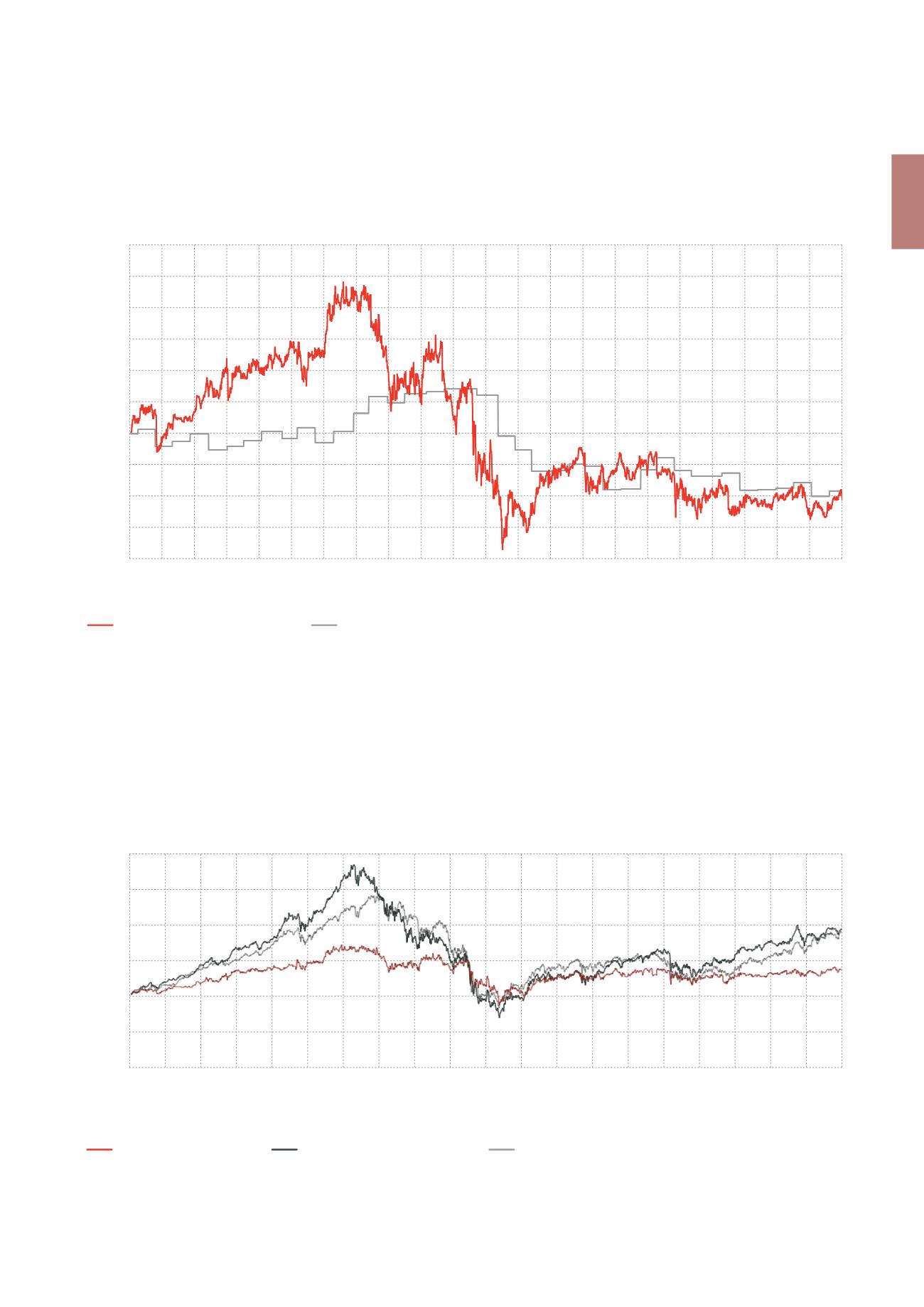

TOTAL RETURNS (IN %)

The total return for the shareholder is measured by reference to the evolu-

tion of the share price and includes the distribution of the dividend or any

other distribution realised or paid by the company.

Assuming the reinvestment of the 2012 dividend made available for pay-

ment in 2013, the Cofinimmo share achieved a return of 7.5% over 2013.

The graph below illustrates the stock market performances of the

Cofinimmo share compared to the BEL20 and EPRA Europe indexes

over the past ten years, dividend return included. During this period, the

Cofinimmo share generated a return of 36.3%, i.e. an annual average return

of 2.9%. The BEL20 and EPRA Europe indexes recorded variations of 88.7%

and 92.6% respectively, which corresponds to average annual yields of

5.9% and 6.8%.

COMPARISON OF SHARE PRICE VS. NET ASSET VALUE PER SHARE

(in €)

TOTAL RETURNS

Cofinimmo share price

Net asset value (in fair value)

170

160

150

140

130

120

110

100

90

80

70

Dec-03

Jul-04

Dec-04

Jul-05

Dec-05

Jul-06

Dec-06

Jul-07

Dec-07

Jul-08

Dec-08

Jul-09

Dec-09

Jul-10

Dec-10

Jul-11

Dec-11

Jul-12

Dec-12

Jul-13

Dec-13

Dec-03

Jul-04

Dec-04

Jul-05

Dec-05

Jul-06

Dec-06

Jul-07

Dec-07

Jul-08

Dec-08

Jul-09

Dec-09

Jul-10

Dec-10

Jul-11

Dec-11

Jul-12

Dec-12

Jul-13

Dec-13

70

80

90

100

110

120

130

140

150

160

170

0

50

100

150

200

250

300

31/12/13

30/06/13

31/12/12

30/06/12

31/12/11

30/06/11

31/12/10

30/06/10

31/12/09

30/06/09

31/12/08

30/06/08

31/12/07

30/06/07

31/12/06

30/06/06

31/12/05

30/06/05

31/12/04

30/06/04

31/12/03

Cofinimmo total return

300

250

200

150

100

50

0

EPRA Europe total return index

BEL20 total return index

\ 111

Cofinimmo in the Stock Market

\ Management Report