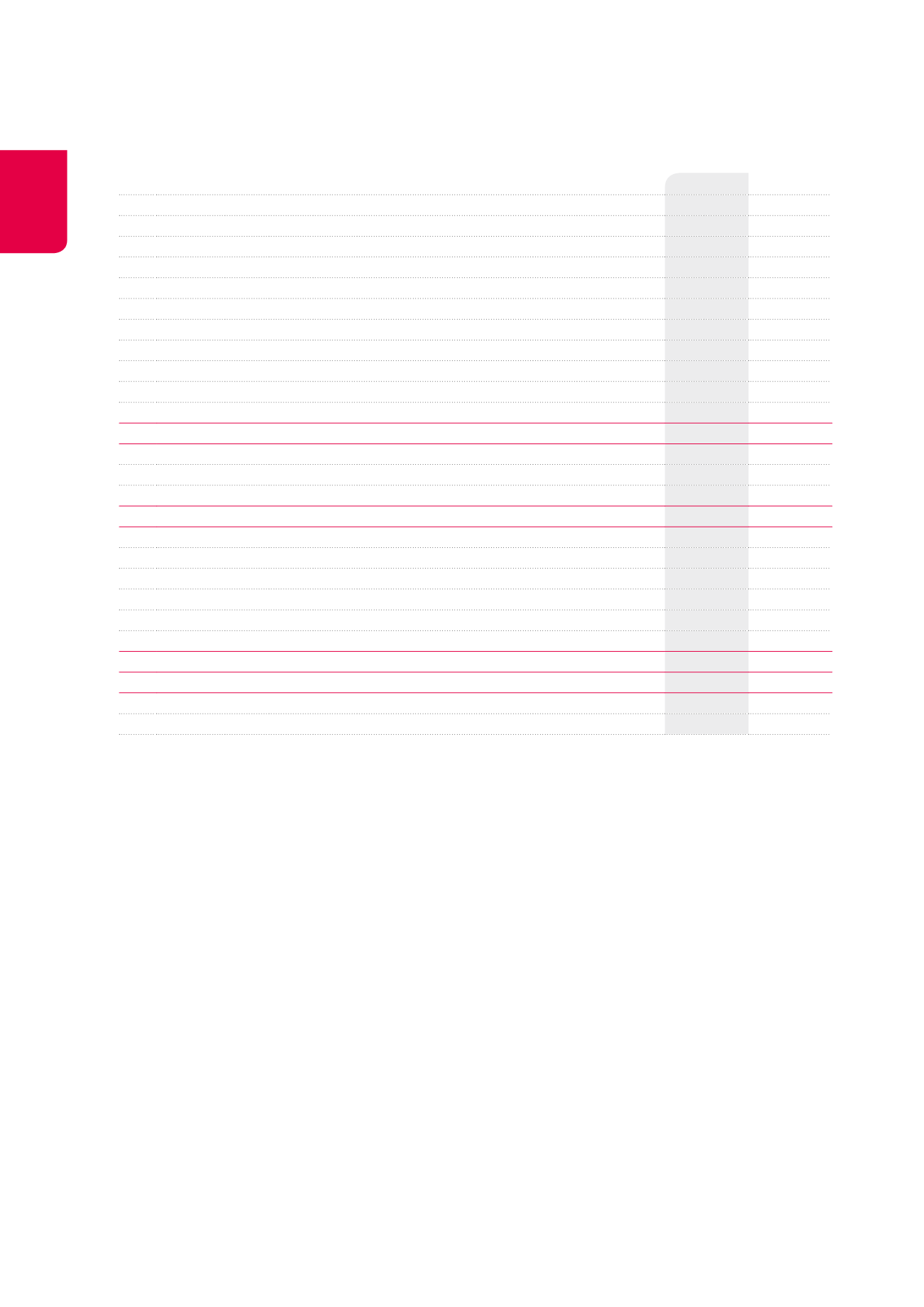

DATA ACCORDING TO THE EPRA PRINCIPLES

EPRA Cost ratios

(x€1,000)

31.12.2014

31.12.2013

(i)

Administrative/operational expenses per IFRS income statement

-36,955

-37,323

Rent-free periods

-2,932

-2,479

Taxes and charges on rented properties not recovered

-2,513

-2,376

Net redecoration costs

-928

-1,176

Technical costs

-3,802

-5,114

Commercial costs

-1,138

-957

Taxes and charges on unlet properties

-3,922

-4,075

Property management costs

-14,544

-14,258

Corporate management costs

-7,176

-6,888

(v)

Share of joint venture expenses

-32

-110

EPRA COSTS (DIRECT VACANCY COSTS INCLUDED) (A)

-36,987

-37,433

(ix)

Direct vacancy costs

5,219

5,677

EPRA COSTS (DIRECT VACANCY COSTS EXCLUDED) (B)

-31,768

-31,756

(x)

Gross rental income less ground rent costs

198,759

197,664

(xii) Add: Share of joint venture gross rental income

689

683

Gross rental income (C)

199,448

198,347

EPRA cost ratio (direct vacancy costs included) (A/C)

18.54%

18.87%

EPRA cost ratio (direct vacancy costs excluded) (B/C)

15.93%

16.01%

* Overhead and operational expenses capitalised (including share of joint ventures)

2,269

2,534

Cofinimmo capitalises overhead costs and operational expenses directly related to development projects (legal fees, project management

fees, capitalised interests, etc.).

Development projects

In 2014, Cofinimmo worked on several redevelopment projects. For details on the ongoing and future projects, see page 44 of the chapter

“Offices”, page 52 of the chapter “Healthcare real estate” and page 60 of the chapter “Property of distribution networks”.

134