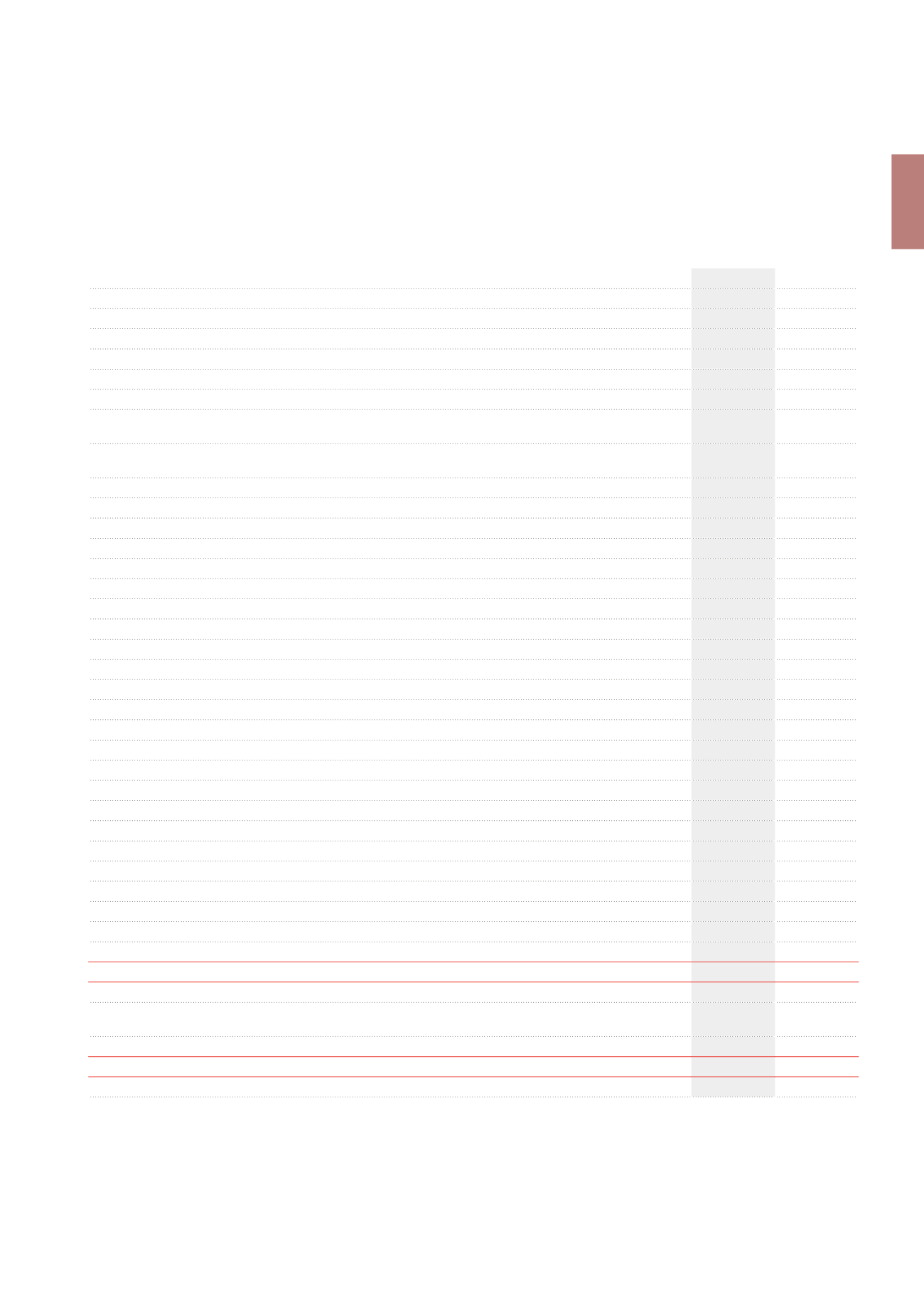

\ 193

Company Accounts

\ Annual Accounts

Global result

(income statement) (abbreviated format)

(x€1,000)

2013

2012

A. NET RESULT

Rental income

124,654

136,353

Writeback of lease payments sold and discounted

25,276

22,994

Rental-related expenses

-293

-296

Net rental income

149,637

159,051

Recovery of property charges

101

756

Recovery income of charges and taxes normally payable

by the tenant on let properties

13,357

14,753

Costs payable by tenants and borne by the landlord on rental damage

and refurbishment at end of lease

-1,277

-1,765

Charges and taxes normally payable by the tenant on let properties

-15,225

-16,294

Property result

146,593

156,501

Technical costs

-3,595

-4,392

Commercial costs

-846

-977

Taxes and charges on unlet properties

-3,984

-3,758

Property management costs

-11,384

-11,226

Other property charges

-16

-1

Property charges

-19,825

-20,354

Property operating result

126,768

136,147

Corporate management costs

-6,367

-6,836

Operating result before result on the portfolio

120,401

129,311

Gains or losses on disposals of investment properties and other non-financial assets

-8,144

1,831

Changes in the fair value of investment properties

-28,205

-21,891

Other result on the portfolio

77

-1,422

Operating result

84,129

107,829

Financial income

29,774

18,981

Net interest charges

-56,073

-54,780

Other financial charges

-2,085

-2,737

Changes in the fair value of financial assets and liabilities

856

28,915

Financial result

-27,528

-9,621

Pre-tax result

56,601

98,208

Corporate tax

579

-2,173

Exit tax

Taxes

579

-2,173

NET RESULT OF THE PERIOD

57,180

96,035

B. OTHER ELEMENTS OF THE GLOBAL RESULT

Impact on the fair value of the estimated transaction costs and transfer duties resulting from the hypothetical disposal

of investment properties

501

830

Changes in the effective part of the fair value of authorised cash flow hedging instruments

57,288

-50,374

OTHER ELEMENTS OF THE GLOBAL RESULT

57,789

-49,544

C. GLOBAL RESULT

114,969

46,491

COMPANY ACCOUNTS