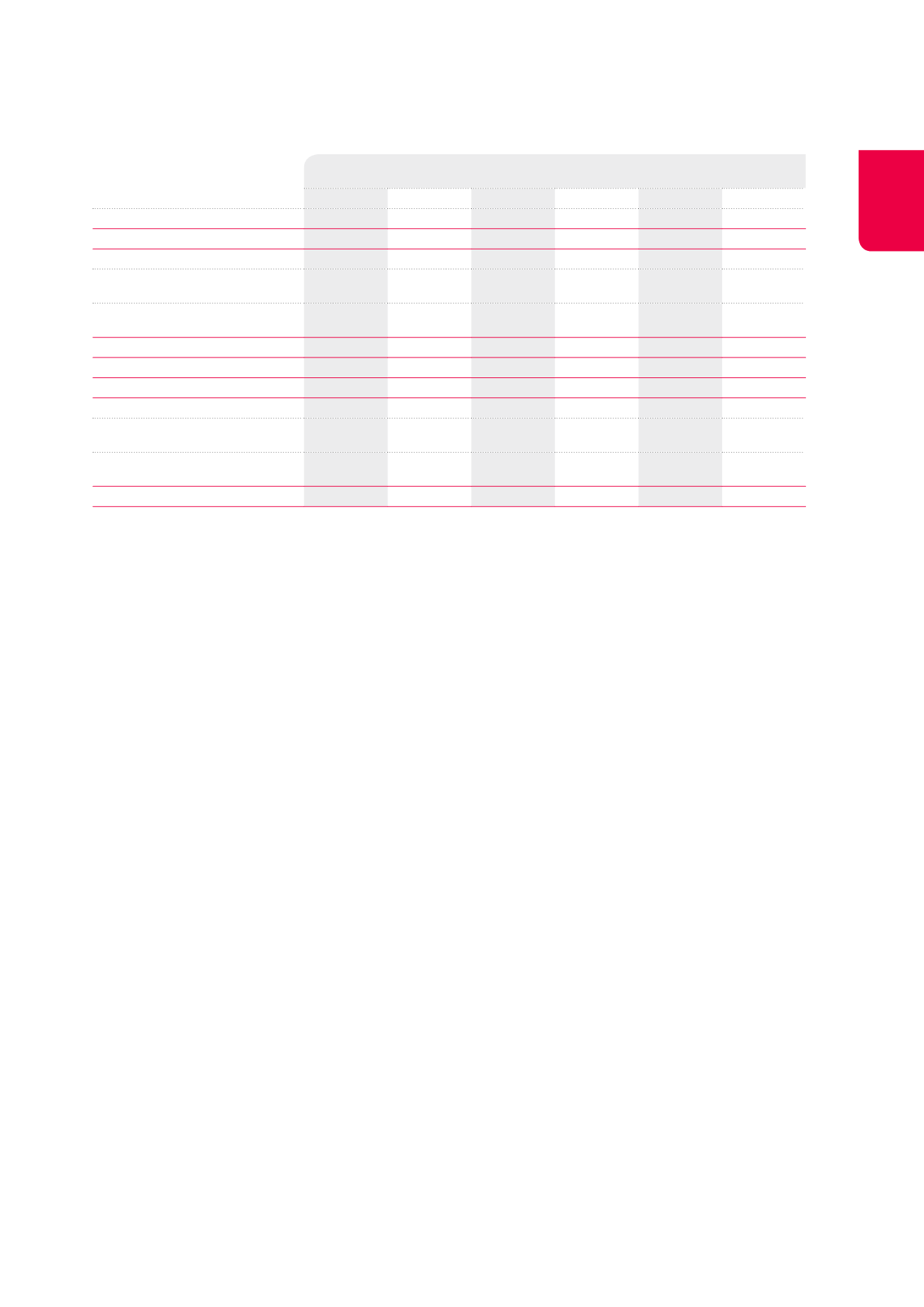

179

Ordinary shares

Convertible

preference shares

Total

(x €1,000)

2014

2013

2014

2013

2014

2013

Capital

AT 01.01

906,099

821,058

36,726

36,764

942,825

857,822

Own shares sold/(purchased) - net

-294

56,635

-294

56,635

Issued as a result

of the optional dividend

20,536

28,368

20,536

28,368

Conversion of preference shares

into ordinary shares

117

38

-117

-38

AT 31.12

926,458

906,099

36,609

36,726

963,067

942,825

Share premiums

AT 01.01

335,799

293,243

36,311

36,349

372,110

329,592

Own shares sold/(purchased) - net

-326

27,014

-326

27,014

Issued as a result

of the optional dividend

12,229

15,504

12,229

15,504

Conversion of preference shares

into ordinary shares

116

38

-116

-38

AT 31.12

347,818

335,799

36,195

36,311

384,013

372,110

Categories of shares

The Group issued two categories of shares:

Ordinary shares:

the holders of ordinary shares are entitled to receive

dividends when these are declared and are entitled to one vote per

share at the General Shareholders’ Meetings of the company. The

par value of each ordinary share is €53.59 at 31.12.2014. The ordinary

shares are listed on the First Market of Euronext Brussels.

Convertible preference shares:

the preference shares were issued

in 2004 in two distinct series which both feature the following main

characteristics:

•

priority right to an annual fixed gross dividend of €6.37 per

share, capped at this level and non-cumulative;

•

priority right in case of liquidation to a distribution equal to the

issue price of these shares, capped at this level;

•

option for the holder to convert his preference shares into

ordinary shares from the fifth anniversary of their issue date

(01.05.2009), at a rate of one ordinary share for one preference

share;

•

option for a third party designated by Cofinimmo (for example,

one of its subsidiaries) to purchase in cash and at their issue

price the preference shares that have not yet been converted,

from the 15th anniversary of their issue date;

•

the preference shares are registered, listed on the First Market

of Euronext Brussels and carry a voting right identical to that of

the ordinary shares.

The first series of preference shares was issued at €107.89 and the

second at €104.40 per share. The par value of both series stands at

€53.33 per share.

Shares held by the Group:

at 31.12.2014, the Group held 54,414 ordi-

nary shares (also see page 102) (31.12.2013: 48,917).

Authorised capital

On 29.03.2011, the General Shareholders’ Meeting authorised the

Board of Directors to issue new capital for €799,000,000 and for a

period of five year. At 31.12.2014, the Board of Directors has made use

of this authorisation for a total amount of €261,740,519.09. Hence,

the remaining authorised capital amounts to €537,259,480.91 at that

date. This authorised capital is based on the par value of €53.33 per

share before 31.12.2007 and €53.59 per ordinary share subsequently.