MANAGEMENT REPORT /

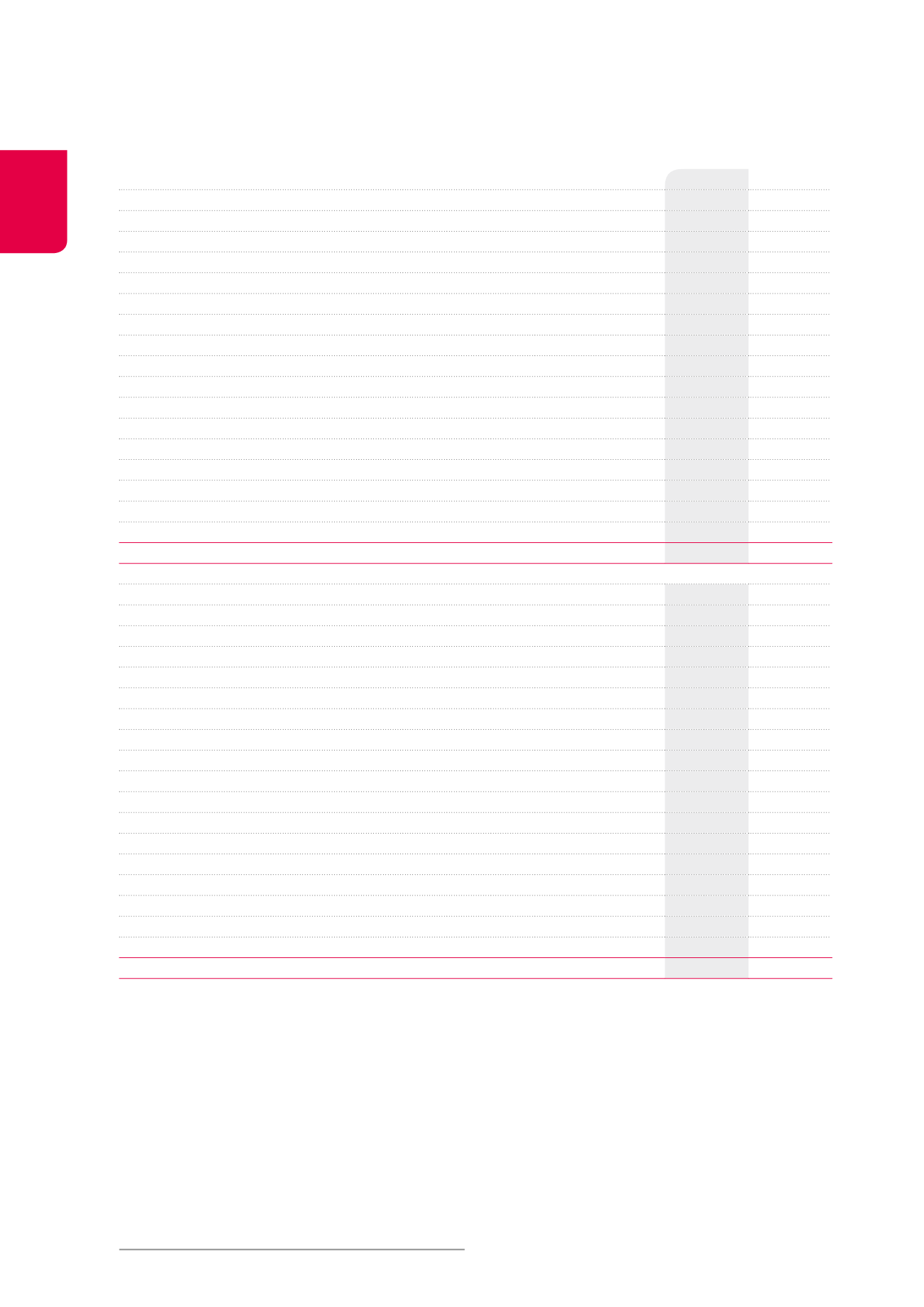

Consolidated accounts and appropriation of company results

Consolidated balance sheet

(x€1,000)

31.12.2014

31.12.2013

Non-current assets

3,410,050 3,565,180

Goodwill

118,356

129,356

Intangible assets

659

753

Investment properties

3,195,773

3,338,709

Other tangible assets

411

677

Non-current financial assets

10,933

20,941

Finance lease receivables

78,018

67,449

Trade receivables and other non-current assets

38

40

Participations in associated companies and joint ventures

5,862

7,255

Current assets

88,962

105,263

Assets held for sale

3,410

8,300

Current financial assets

498

2,782

Finance lease receivables

1,618

1,236

Trade receivables

24,781

25,698

Tax receivables and other current assets

17,505

24,304

Cash and cash equivalents

17,117

15,969

Accrued charges and deferred income

24,033

26,974

TOTAL ASSETS

3,499,012 3,670,443

Shareholders’ equity

1,608,965

1,681,462

Shareholders’ equity attributable to shareholders of the parent company

1,541,971

1,614,937

Capital

963,067

942,825

Share premium account

384,013

372,110

Reserves

247,562

241,265

Net result of the financial year

-52,671

58,737

Minority interests

66,994

66,525

Liabilities

1,890,047

1,988,981

Non-current liabilities

1,303,250

1,412,904

Provisions

17,658

18,180

Non-current financial debts

1,148,023

1,266,665

Other non-current financial liabilities

102,041

93,304

Deferred taxes

35,528

34,755

Current liabilities

586,797

576,077

Current financial debts

473,499

455,509

Other current financial liabilities

24,698

21,921

Trade debts and other current debts

59,850

64,680

Accrued charges and deferred income

28,750

33,967

TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES

3,499,012 3,670,443

Comments on the consolidated balance sheet

The

investment value

of the property portfolio

1

, as established by

the independent real estate experts, amounts to €3,329.2 million at

31.12.2014, compared to €3,478.9 million at 31.12.2013. Its

fair value

,

as appears from the consolidated balance sheet, by application of

IAS 40, is obtained by deducting transaction costs from the invest-

ment value. At 31.12.2014, the fair value stands at €3,199.2 million,

compared to €3,347.0 million at 31.12.2013.

The item “

Participations in associated companies and joint

ventures

” concerns the stake of 51% held by Cofinimmo in Cofinéa

I SAS (medical residences in France). The item “

Minority interests

”

includes the mandatory convertible bonds issued by the subsidiary

Cofinimur I SA (MAAF distribution network in France), as well as the

minority interests of the Silverstone and Pubstone subsidiaries.

1

Including assets held for own use and development projects.

20