MANAGEMENT REPORT /

Strategy

Real estate strategy

1

Investment criteria

A moderate risk profile

Investment decisions are based on the application of rigorous

valuation models founded on precise financial criteria. The criterion

determining the acquisition of buildings which investment value

is within the portfolio average and for which there is no specific

financing, is:

Architectural and environmental qualities

Apart from the usual “due diligence” examinations, each building

assessed is rated according to a range of factors:

•

Intrinsic qualities (for office buildings: the size and modularity

of the floors, the ratio of parking spaces, the headroom,

daylight, etc.);

•

Energy performance;

•

Location (access by car, public transportation, submarket

rental activity, level of local taxes, etc.);

•

Environment (nearby shops, hotels, views, etc.).

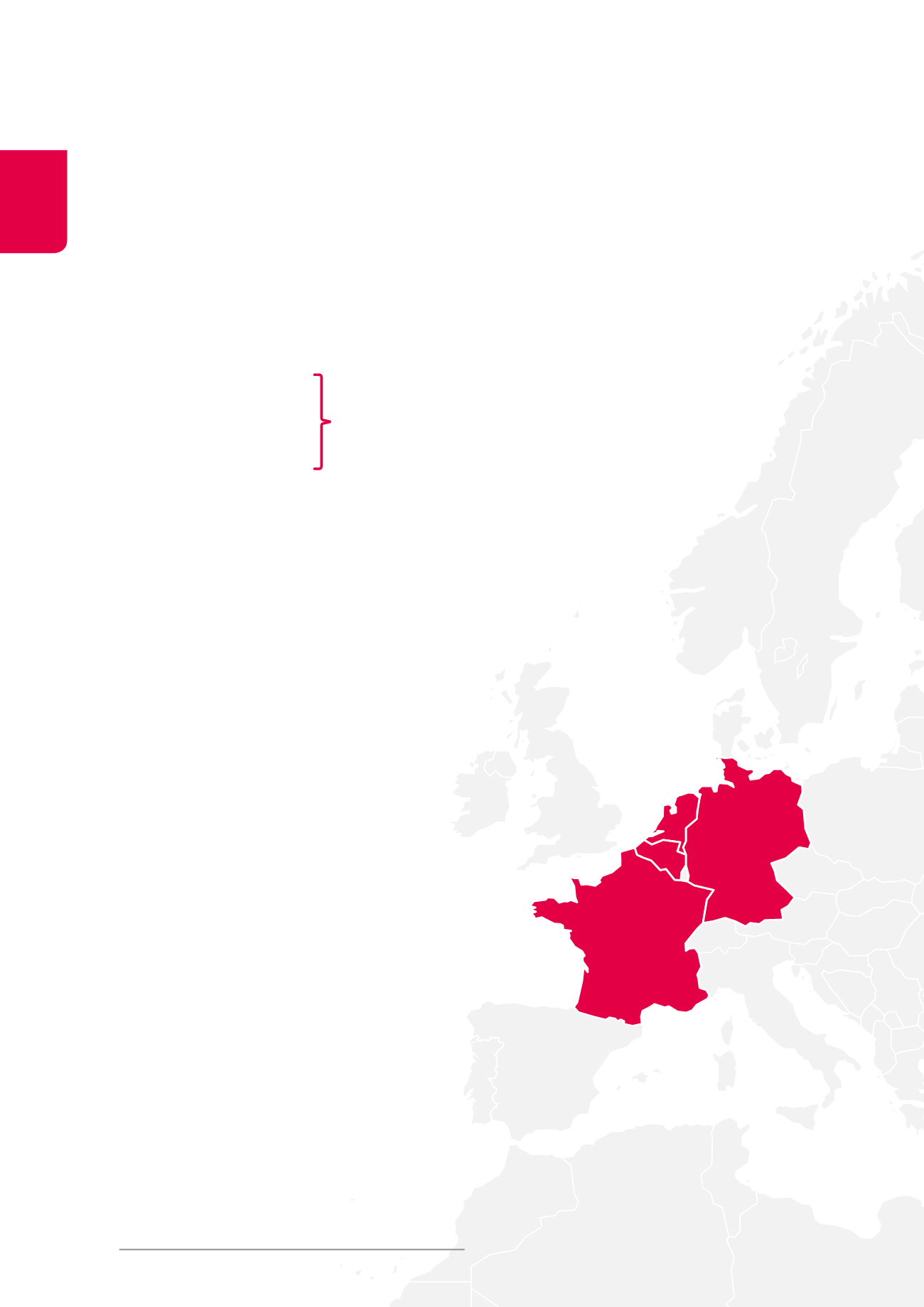

Geographical presence

Operating exclusively in Belgium until 2006, Cofinimmo went on to

obtain footholds in the Netherlands in 2007 (part of the Pubstone

portfolio) and in France in 2008 (healthcare real estate), in both

cases through long-term partnerships with tenant operators. In 2011

and 2012, the Group strengthened its presence in France and the

Netherlands via the acquisition of the portfolio of MAAF insurance

agencies and acute care clinics.

In 2014, the Group extended its geographical presence through a

first acquisition in the healthcare real estate sector in Germany and

a second portfolio in the Netherlands.

The company’s strategy includes expansion into Belgium’s neigh-

bouring countries with a rate of establishment giving it a sound

knowledge of the foreign property markets it has targeted.

1

The investment strategy of this year also applies to future years.

Except in cases where Cofinimmo is not the owner in perpetuity

of the property and where it is planned to transfer the property

free of charge or at a fixed value to a third party at the end of the

lease (as is the case, for example, in the majority of Public-Private

Partnerships), the residual value is estimated conservatively.

For large-scale operations (value of unit greater than 7% of the port-

folio value) or those associated with a special financing arrange-

ment, the company also examines the combination of the average

accretions of the following items over five years:

•

Net current result per share;

•

Revalued net asset value per share.

Differentiation

The Group’s differentiation strategy allows investors to access

specific and non-traditional asset portfolios, which cannot be repli-

cated individually. Therefore, thanks to the diversification of its port-

folio, Cofinimmo not only offers healthcare real estate assets in four

European countries, but also “sale & lease back” transactions and

specific properties intended exclusively for the public authorities.

Compared with the

acquisition price,

costs included

Long-term cash flow

+ Residual value

Discounted at the weighed

average cost of [equity + debt]

16