COFINIMMO’S ARTICLES OF ASSOCIATION

Extracts from the Cofinimmo Articles of Association are published on

pages 205 to 209. Their most recent revisions date from the Extraordinary

General Shareholders’ Meeting of 05.12.2013 and from the Board of

Directors’ meetings of 17.01.2013, 04.04.2013, 25.05.2013, 04.07.2013 and

10.01.2014.

INFORMATION REQUIRED UNDER ARTICLE 34

OF THE ROYAL DECREE OF 14.11.2007

1

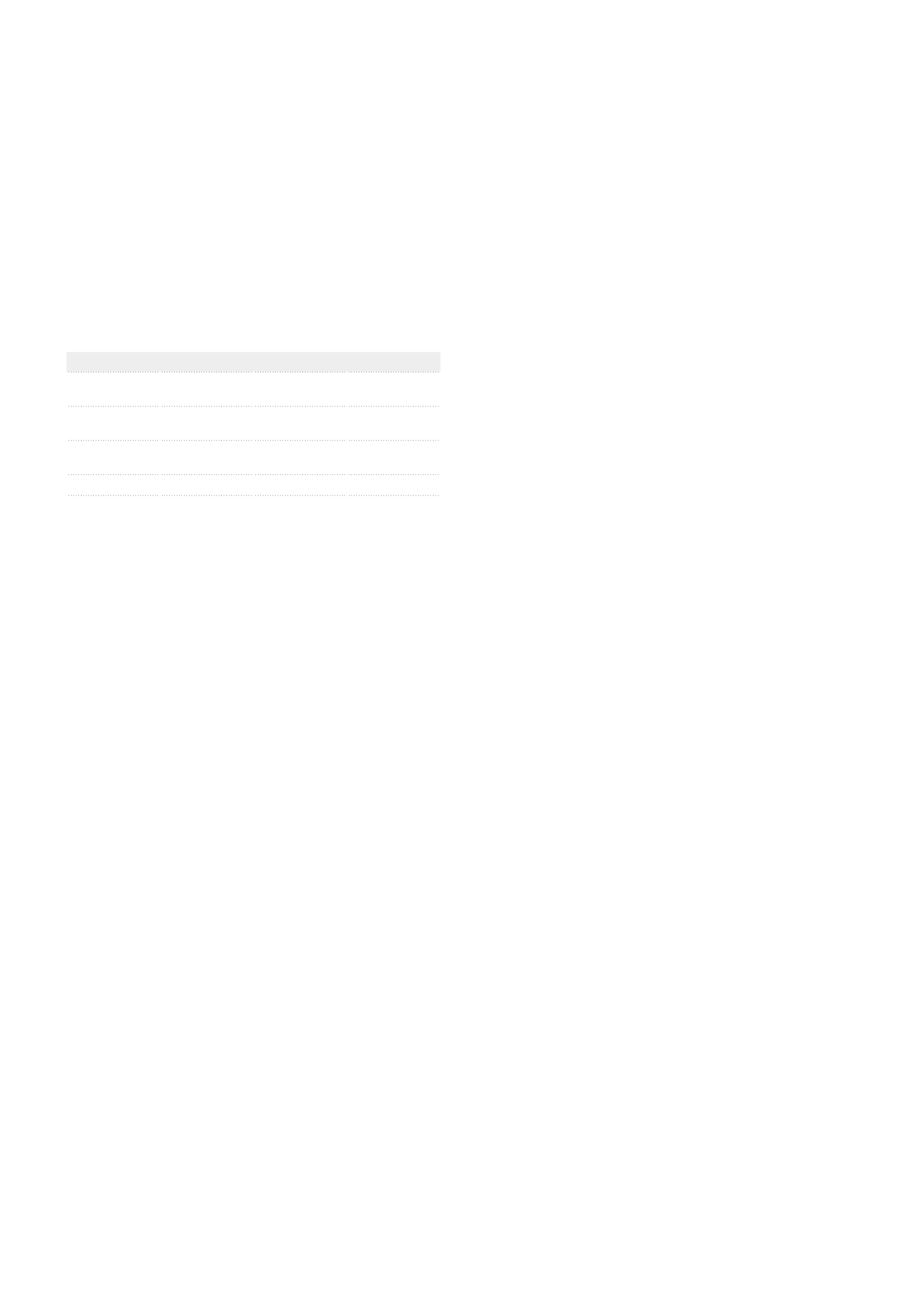

CAPITAL STRUCURE

2

Shares

Number

Capital

(in €)

