192

ANNUAL ACCOUNTS /

Notes to the consolidated accounts

Non-controlling interests

1

Non-controlling interests represent third-party interests in subsidiar-

ies neither directly nor indirectly held by the Group.

Cofinimur I

At the end of 2011, Cofinimmo acquired a portfolio of agencies and

offices from the MAAF Group through its subsidiary Cofinimur I.

Foncière Atland owns 2.35% of the shares of the Cofinimur I struc-

ture. In addition, at the time of the acquisition, Cofinimur I also issued

mandatory convertible bonds (MCB), considered as non-controlling

interests.

Foncière Atland is a listed French property company with the SIIC

status. It specialises in corporate real estate, offices, business

premises, warehouses and retail.

For further information about the Group:

www.fonciere-atland.fr.

Pubstone

At the end of 2007, Cofinimmo acquired a portfolio of cafés/restau-

rants owned until then by Immobrew SA/NV, a subsidiary of AB InBev

and renamed Pubstone SA/NV. At 31.12.2014, AB InBev owns an indi-

rect stake of 10% in the Pubstone structure.

In addition, following the restructuration of the Pubstone Group in

December 2013, InBev Belgium owns 10% direct minority interests in

Pubstone Properties BV.

Anheuser-Busch InBev (AB InBev) is the world’s largest brewer by

volume of beer brewed. Listed on the stock exchange, its adminis-

trative offices are located in Leuven, Belgium.

For further information about the Group:

www.ab-InBev.com.

Silverstone

During the financial year 2012, Cofinimmo set up a structure,

Silverstone SA/NV, holding a portfolio of nursing homes in Belgium.

Senior Assist holds 5% of Silverstone SA/NV at 31.12.2014.

Senior Assist is a family group founded in 2005 which operates in

the home care and accommodation of dependent elderly people

sectors. It operates 32 nursing homes in Belgium.

For further information about the Group:

www.senior-assist.be.The holding of these interests by companies outside of the Group,

and therefore not controlled by Cofinimmo, is considered immaterial

with regard to the Group’s total shareholders’ equity (at 31.12.2014,

the minority interests amount to €67 million vs. Cofinimmo’s share-

holders’ equity of €1,609 million, i.e. 4.2%).

