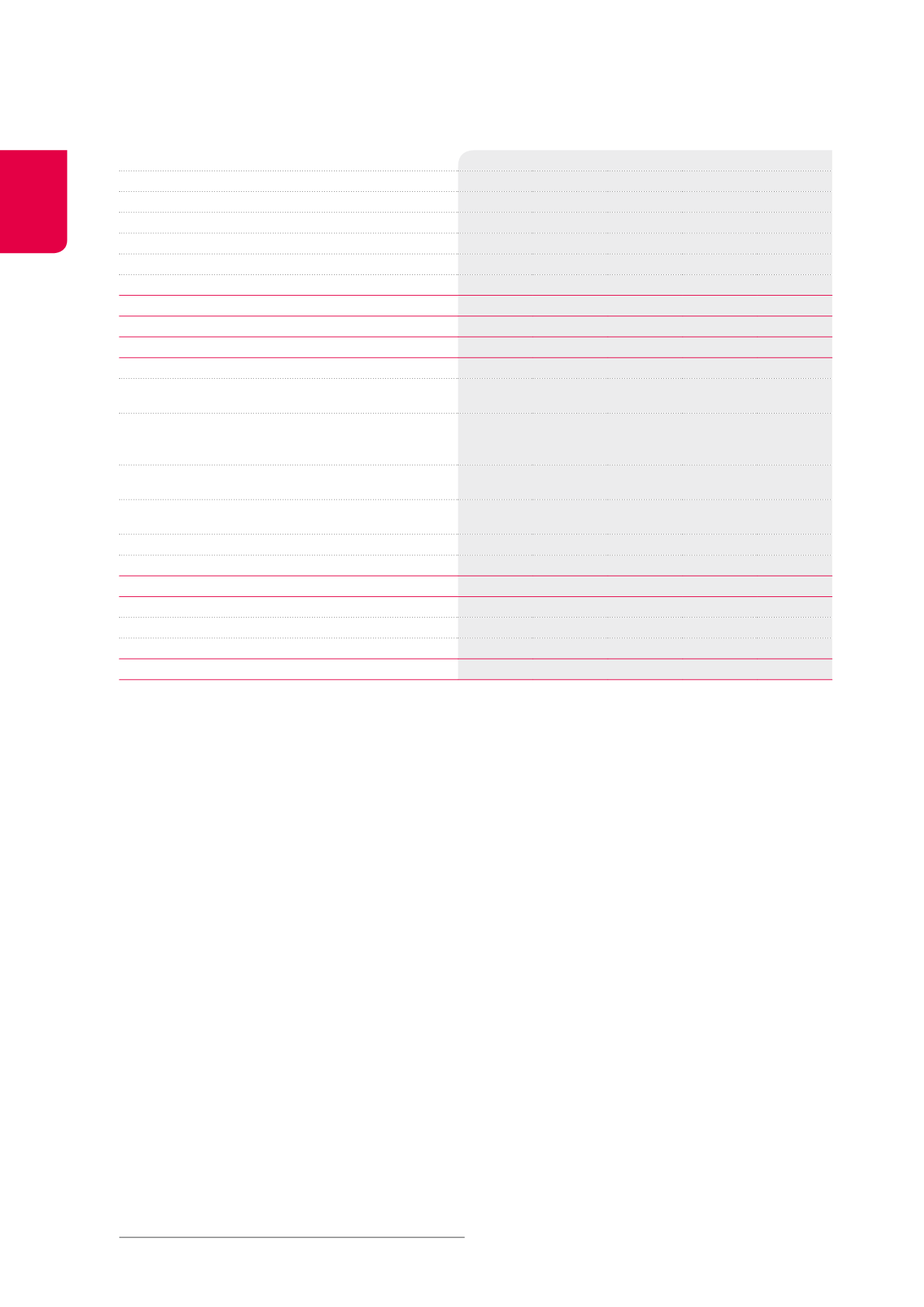

MANAGEMENT REPORT /

Consolidated accounts and appropriation of company results

(x €1,000)

Q1 2014 Q2 2014 Q3 2014 Q4 2014

2014

1

Pre-tax result

1,171

-61,083

10,846

1,340

-47,726

Corporate tax

30

-192

-772

-1,559

-2,493

Exit tax

761

40

20

103

926

Taxes

791

-152

-752

-1,456

-1,567

Net result of the period

1,962

-61,235

10,094

-114 -49,293

Minority interests

-1,209

-994

-1,114

-61

-3,378

NET RESULT - GROUP SHARE

753 -62,229

8,980

-175

-52,671

NET CURRENT RESULT - GROUP SHARE

6,213 -45,954

11,448

12,638

-15,655

RESULT ON THE PORTFOLIO - GROUP SHARE

-5,460

-16,275

-2,468

-12,813

-37,016

B. OTHER ELEMENTS OF THE GLOBAL RESULT RECYCLABLE UNDER

THE INCOME STATEMENT

Impact on the fair value of estimated transaction costs

resulting from the hypothetical disposal of investment

properties

-97

2,303

-1,789

1,360

1,777

Changes in the effective part of the fair value of authorised

cash flow hedge instruments

-4,098

-3,143

316

2,209

-4,716

Restructuring of the hedging instruments which relationship

has been terminated

79

56,278

79

79

56,515

Other elements of the global result

-4,116

55,438

-1,394

3,648

53,576

Minority interests

11

7

18

OTHER ELEMENTS OF THE GLOBAL RESULT - GROUP SHARE

-4,116

55,449

-1,394

3,655

53,594

C. GLOBAL RESULT

-2,154

-5,797

8,701

3,533

4,283

Minority interests

-1,209

-983

-1,115

-53

-3,360

GLOBAL RESULT - GROUP SHARE

-3,363

-6,780

7,586

3,480

923

1

The half-year and annual figures are verified by the Auditor Deloitte, Company

Auditors.

22