182

ANNUAL ACCOUNTS /

Notes to the consolidated accounts

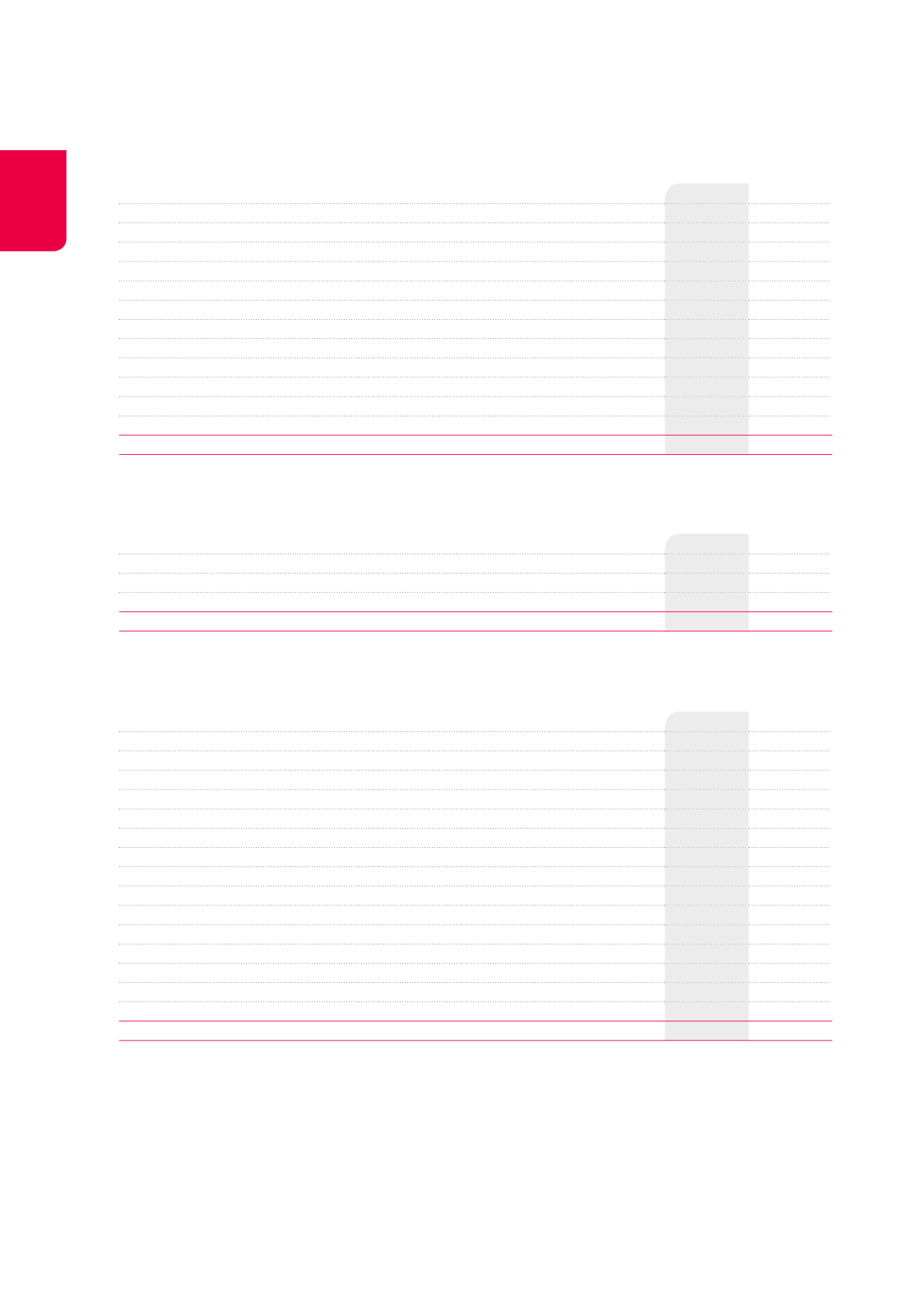

NOTE 38. NON-CASH CHARGES AND INCOME

(x €1,000)

2014

2013

Charges and income related to operating activities

4,870

24,069

Changes in the fair value of investment properties

5,455

26,260

Writeback of lease payments sold and discounted

-15,931

-25,276

Movements in provisions and stock options

-522

-1,484

Depreciation/Writedown (or writeback) on intangible and tangible assets

460

615

Losses (or writeback) on current assets

3

-83

Exit tax

-926

-618

Deferred taxes

1,739

Goodwill impairment

11,000

21,000

Rent-free periods

-378

189

Minority interests

3,378

3,127

Other

592

339

Charges and income related to financing activities

133,583

11,204

Changes in the fair value of financial assets and liabilities

136,143

13,686

Other

-2,560

-2,482

TOTAL

138,453

35,273

NOTE 36. TRADE DEBTS AND OTHER CURRENT DEBTS

(x €1,000)

2014

2013

Trade debts

22,575

25,844

Other current debts

37,275

38,836

Exit tax

621

611

Taxes, social charges and salaries debts

25,343

25,881

Taxes

23,375

24,153

Social charges

667

498

Salaries debts

1,301

1,230

Other

11,311

12,344

Dividend coupons

38

48

Provisions for withholding taxes and other taxes

6,867

8,705

Pubstone dividend coupons

1,322

1,322

Miscellaneous

3,084

2,269

TOTAL

59,850

64,680

NOTE 37. ACCRUED CHARGES AND DEFERRED INCOME

(x €1,000)

2014

2013

Rental income received in advance

9,922

9,614

Interests and other charges accrued and not due

18,803

24,268

Other

25

85

TOTAL

28,750

33,967

.