THE “FISCALE BELEGGINSTELLING” (FBI)

The main characteristics of the Fiscale Beleggingsintelling regime are as

follows:

•

only public limited companies, limited liability companies and mutual

funds can be considered as FBIs;

•

the FBI’s statutory purpose and actual operations may only involve the

investment of assets;

•

investments which consist of fixed assets may be financed by

external capital up to no more than 60% of the book value of the

fixed assets;

•

all other investments may be financed by external capital up to no

more than 20% of the book value of these investments;

•

at least 75% of shares or ownership interests in an unlisted FBI must

be held by natural persons, entities not subject to income tax and/or

publicly traded investment companies;

•

natural persons may not directly or indirectly own 5% or more of the

shares or ownership interests in an unlisted FBI;

•

entities established in the Netherlands may not own 25% or more of the

shares or ownership interests in an unlisted FBI through non-resident

companies or funds;

•

FBI profits are subject to a 0% corporate tax rate;

•

the share of the FBI’s profits that can be distributed must be paid to

the shareholders and other beneficiaries within eight months following

the close of each financial year.

Cofinimmo does not have the FBI status in the Netherlands for Pubstone

Properties and its subsidiaries, but it does have the FBI status for its sub-

sidiary Superstone.

SHARE CAPITAL

ISSUED CAPITAL

The capital is fully paid-up.

SHARE CAPITAL

The shares have no par value.

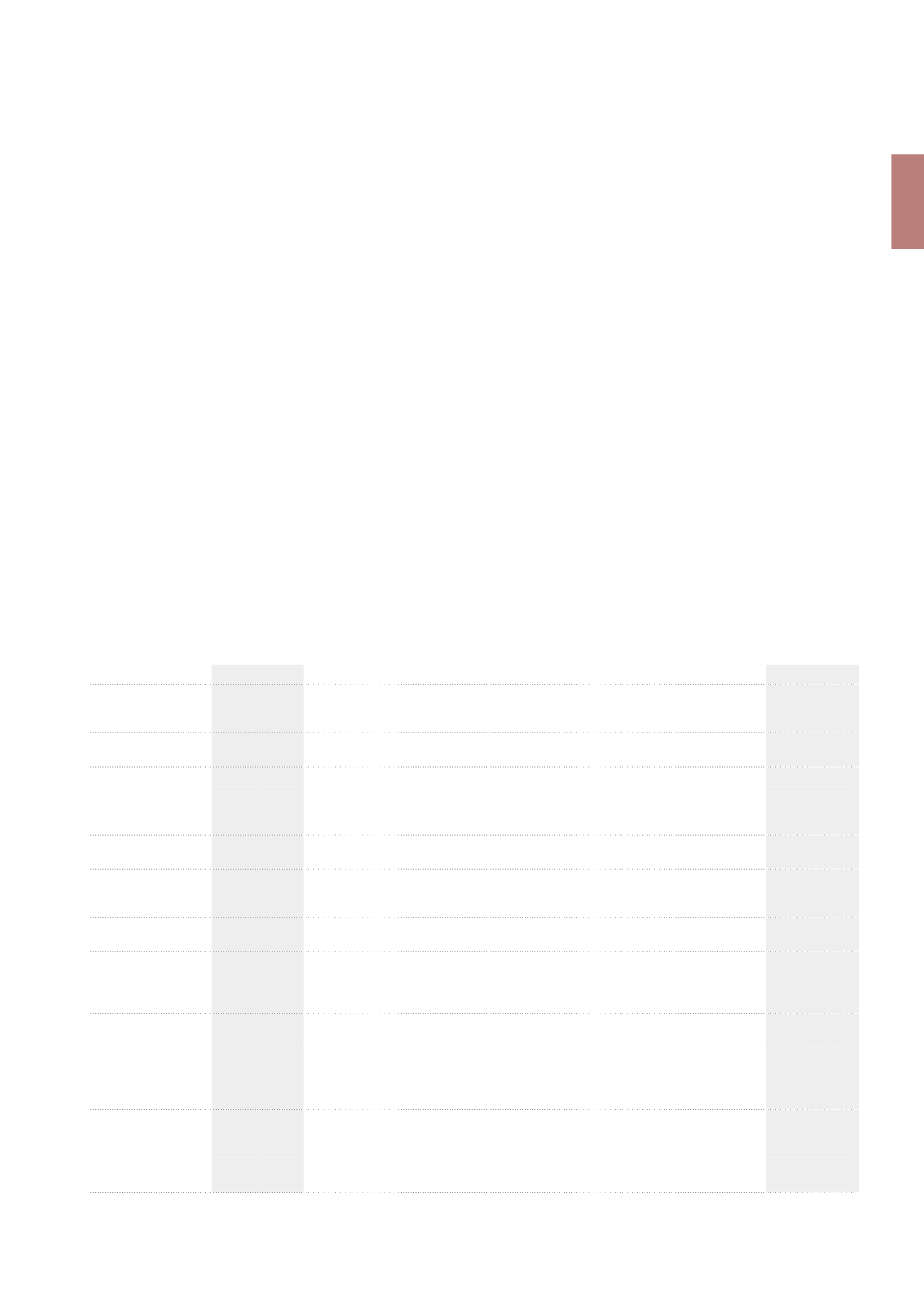

SCHEDULE OF CHANGES

The history of the share capital changes before 2013 can be consulted in the 2012

AnnualFinancialReportaswellasinTitleVIIIofthecompany’sArticlesofAssociation.

These documents are available on the website of the company

(www.cofinimmo.com).

Changes in 2013

Date of the transaction

31.03.2013

06.06.2013

30.06.2013

30.09.2013

31.12.2013

Type of transaction

Situation at

31.12.2012

Conversion

preference

shares Q1 2013

Contribution

in kind of

dividend rights

Conversion

preference

shares Q2 2013

Conversion

preference

shares Q3 2013

Conversion

preference

shares Q4 2013

Situation at

31.12.2013

Amount (€) of share

capital

+28,367,771.12

Issue price (€)

82.875

Amount (€) of the net

contribution to the

shareholders’ equity

1

+15,503,104.63

Number of ordinary

shares

+50

+529,362

+84

+581

Total number of

ordinary shares after

the transaction

16,423,925

16,423,975

16,953,337

16,953,421

16,953,421

16,954,002

16,954,002

Number of preference

shares COFP1

-50

Total number of

preference shares

COFP1 after the

transaction

395,198

395,148

395,148

395,148

395,148

395,148

395,148

Number of preference

shares COFP2

-84

-581

Total number of

preference shares

COFP2 after the

transaction

294,199

294,199

294,199

294,115

294,115

293,534

293,534

Total number of

preference shares

after the transaction

689,397

689,347

689,347

689,263

689,263

688,682

688,682

Total share capital

after the transaction

917,079,045.11

917,079,045.11

945,446,816.23 945,446,816.23 945,446,816.23 945,446,816.23

945,446,816.23

1

According to the accounting rules for the Sicafis/Bevaks under Belgian Law.

\ 203

Share Capital

\ Standing Document