194

ANNUAL ACCOUNTS /

Notes to the consolidated accounts

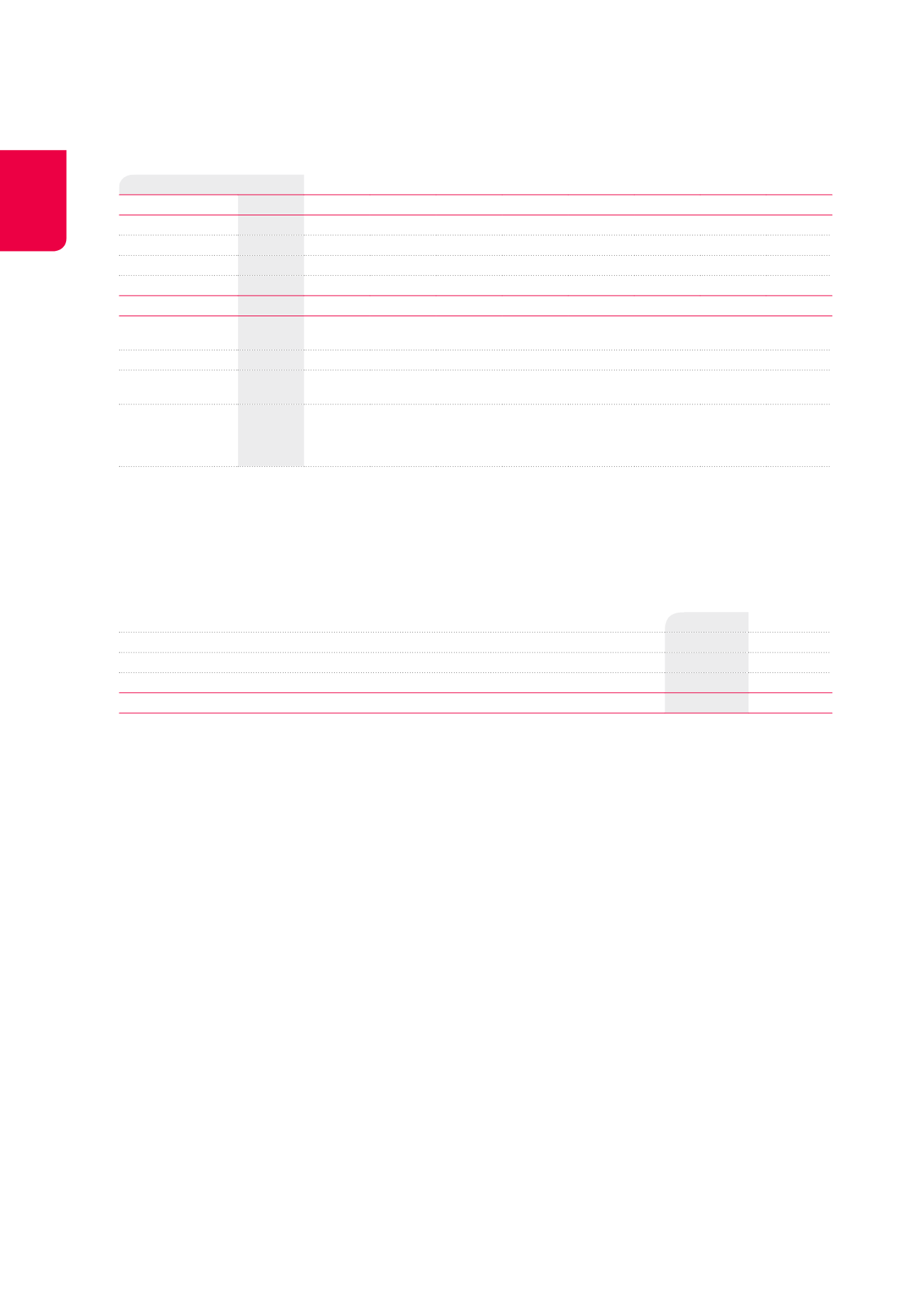

Evolution of the number of stock options

Year of the plan

2014

2013

2012

2011

2010

2009

2008

2007

2006

AT 01.01

925

4,095

8,035

5,740

7,215

6,730

7,300

8,000

Granted

3,000

Cancelled

-1,250

-184

-695

-1,800

-1,800

-2,100

Exercised

-3,992

Expired

AT 31.12

-992

925

4,095

6,785

5,556

6,520

4,930

5,500

5,900

Exercisable at

31.12

6,785

5,556

6,520

4,930

5,500

5,900

Strike price (in €)