%

Ordinary

(COFB)

16,954,002 908,541,308.87

96.10

Preference

(COFP1)

395,148 21,175,429.91

2.24

Preference

(COFP2)

293,534 15,730,077.45

1.66

TOTAL

17,642,684 945,446,816.23

100.00

The share capital stands at €945,446,816.23 and is divided into 17,642,684

fully paid-up shares, each of which represents an equal portion, of which

16,954,002 ordinary shares without par value and 688,682 preference

shares without par value, that is a series of 395,148 preference shares

P1 and a series of 293,534 preference shares P2. Each preference share

carries a dividend payable by priority over the dividends payable on the

ordinary shares. The gross annual amount of the priority dividend is €6.37

per preference share.

Preference shares are convertible into ordinary shares at the option of

their holders exercised in the cases referred to in Article 8.2 of the Articles

of Association. More specifically, preference shares are convertible into

ordinary shares, in one or more tranches, at the option of their holders

exercised in the following cases:

•

during the ten final calendar days of each civil quarter;

•

at any time during a period of one month following the notification of

the implementation of the promise of sale referred to below; and,

•

in the event of the liquidation of the company, during a period

starting 15 days after the publication of the decision to liquidate and

ending on the day before the General Meeting closing the liquidation.

Conversions will occur at the rate of one ordinary share for one preference

share. Conversions will be considered to take place with effect on the date

of sending the application for conversion. The applications for conversion

must be sent to the company by the holder of preference shares by regis-

tered letter, indicating the number of preference shares for which conver-

sion is requested. Before 01.05.2009, the start date of the first conversion

opportunity, each holder of preference shares received a letter containing

information on the procedure to be followed.

The subscription or acquisition of preference shares implies a commit-

ment to sell such shares to a third party designated by the company (call

option) dating from the 15th year following their issue (2019), subject to

the conditions and in accordance with the procedure defined in Article 8

of the Articles of Association. Finally, the preference share has priority in

the case of liquidation.

On 14.04.2011, the company issued bonds convertible into ordinary shares

of the company. The issue relates to 1,486,379 convertible bonds with a

nominal value of €116.60, i.e. for a total amount of €173,311,791.40. The con-

vertible bonds allow the holder to receive Cofinimmo ordinary shares at a

rate of one for one. The exchange parity will be adjusted according to the

anti-dilution provisions customary for this type of issue. The conversion

period is open, at any time, from 08.06.2011 until the first of the following

two dates: (i) seven working days before the maturity date, or (ii) if the

bonds have been called for redemption prior to the maturity date, seven

working days before the redemption date.

On 20.06.2013, the company issued bonds convertible into ordinary shares

of the company. The issue relates to 1,764,268 convertible bonds with a

nominal value of €108.17, i.e. for a total amount of €190,840,869.56. The

convertible bonds allow the holder to receive Cofinimmo ordinary shares

at a rate of one for one. Upon conversion, the company will have the option

to deliver new and/or existing shares, cash or a combination thereof. The

exchange parity will be adjusted according to the anti-dilution provisions

customary for this type of issue. The conversion period is open, at any

time, from 20.06.2013 until the first of the following two dates: (i) seven

working days before the maturity date, or (ii) if the bonds have been called

for redemption prior to the maturity date, seven working days before the

redemption date.

A bondholder may exercise his conversion right relating to a convertible

bond by submitting a duly completed notification of conversion together

with the convertible bond to convert. The notification form is available from

the paying, conversion and domiciliary agent, i.e. BNP Paribas Securities

Services. Each bondholder has been informed of the procedure in the

operation note issued for this purpose, which can be consulted on the

company’s website

www.cofinimmo.com.

A total of 3,250,600 bonds convertible into ordinary shares currently

exist, of which 1,486,332 issued on 28.04.2011 and 1,764,268 issued on

20.06.2013. If all outstanding bonds were to be converted, it would create

a maximum of 3,250,600 ordinary shares, conferring the same number of

voting rights.

There are no other restrictions on the transfer of securities and the exer-

cise of the voting right, other than those stipulated in the Law.

1

In relation to the obligations of issuers of financial instruments admitted for trading on a regulated market – see also the Law of 01.04.2007 relating to takeover bids.

2

At the time of writing of this Annual Financial Report.

Management Report

/ Corporate Governance Statement

84

/