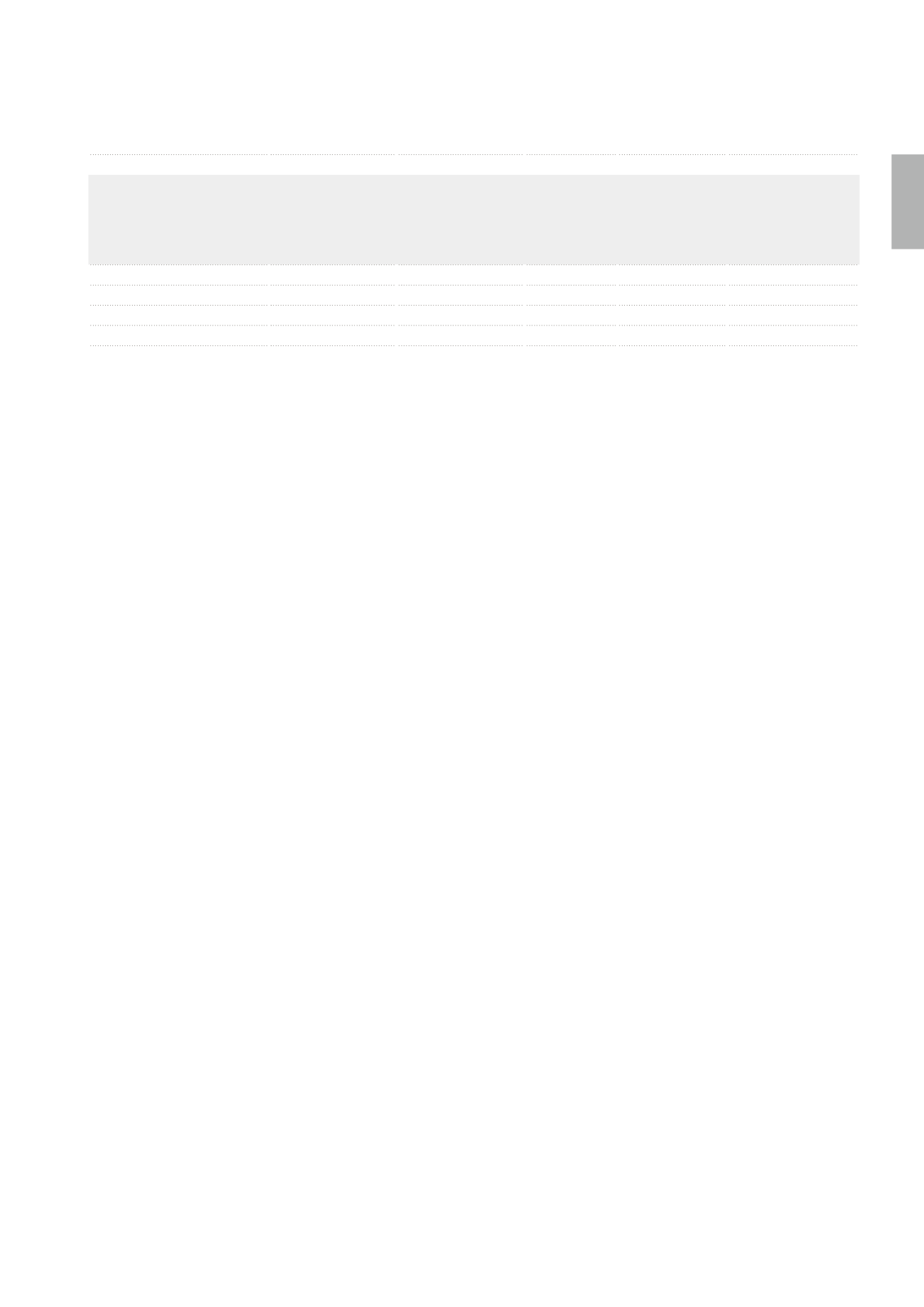

ATTENDANCE OF THE EXECUTIVE DIRECTORS

1

Attendance

at Board meeting

Attendance at

Nomination,

Remuneration

and Corporate

Governance

Committee meetings

Attendance

at Audit

Committee

meetings

Total

remuneration

(in €)

Number

of shares held at

31.12.2013

Jean-Edouard Carbonnelle

10/10

-/-

4/4

-/-

550

Xavier Denis

10/10

-/-

1/4

-/-

80

Marc Hellemans

10/10

-/-

4/4

-/-

0

Françoise Roels

9/10

3/3

3/4

-/-

0

Variable remuneration

The variable remuneration is intended to remunerate the collective and

individual contribution of the members of the Executive Committee. Its

amount is determined in function of the effective achievement of financial

and quality goals set and assessed annually by the Board of Directors on

the proposal of the Nomination, Remuneration and Corporate Governance

Committee. These objectives are set according to criteria, weighted

depending upon their importance, approved by the Board of Directors on

the proposal of the Nomination, Remuneration and Corporate Governance

Committee. The variable remuneration is in principle (“target”) 50% of the

fixed annual remuneration, but can be higher without ever exceeding 75%.

