10

/

Management Report

/ Key Figures

KEY FIGURES

MANAGEMENT REPORT

Global information

(x€1,000,000)

31.12.2013

31.12.2012

Portfolio of investment properties (in fair value)

3,347.0

3,308.6

(x€1,000)

31.12.2013

31.12.2012

Property result

216,909

222,373

Operating result before result on the portfolio

185,619

188,839

Financial result

-74,935

-83,877

Net current result (Group share)

104,924

97,486

Result on the portfolio (Group share)

-46,187

586

Net result (Group share)

58,737

98,072

(in %)

31.12.2013

31.12.2012

Operating costs/average value of the portfolio under management

1

0.83%

0.87%

Operating margin

85.57%

84.92%

Weighted residual lease term

2

(in years)

11.6

11.7

Occupancy rate

3

95.43%

95.71%

Gross rental yield at 100% occupancy

7.03%

7.01%

Net rental yield at 100% occupancy

6.55%

6.55%

Average interest rate on borrowings

4

3.92%

4.11%

5

Debt ratio

6

48.87%

49.90%

Loan-to-value ratio

7

49.61%

51.21%

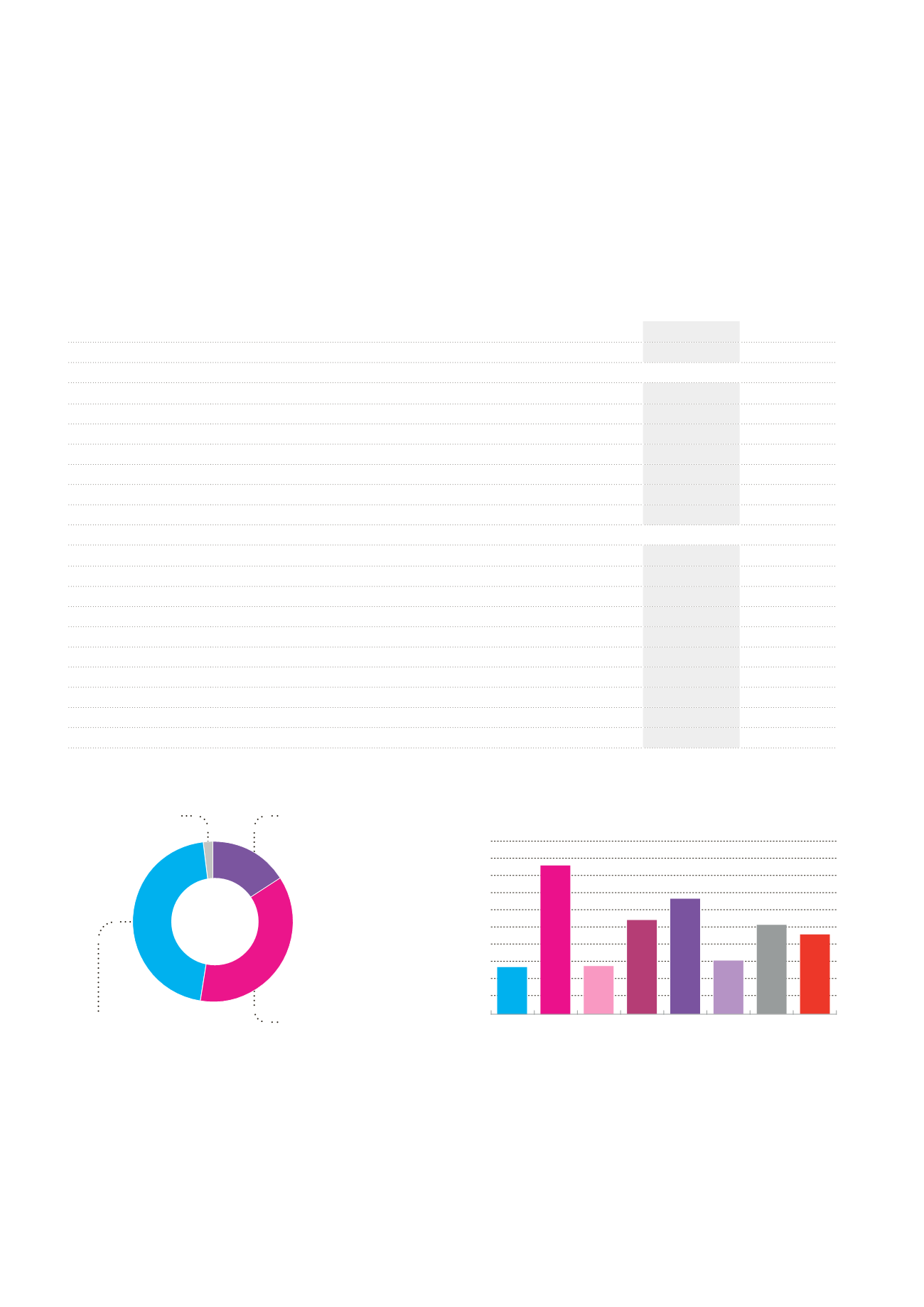

Healthcare real estate 36.7%

Offices 45.6%

Property of distribution

networks 15.9%

Other 1.8%

Breakdown of the portfolio in fair value

(in %)

Weighed residual lease length per segment

(in years)

2

6.9

21.7

7.0

13.7

16.8

7.8

13.0 11.6

Offices Healthcare

real estate

Belgium

Healthcare

real estate

France

Healthcare

real estate

Netherlands

Cafés/

restaurants

(Pubstone)

Insurance

agancies

(Cofinimur I)

Other

Global

portfolio

1

Average value of the portfolio plus the value of sold receivables relating to buildings which maintenance costs payable by the owner are still met by the Group through total cover

insurance premiums.

2

Up until the date of the tenant’s first break option.

3

Calculated according to actual rents and the estimated rental value for unoccupied buildings.

4

Including bank margins.

5

Until the end of 2012, the calculation of the average interest rate on borrowings included the depreciation costs of hedging instruments pertaining to the period. As a result of the

restructuration of the hedging scheme during 2013, the method used for the calculation of the average interest rate on borrowings has been reviewed and no longer includes these

costs. If this calculation method had been applied at 31.12.2012, the average interest rate on borrowings would have stood at 3.77% instead of 4.11%.

6

Legal ratio calculated in accordance with the legislation regarding Sicafis/Bevaks as financial and other debts divided by total assets. In accordance with Article54 of the Royal Decree

of 07.12.2010, where the debt ratio exceeds 50%, Cofinimmo must draw up a financial plan accompanied by an execution schedule detailing the measures taken to prevent this debt

ratio exceeding 65% of the consolidated assets. See Note23, section D.

7

Ratio calculated as the net financial debt divided by the sum of the fair value of the portfolio and the finance lease receivables.

25

20

15

10

5

0