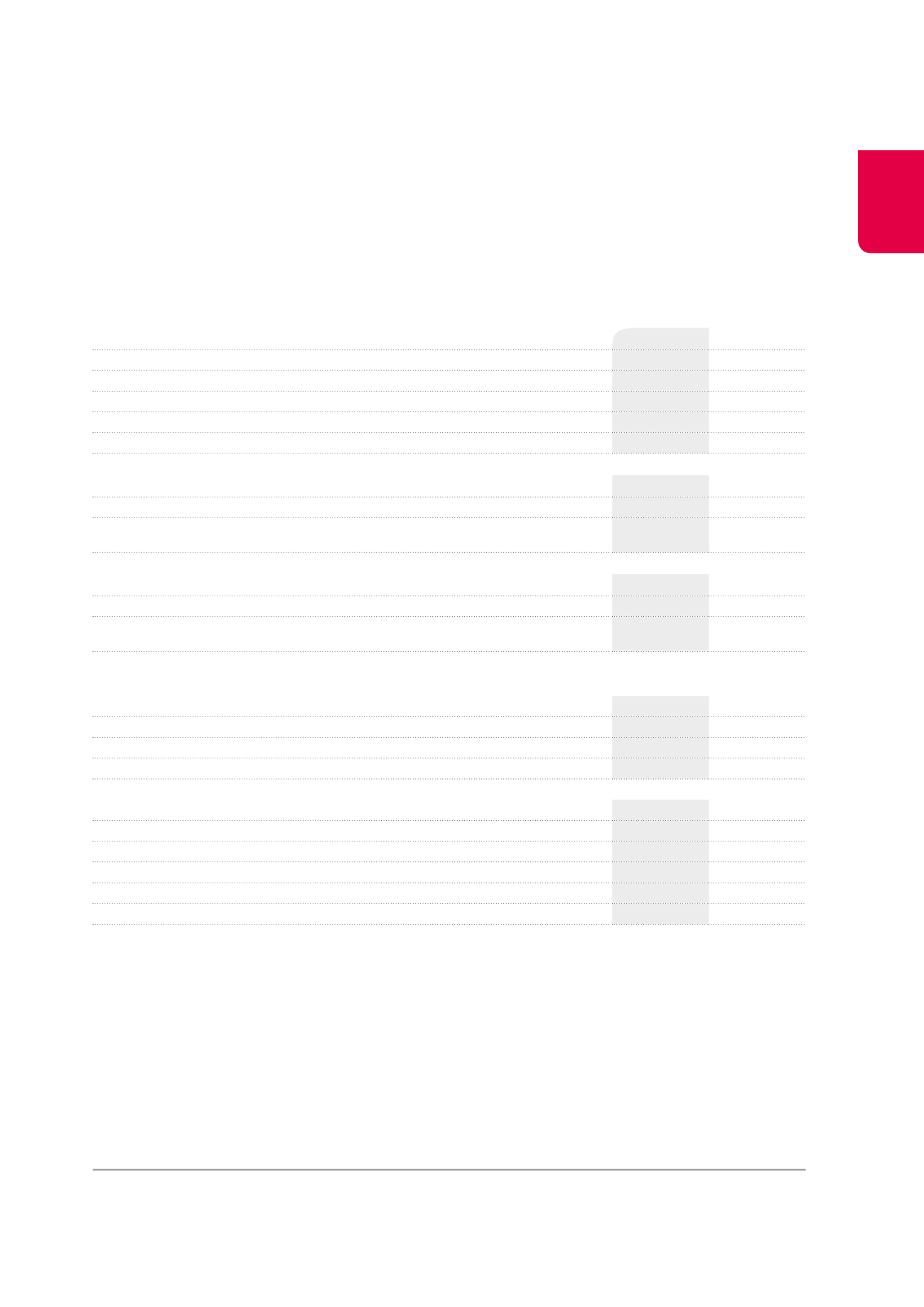

Figures per share

1

(in €)

Results per share

31.12.2014

31.12.2013

Net current result – Group share – excluding IAS39 impact

6.70

6.78

IAS39 impact

-7.57

-0.82

Net current result – Group share

-0.87

5.96

Realised result on the portfolio

-2.06

-2.62

Net result – Group share

-2.93

3.34

Net asset value per share

31.12.2014

31.12.2013

Revalued net asset value in fair value

2

after distribution of the dividend for the year 2013

85.80

85.77

Revalued net asset value in investment value

3

after distribution of the dividend for the year

2013

90.08

90.24

Diluted net asset value per share

4

31.12.2014

31.12.2013

Diluted revalued Net Asset Value in fair value

2

after distribution of dividend for the year 2013

92.01

90.58

Diluted revalued Net Asset Value in investment value

3

after distribution of dividend for the year

2013

95.54

94.40

EPRA performance indicators

5

(in € per share)

31.12.2014

31.12.2013

EPRA Earnings

6.70

6.78

EPRA Net Asset Value (NAV)

96.08

98.85

EPRA Adjusted Net Asset Value (NNNAV)

92.01

95.74

(in %)

31.12.2014

31.12.2013

EPRA Net Initial Yield (NIY)

6.1%

6.2%

EPRA “Topped-up” NIY

6.0%

6.2%

EPRA Vacancy Rate

4.9%

5.0%

EPRA Cost ratio (direct vacancy costs included)

18.5%

18.9%

EPRA Cost ratio (direct vacancy costs excluded)

15.9%

16.0%

1

Ordinary and preference shares.

2

Fair value: after deduction of transactions costs (mainly transfer taxes) from the

value of investment properties.

3

Investment value: before deduction of transactions costs.

4

By assuming the theoretical conversion of the convertible bonds issued by

Cofinimmo, the mandatory convertible bonds issued by Cofinimur I and the stock

options.

5

These data are not compulsory according to the RREC regulation and are not

subject to verification by public authorities. The Auditor verified that the “EPRA

Earnings”, “EPRA NAV” and “EPRA NNNAV” ratios are calculated according to the

definitions included in the “2014 EPRA Best Practices Recommendations” and

that the financial data used in the calculation of these ratios comply with the

accounting data included in the audited consolidated financial statements.

13