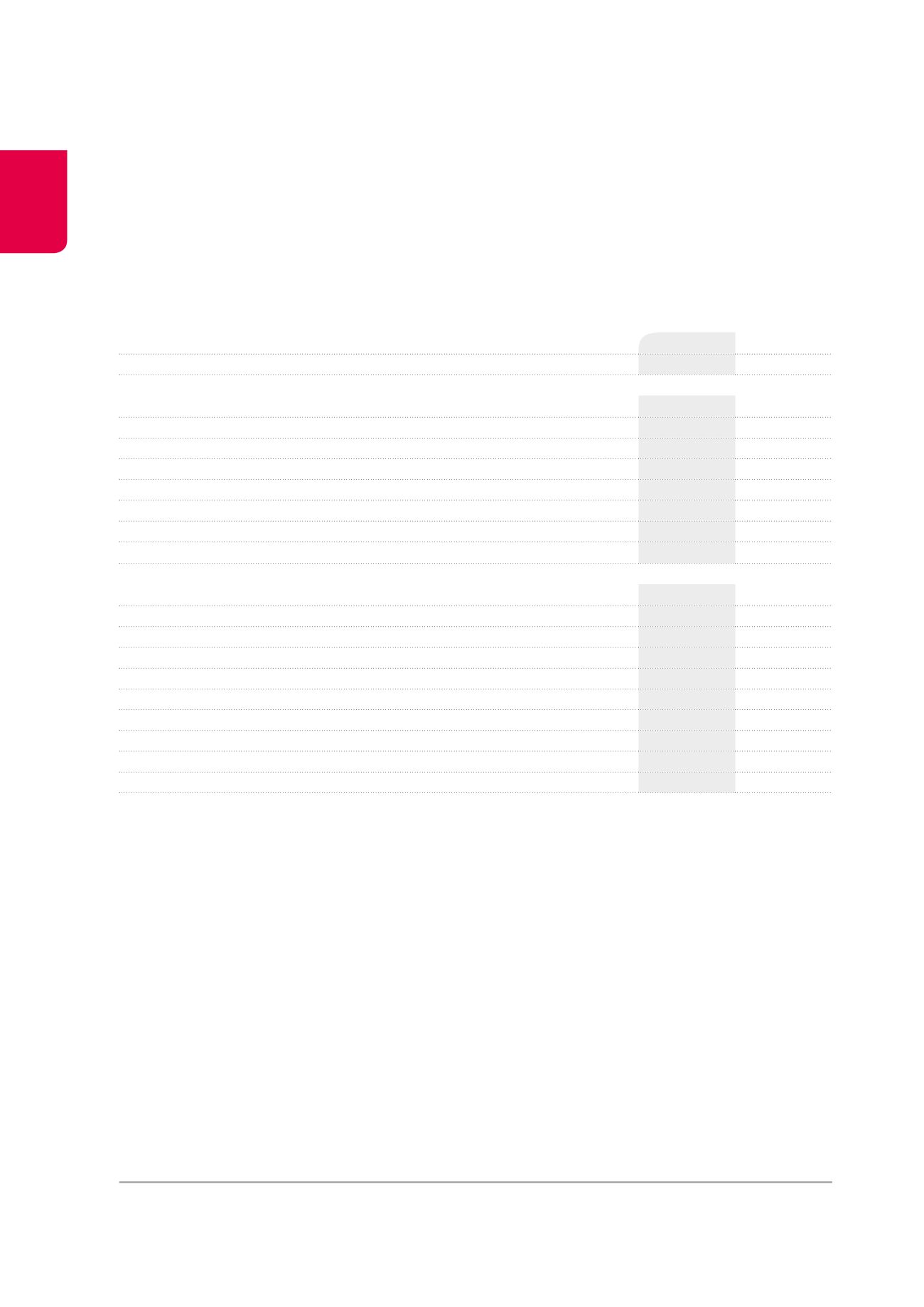

Global information

(x €1,000,000)

31.12.2014

31.12.2013

Portfolio of investment properties (in fair value)

3,199.2

3,347.0

(x €1,000)

31.12.2014

31.12.2013

Property result

208,074

216,909

Operating result before result on the portfolio

177,742

185,619

Financial result (excluding IAS39 impact)

-51,432

-61,249

IAS39 impact

-136,143

-13,686

Net current result - Group share

-15,655

104,924

Result on the portfolio - Group share

-37,016

-46,187

Net result - Group share

-52,671

58,737

(in %)

31.12.2014

31.12.2013

Operating costs/average value of the portfolio under management

1

0.85%

0.83%

Operating margin

85.4%

85.6%

Weighed residual lease term

2

(in years)

11.0

11.6

Occupancy rate

3

95.2%

95.4%

Gross rental yield at 100% occupancy

6.9%

7.0%

Net rental yield at 100% occupancy

6.5%

6.5%

Debt ratio

4

48.1%

48.9%

Average cost of debt

5

3.4%

3.9%

Average debt maturity (in years)

3.4

3.8

1

Average value of the portfolio plus the value of sold receivables relating to

buildings which maintenance costs payable by the owner are still met by the

Group through total cover insurance premiums.

2

Up until the date of the tenant’s first break option.

3

Calculated according to the actual rents and, for unoccupied buildings, the rental

value estimated by the independent real estate experts.

4

Legal ratio calculated in accordance with the legislation regarding RREC as

financial and other debts divided by total assets.

5

Including bank margins.

Key figures

MANAGEMENT REPORT /

Key figures

12