1

Gross dividend on the average annual share price.

2

Appreciation of the share price + dividend yield.

3

Dividends are subject to a 25% withholding tax.

4

Forecast.

5

Average calculated based on the number of trading days during which a volume was recorded.

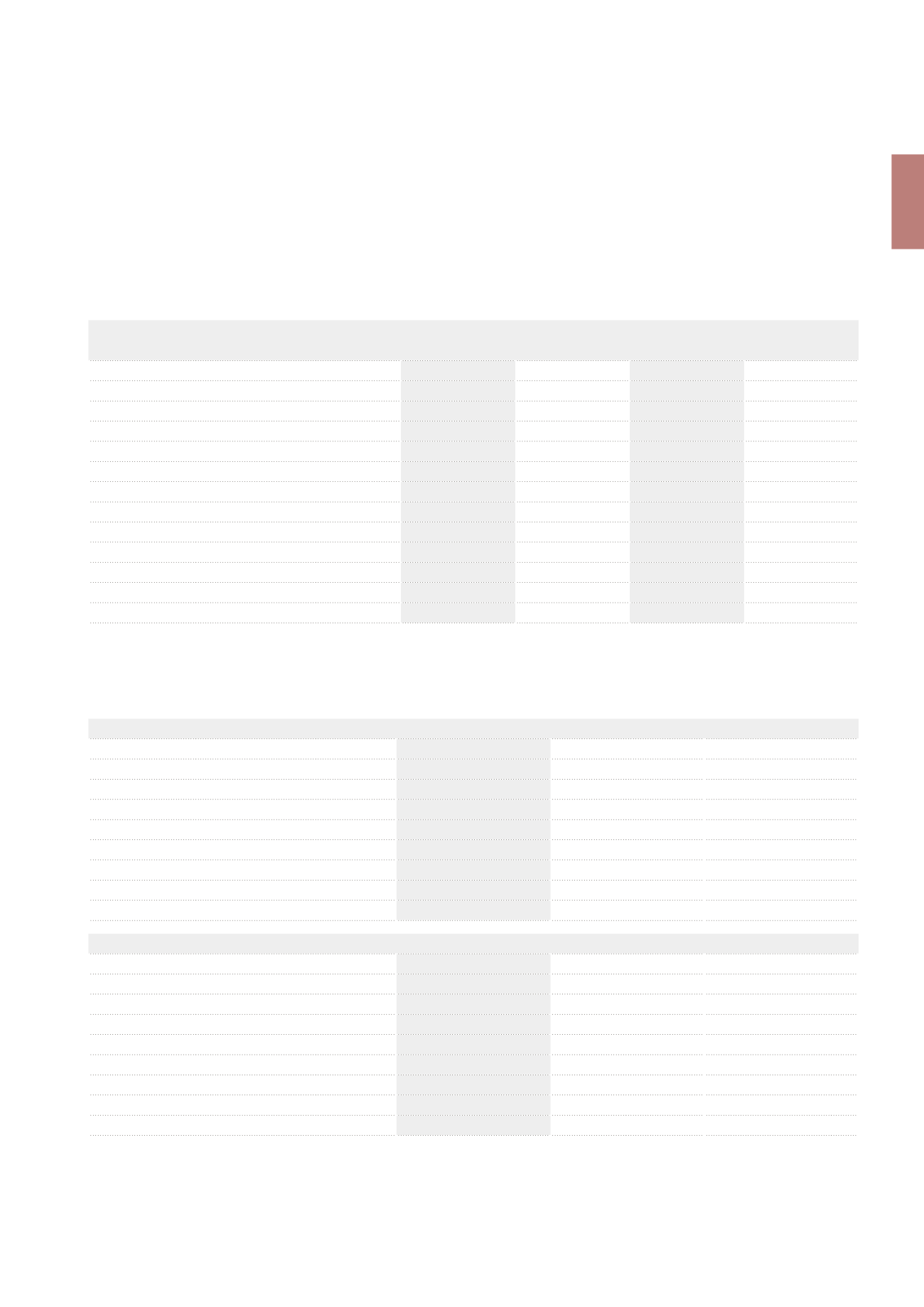

THE PREFERENCE SHARE

The preference shares are listed on NYSE Euronext Brussels (tickers: COFP1

for the series issued on 30.04.2004 and COFP2 for the series issued on

26.05.2004). These shares are registered with voting rights and are con-

vertible into ordinary shares since 01.05.2009, at a rate of one for one.

During the financial year 2013, 715 preference shares were converted into

ordinary shares. At 31.12.2013, 688,682 non-converted preference shares

are still outstanding.

In 2019, Cofinimmo will have the possibility to purchase the non-converted

shares at their issue price (also see the section “Capital structure” under

the chapter “Corporate Governance Statement” of this Annual Financial

Report).

ISIN BE0003811289

(COFP1)

ISIN BE0003813301

(COFP2)

2013

2012

2013

2012

Share price (in €)

At close

95.00

95.00

78.00

82.51

Average

95.00

98.55

84.71

82.32

Dividend yield

1

6.71%

6.46%

7.52%

7.74%

Gross return

2

(over 12months)

6.71%

8.06%

-1.89%

15.58%

Dividend

3

(in €)

Gross

6.37

4

6.37

6.37

4

6.37

Net

4.78

4

4.78

4.78

4

4.78

Volume

Average daily volume

5

0

28

66

91

Annual volume

0

139

1,061

2,909

Number of shares

395,148

395,198

293,534

294,199

Market capitalisation at the end of the period (x €1,000)

37,539

37,544

22,896

24,274

THE CONVERTIBLE BONDS

Cofinimmo issued two bonds convertible into ordinary shares:

ISIN BE0002176429

(Cofinimmo SA/NV 2011-2016)

2013

2012

2011

Market price (in %)

At close

102.75

102.30

93.19

Average

102.92

98.53

97.40

Yield to maturity (12-month average)

0.54%

2.27%

2.44%

Effective yield at issue

3.13%

3.13%

3.13%

Interest coupon (in %)

Gross (per €116.6)

3.13

3.13

3.13

Net (per €116.6)

2.34

2.34

2.47

Number of securities

1,486,332

1,486,332

1,486,332

ISIN BE6254178062

(Cofinimmo SA/NV 2013-2018)

2013

2012

2011

Market price (in €)

At close

110.56

N/A

N/A

Average

109.59

N/A

N/A

Yield to maturity (12-month average)

1.54%

N/A

N/A

Effective yield at issue

2.00%

N/A

N/A

Interest coupon (in %)

Gross (per €108.17)

2.00

N/A

N/A

Net (per €108.17)

1.50

N/A

N/A

Number of securities

1,764,268

N/A

N/A

\ 113

Cofinimmo in the Stock Market

\ Management Report