196

/

Annual Accounts /

Company Accounts

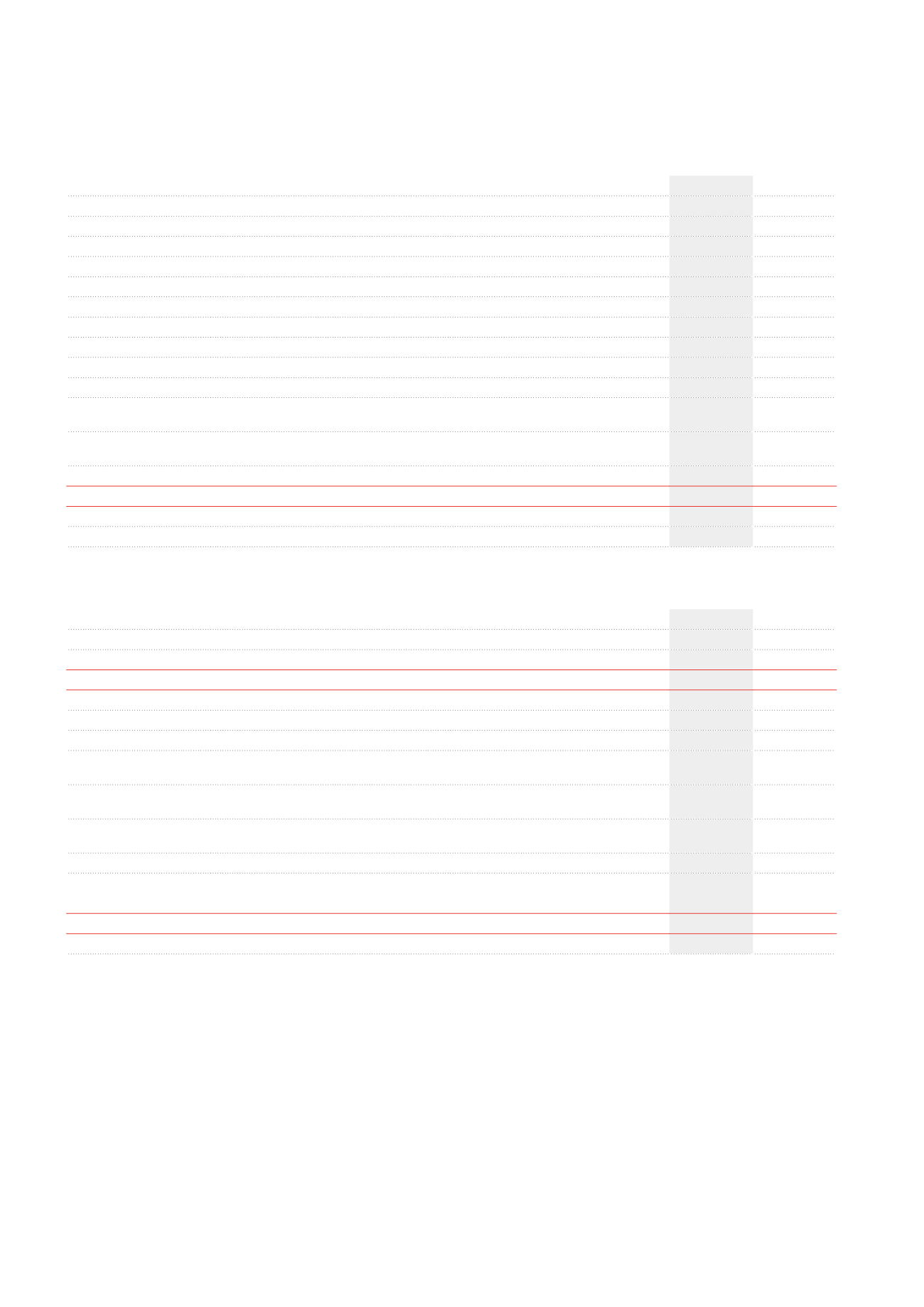

Non-distributable equity according to Article617 of the Company Code

(x€1,000)

2013

2012

Net assets

1,614,937

1,514,701

Dividend distribution and profit-sharing plan

-106,164

-111,208

NET ASSETS AFTER DISTRIBUTION

1,508,773

1,403,493

Paid-up capital or, if greater, subscribed capital

945,447

917,079

Share premiums unavailable for distribution according to the Articles of Association

451,673

436,170

Reserve for the positive balance of changes in the fair value of investment properties

Reserve for the estimated transaction costs and transfer duties resulting

from the hypothetical disposal of investment properties

-60,632

-59,987

Reserve for the balance of changes in the fair value

of authorised hedging instruments qualifying for hedge account

-84,168

-146,032

Reserve for the balance of changes in the fair value

of authorised hedging instruments not qualifying for hedge accounting

3,743

-14,900

Reserve for own shares

Other reserves declared non-distributable by the General Meeting

3,279

2,941

Legal reserve

NON-DISTRIBUTABLE EQUITY ACCORDING TO ARTICLE 617 OF THE COMPANY CODE

1,259,342

1,135,269

Remaining margin after distribution

249,431

268,225

Dividend distribution obligation according to the Royal Decree of 07.12.2010 concerning Sicafis/Bevaks

(x€1,000)

2013

2012

Net result

57,180

96,035

Depreciation (+)

374

381

Writedowns (+)

-61

-3

Writeback of writedowns (-)

-1

-14

Writeback of lease payments sold and discounted (-)

-25,276

-22,994

Other non-cash elements (+/-)

2,423

18,769

Result on disposal of property assets (+/-)

8,143

-1,831

Changes in the fair value of investment properties (+/-)

7,663

-25,794

Corrected result (A)

50,445

64,549

Realised gains and losses

1

on property assets during the financial year (+/-)

-40,385

6,718

Realised gains

1

on property assets during the financial year,

exonerated from the distribution obligation if reinvested within four years (-)

-6,594

-10,928

Realised gains on property assets previously exonerated from the distribution obligation

and not reinvested within four years (+)

Net gains on disposal of property assets not exonerated from the distribution obligation (B)

-46,979

-4,210

TOTAL (A+B) X 80%

2,773

48,271

Debt decrease (-)

-62,101

DIVIDEND DISTRIBUTION OBLIGATION

48,271

1

In relation to the acquisition value, increased by the capitalised renovation costs.