88.75

88.12

84.85

97.45

93.45

86.06

122.92

143.66

129.27

Last exercise

date

16.06.2024 16.06.2023 18.06.2022 14.06.2021 13.06.2020 11.06.2019 12.06.2023

1

12.06.2022

1

13.06.2021

1

Fair value of the

options at the

date of granting

(x €1,000)

102.99

164.64

168.18

363.9

255.43

372.44

353.12

261.27

216.36

Cofinimmo applies the IFRS 2 standard by recognising over the vesting period (namely three years) the fair value of the stock options at the

date of granting according to the progressive acquisition method. The annual cost of the progressive vesting is recognised under the item

“Personnel charges” of the income statement.

NOTE 45. AVERAGE NUMBER OF PEOPLE LINKED BY AN EMPLOYMENT CONTRACT OR

BY A PERMANENT SERVICE CONTRACT

2014

2013

Average number of people linked by an employment contract or by a permanent service contract

115

111

Employees

111

107

Executive management personnel

4

4

FULL TIME EQUIVALENT

108

105

1

In accordance with the “Loi de relance économique”/”Wet van de Economische

Heropleving” of 27.03.2009, the exercise period of the stock option plans of 2006

to 2008 was extended from ten to 15 years.

NOTE 46. RELATED-PARTY TRANSACTIONS

The emoluments and insurance premiums borne by Cofinimmo

and its subsidiaries for the benefit of the members of the Board of

Directors, charged to the income statement, amount to €1,746,504 of

which €369,833 are attributed to post-employment benefits.

The chapter “Corporate Governance Statement” of this Annual

Financial Report details the composition of the various deci-

sion-making bodies and includes the tables on the remuneration of

the Non-Executive and Executive Directors.

The difference between the amount under the income statement and

that stated in the tables is explained by movements in provisions.

The Directors are not beneficiaries of the profit-sharing scheme,

which exclusively concerns the employees of the Group.

As a reminder, at the end of 2012, Cofinimmo signed a joint venture

with the entity Cofinea I SAS, a company incorporated under French

Law. Cofinimmo owns 51% of its capital and the Orpea Group 49%.

With the exception of its participation in Cofinea I, Cofinimmo has not

had any other transactions with this joint venture. Furthermore, there

was no transaction in 2014 with the Orpea Group. For more details,

see Note 43.

There were no other transactions with other related parties.

NOTE 47. EVENTS AFTER THE CLOSING

No significant events occurred after the closing date that could have

a significant impact on the figures at 31.12.2014.

However, it is worth mentioning the restructuring of interest rate

hedging instruments. In addition to the hedges cancelled in

May 2014, Cofinimmo cancelled sold FLOOR options for a notional

amount of €200 million in January 2015. The cost of this restructur-

ing stood at €17.7 million and will progressively be recorded under

the income statements of 2015, 2016 and 2017 under the IAS 39 item,

in compliance with the applicable accounting rules.

It is also worth mentioning the extension of two credit lines in

January 2015 and the private placement of bonds for a total amount

of €190 million in March 2015.

For more details on these operations, see the chapter “Events after

31.12.2014” of this Annual Financial Report.

The amount of the dividend proposed at the Ordinary General

Shareholders’ Meeting of 13.05.2015 stands at €95,067,549.50 for

the ordinary shares and at €4,372,909.45 for the preference shares.

For more details, see Note 33.