190

/

Annual Accounts /

Notes to the Consolidated Accounts

NOTE 43.

PAYMENTS BASED ON SHARES

Stock option plan

In 2006, Cofinimmo launched a stock option plan whereby 8,000 stock

options were granted to the Group’s management. This plan was

relaunched during each of the following years. In 2013, a total of

3,320 stock options were granted.

When they are exercised, the beneficiaries will pay the exercise price

of €88.12 per share for the 2013 plan in exchange for the delivery of the

securities. In the event of the voluntary or involuntary departure (exclud-

ing premature termination for serious reasons) of a beneficiary, the stock

options accepted and vested can only be exercised during the first

exercise window following the date of premature termination of the con-

tract, except in case of retirement. Options which have not been vested

are cancelled. In the event of the involuntary departure of a beneficiary for

serious reasons, all stock options accepted but not exercised, whether

vested or not, are cancelled. These conditions governing the acquisition

and the exercise periods in the event of a departure, whether voluntary

or involuntary, will apply without prejudice to the powers of the Board of

Directors for the members of the Executive Committee or the powers of

the Executive Committee for the other participants to authorise waivers

to these provisions in favour of the beneficiary, based on objective and

relevant criteria.

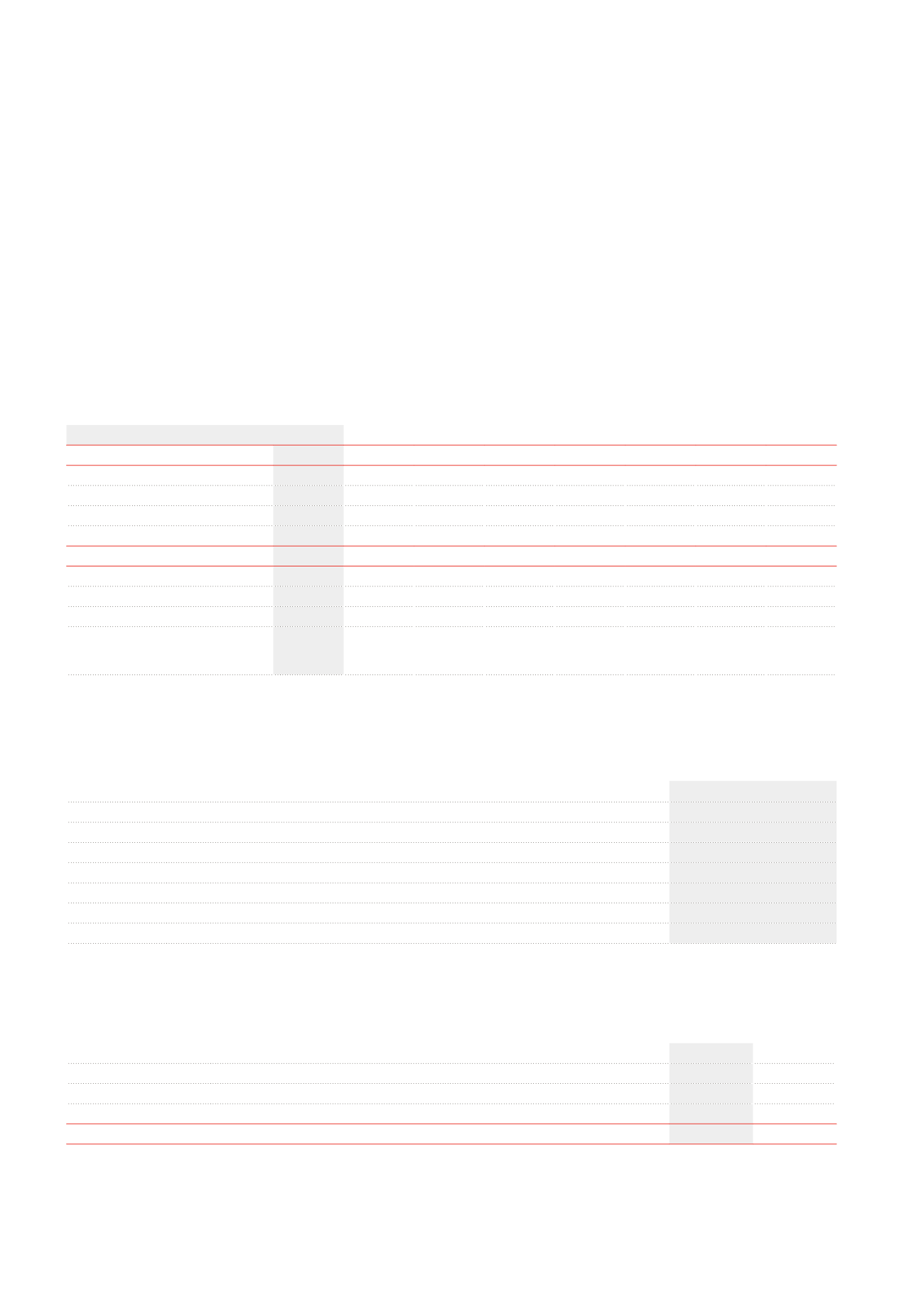

Evolution of the number of stock options

Year of the plan

2013

2012

2011

2010

2009

2008

2007

2006

AT 01.01

4,095

8,035

5,740

7,215

6,730

7,300

8,000

Granted

3,320

Cancelled

-1,250

-184

-695

-1,800

-1,800

-2,100

Exercised

-2,395

Expired

AT 31.12

925

4,095

6,785

5,556

6,520

4,930

5,500

5,900

Exercisable at 31.12

5,556

6,520

4,930

5,500

5,900

Strike price (in €)

88.12

84.85

97.45

93.45

86.06

122.92

143.66

129.27

Last exercise date

16.06.2023 18.06.2022 14.06.2021

13.06.2020 11.06.2019 12.06.2023

1

12.06.2022

1

13.06.2021

1

Fair value of the options

at the date of granting

(x €1,000)

164.64

168.18

363.9

255.43

372.44

353.12

261.27

216.36

Cofinimmo applies the IFRS 2 standard by recognising over the vesting period (namely three years) the fair value of the stock options at the date of

granting according to the progressive acquisition method. The annual cost of the progressive vesting is recognised under the item “Personnel charges”

of the income statement.

Fair value of the stock options at the date of granting and assumptions used - weighted average

2013

Price valuation model

Black & Scholes

Contractual duration of the options

10 years

Estimated duration

8 years

Strike price (in €)

88.12

Volatility (average last three years)

12.25%

Risk-free interest rate

Euro Swap Annual Rate

Fair value of the options at the date of granting, recognised over three years (x €1,000)

164.64

NOTE 44.

AVERAGE NUMBER OF PEOPLE LINKED BY AN EMPLOYMENT CONTRACT OR

BY A PERMANENT SERVICE CONTRACT

2013

2012

Average number of people linked by an employment contract or by a permanent service contract

111

113

Employees

107

109

Executive management personnel

4

4

FULL TIME EQUIVALENT

105

108

1

In accordance with the “Loi de relance économique”/”Wet van de Economische Heropleving” of 27.03.2009, the exercise period of the stock option plans of 2006 to 2008 was extended

from 10 to 15years.