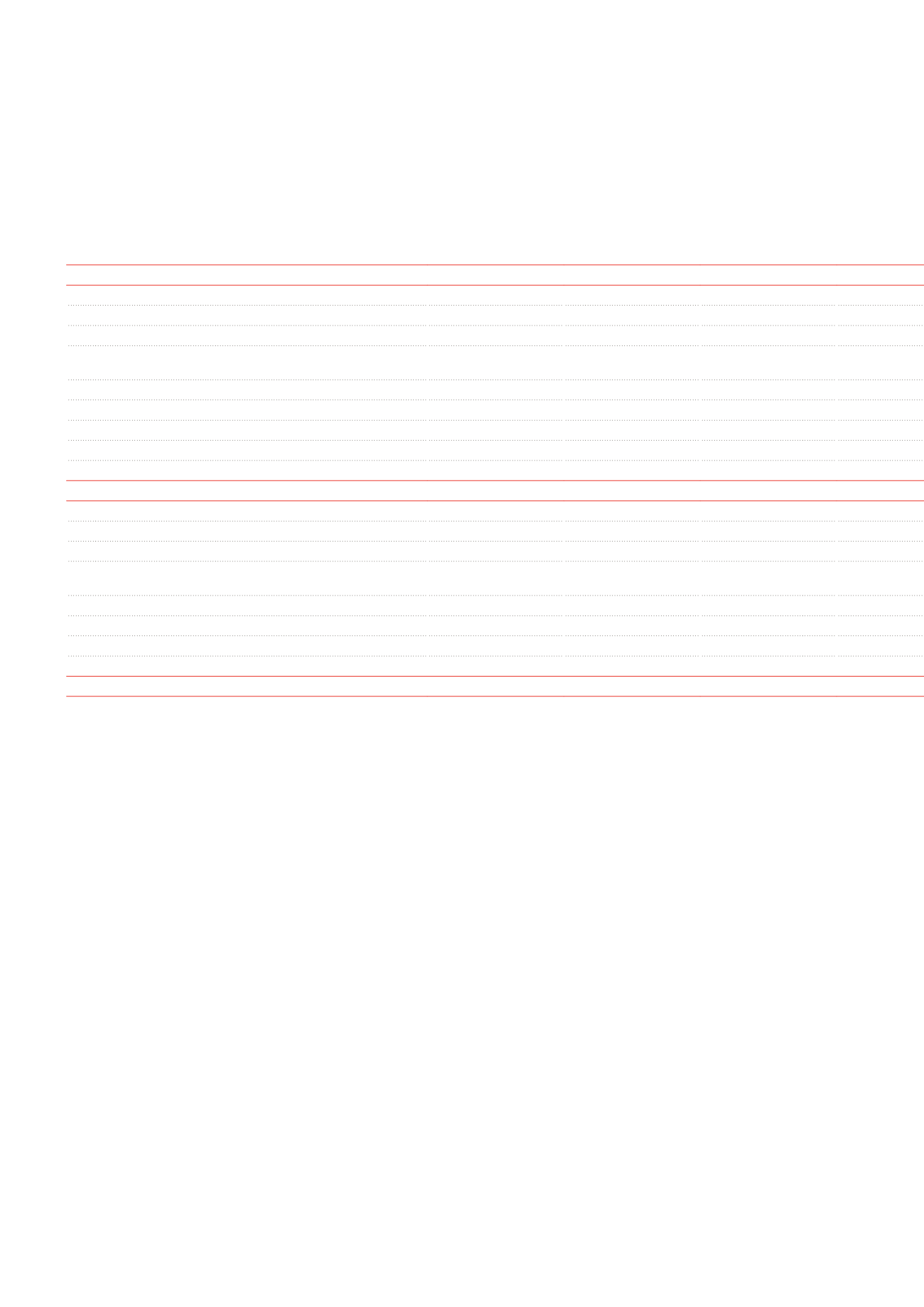

198

/

Annual Accounts /

Company Accounts

Detail of the reserves

(x €1,000)

Reserve for the positive/

negative balance of

changes in the fair value

of investment properties

Reserve for the

estimated transaction

costs resulting from the

hypothetical disposal of

investment properties

Reserve for the balance of

changes in the fair value

of authorised hedging

instruments qualifying

for hedge accounting as

defined under IFRS

AT 01.01.2012

-160,588

-60,066

-116,379

Appropriation of the 2011 net result

11,626

-575

9,641

Elements recognised in the global result

830

-50,374

Cash flow hedge

-50,374

Impact on the fair value of estimated transaction costs resulting

from the hypothetical disposal of investment properties

830

Impact of mergers

Other

SUBTOTAL

-148,962

-59,811

-157,112

Acquisitions/disposals of own shares

Dividends

AT 31.12.2012

-148,962

-59,811

-157,112

Appropriation of the 2012 net result

23,727

-176

11,080

Elements recognised in the global result

501

57,288

Cash flow hedge

57,288

Impact on the fair value of estimated transaction costs resulting

from the hypothetical disposal of investment properties

501

Other

SUBTOTAL

-125,235

-59,486

-88,744

Acquisitions/disposals of own shares

Dividends

AT 31.12.2013

-125,235

-59,486

-88,744