The variable remuneration is only paid once the budget has been attained

up to at least 80%.

The analysis of the degree of achievement of the financial criteria is

done on the basis of accounting and financial data analysed by the Audit

Committee. The Nomination, Remuneration and Corporate Governance

Committee calculates what the variable remuneration could be on the

basis of the degree of achievement of the goals. This calculation only

serves as a guidance for the final setting of the variable remuneration.

Indeed, this will also take into account the specific situation of the com-

pany and of the market in general. The Nomination, Remuneration and

Corporate Governance Committee then draws up a variable remuneration

proposal and submits it to the Board of Directors, which in turn assesses

the work of the Executive Committee and determines the final amount of

the variable remuneration to be granted.

There are no provisions concerning the recovery right of variable remuner-

ations paid based on inexact financial data other than civil law provisions,

being the application of the principle of undue payment.

For the financial year 2013, the performance assessment criteria were:

•

the net current result per share (25%);

•

the cost/income ratio (15%);

•

the Loan-to-value ratio (10%);

•

the continued diversification of assets, the consolidation of

shareholder equity, and the reconversion projects (50%).

The Nomination, Remuneration and Corporate Governance Committee has

assessed the achievement of the 2013 objectives of the members of the

Executive Committee and has proposed to the Board of Directors a varia-

ble remuneration of 45% of the fixed annual remuneration. This proposal

was accepted by the Board of Directors.

As from the financial year 2013, and in strict application of the Law of

06.04.2010, the Board of Directors decided to grant half of the variable

remuneration in the form of cash, and the other half in the form of a phan-

tom stock unit plan spread over time. This plan consists in liquidating in

cash en over three years the countervalue of ordinary Cofinimmo shares

subject to a phantom free award.

During its meeting of 06.02.2014, the Board of Directors decided (i) to

spread the awarding of the variable remuneration for the year 2013 over

a period of three years, and (ii) for half of the variable remuneration, to

determine the final amount which will be awarded in 2015 and 2016 based

on the evolution of the ordinary Cofinimmo share price from the provisional

attribution date of 06.02.2014.

The spreading will be done over three years, i.e. 50% of the variable remu-

neration will be paid in 2014, 25% will be awarded in February 2015 and the

remaining 25% in February 2016.

In order to determine the amount of the variable remuneration to be

awarded in 2015 and 2016, half of the variable remuneration as determined

on 06.02.2014 is converted into phantom stock units by dividing it by the

fair market value of the ordinary share at that date.

At the moment of the final award, the said units will be converted into a

cash amount by multiplying the number of stock units by the fair market

value of the ordinary share of the company on the date of the final award,

increased by the gross dividends awarded since the provisional award

date.

A detailed description of the phantom stock unit plan can be viewed in

Appendix IV of the Executive Committee Charter available on the company

website

www.cofinimmo.com.

For the financial year 2014, the granting of the variable remuneration will

depend on the achievement of objectives weighed as follows:

•

the net current result per share (40%);

•

the cost/income ratio (10%);

•

the legal debt ratio (10%);

•

the management of important development projects (40%).

Stock option plan

The stock option plan was offered for the first time in 2006, the main objec-

tives being to encourage the maximisation of Cofinimmo’s long-term value

by linking management’s interests to those of the shareholders and to

strengthen the long-term vision.

Stock options are granted in a discretionary manner to the members of the

Executive Committee. No goal is set in this respect. The Board of Directors

deems that this remuneration is therefore not to be considered as a variable

remuneration within the meaning of the Law of 06.04.2010. An option’s exer-

cise period amounts to ten years as of the date of the offer.

Upon recommendation of the Nomination, Remuneration and Corporate

Governance Committee, the Board of Directors decided in its session of

11.06.2009 to extend the period of exercise of options granted in 2006,

2007 and 2008 by five years, in application of the “Loi de relance économi-

que”/”Wet van de economische heropleving” of 27.03.2009.

1

Mr. Jean-Edouard Carbonnelle, Mr. Xavier Denis, Mr. Marc Hellemans and Mrs. Françoise Roels frequently attend the meetings of the Audit Committee and Mrs. Françoise Roels frequently

attends the meetings of the Nomination, Remuneration and Corporate Governance Committee, but they are not members of these Committees.

\ 87

Corporate Governance Statement \

Management Report