183

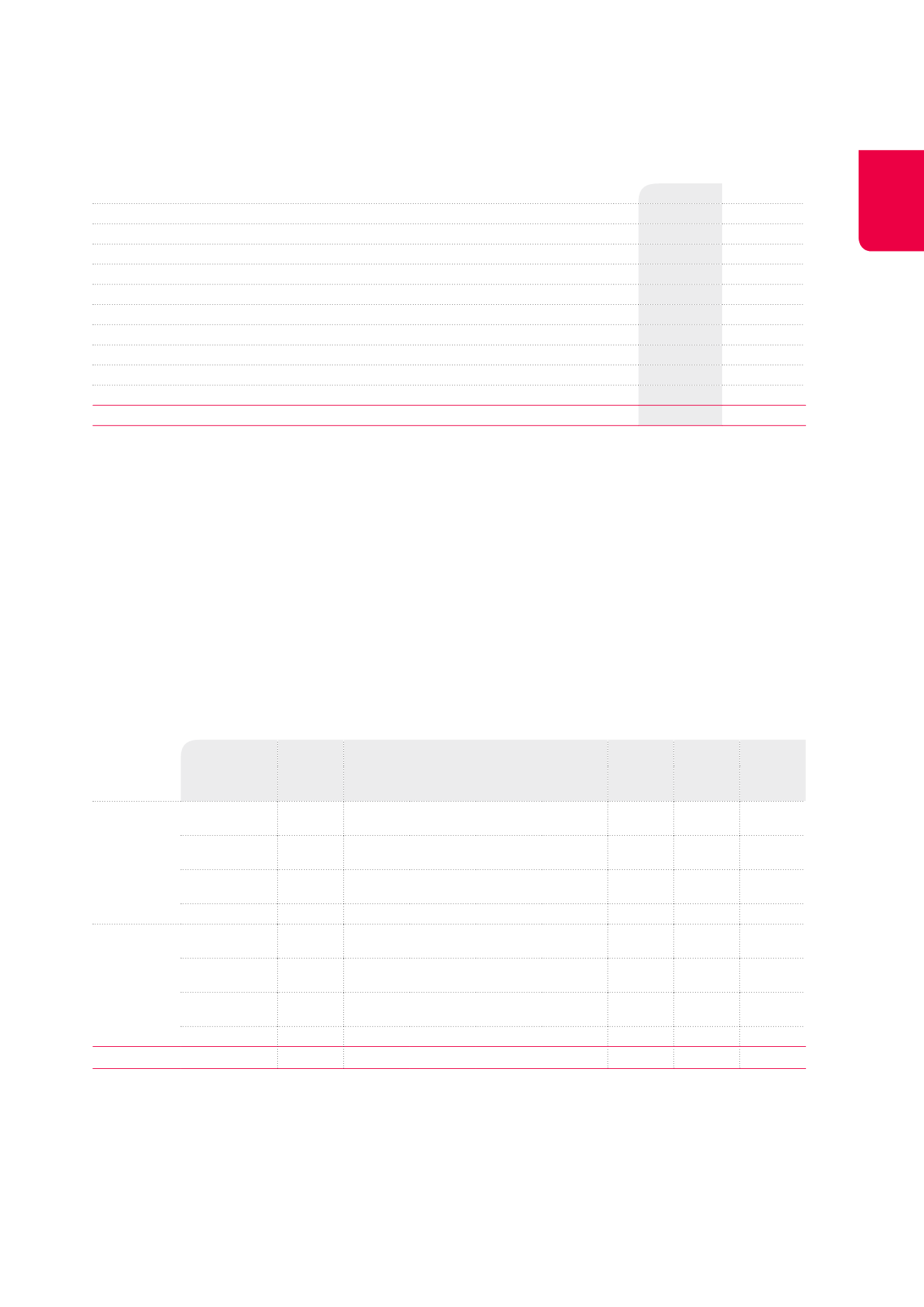

NOTE 39. CHANGES IN WORKING CAPITAL REQUIREMENTS

(x €1,000)

2014

2013

Movements in asset items

4,727

9,602

Trade receivables

-655

-1,926

Tax receivables

-633

5,056

Other short-term assets

6,280

-198

Deferred charges and accrued income

-265

6,670

Movements in liability items

-9,764

-11,500

Trade debts

-3,900

-12,228

Taxes, social charges and salaries debts

1,587

860

Other current debts

-2,537

2,586

Accrued charges and deferred income

-4,914

-2,718

TOTAL

-5,037

-1,898

NOTE 40. EVOLUTION OF THE PORTFOLIO PER SEGMENT DURING THE FINANCIAL YEAR

The tables below show the movements of the portfolio per segment during the financial year 2014 in order to detail the amounts included in the cash

flow statement.

The amounts related to properties and included in the cash flow statement and in the tables below are shown in investment value.

Acquisitions of investment properties

Acquisitions made during a financial year can be realised in three ways:

•

acquisition of the property directly against cash, shown under the item “Acquisitions of investment properties” of the cash flow

statement;

•

acquisition of the property against shares, not shown in the cash flow statement as it is a non-cash transaction;

•

acquisition of the company owning the property against cash, shown under the item “Acquisitions of consolidated subsidiaries” of the

cash flow statement.

(x €1,000)

Offices

Healthcare real estate

Property of

distribution

networks

Other

Total

Belgium France Netherlands Germany

Properties

available for

lease

Properties

against cash

56,421

11,058

535

68,014

Properties

against shares

Companies

against cash

Subtotal

56,421

11,058

535

68,014

Development

projects

Properties

against cash

3,646

1,253

109

5,008

Properties

against shares

Companies

against cash

Subtotal

3,646

1,253

109

5,008

TOTAL

3,646

57,674

11,058

644

73,022

The amount of K€73,022 shown in the cash flow statement under the item “Acquisitions of investment properties” comprises the sum of the

direct property acquisitions.