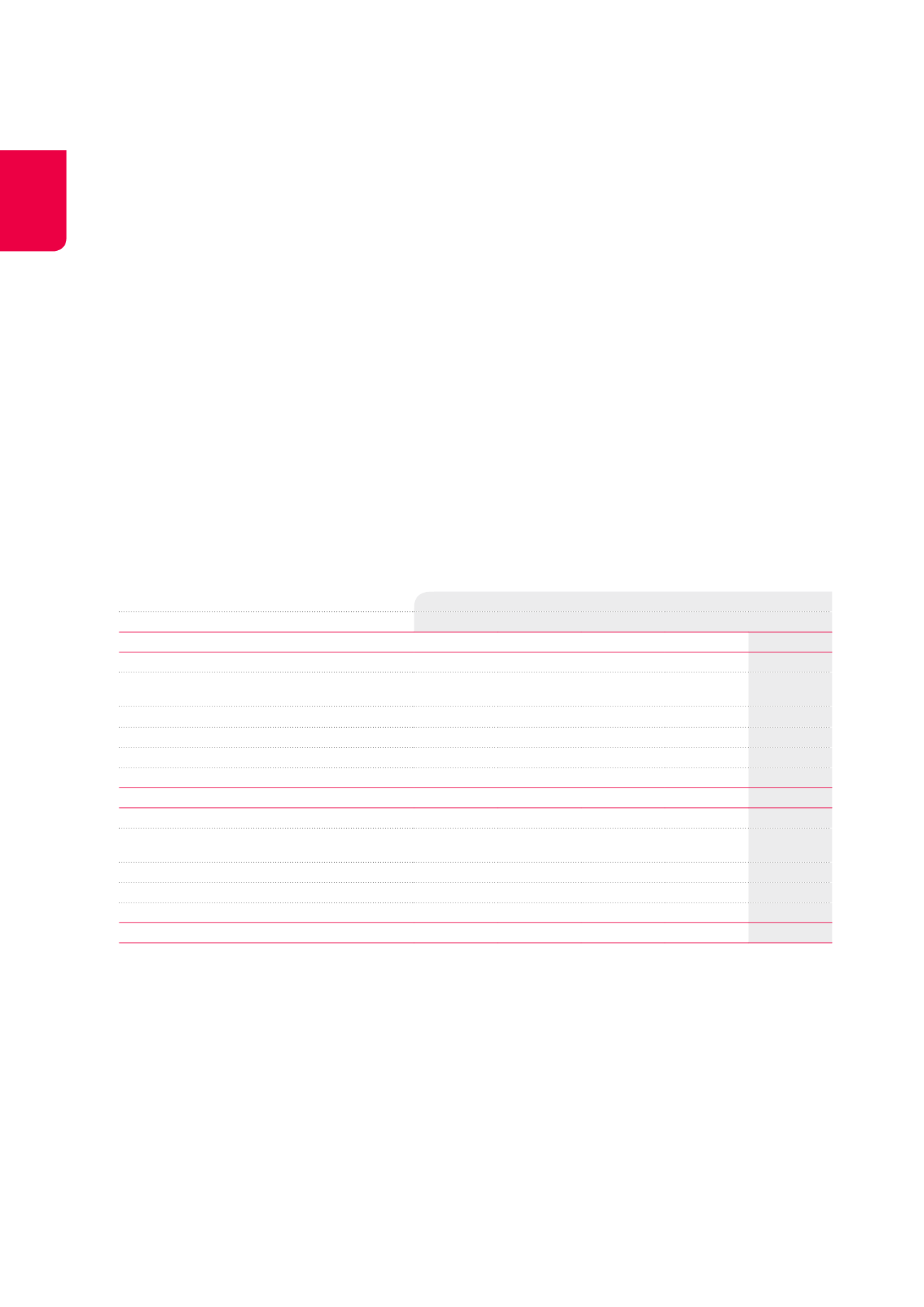

Change in non-controlling interests

(x €1,000)

Cofinimur I

Pubstone

Silverstone

Total

Atland MCB-holders

InBev Senior Assist

AT 01.01.2013

1,345

48,133

11,658

5,127

66,263

Interests in the income statement

62

2,860

-265

470

3,127

Reserve for the estimated transaction costs

and transfer duties

1

-15

-21

-35

Transactions with non-controlling interests

277

277

MCB coupon

-2,727

-2,727

Dividends

-32

-241

-273

Other

-136

10

16

3

-107

AT 31.12.2013

1,240

48,276

11,671

5,338

66,525

Interests in the income statement

84

2,927

-132

499

3,378

Reserve for the estimated transaction costs

and transfer duties

-1

-8

-9

-18

MCB coupon

-2,703

-2,703

Dividends

-35

-284

-319

Other

1

130

131

AT 31.12.2014

1,289

48,630

11,531

5,544

66,994

1

The term “non-controlling interests” as defined under IFRS 12 designates minority interests.

2

For more information, see Note 4.

Joint ventures

At 31.12.2014, the Cofinimmo Group owns the joint venture Cofinéa I,

consolidated under the equity method because the Group exercises

a joint control on this company under the contractual partnership

agreement with the associated shareholders.

Given its share in the result of the Cofinimmo Group, this joint venture

is considered to be immaterial.

As a reminder, on 20.06.2014, Cofinimmo bought all the shares of the

company FPR Leuze

2

.

Since that date, Cofinimmo exercises an exclusive control on the

company, which is thus fully consolidated. The share of Cofinimmo

in the result of FPR Leuze before the purchase of the shares is to be

found in the consolidated income statement under the item “Shares

in the result of associated companies or joint ventures”.