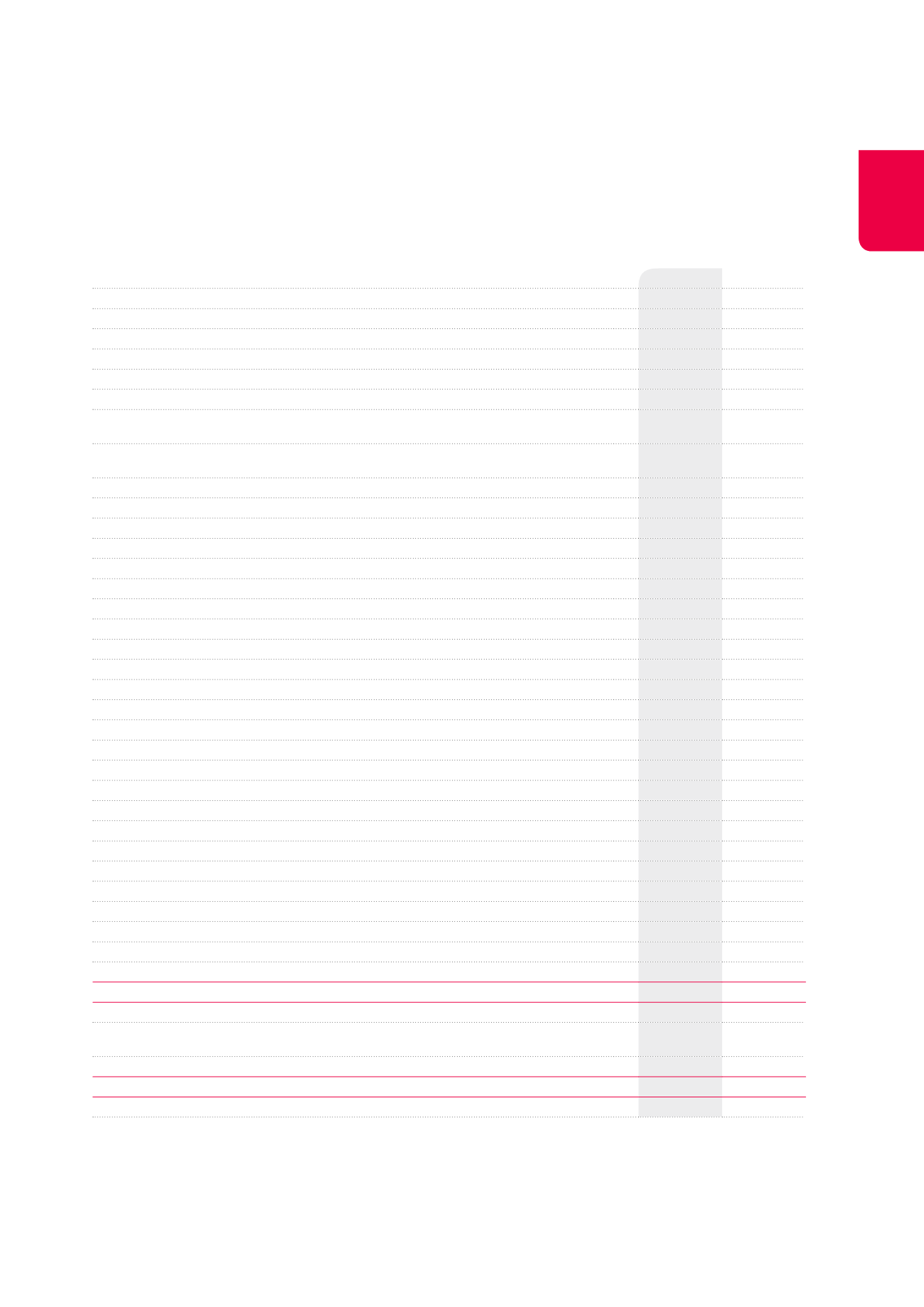

197

Global result (income statement) (abbreviated format)

(x€1,000)

2014

2013

A. NET RESULT

Rental income

125,411

124,654

Writeback of lease payments sold and discounted

15,931

25,276

Rental-related expenses

-345

-293

Net rental income

140,997

149,637

Recovery of property charges

588

101

Recovery income of charges and taxes normally payable

by the tenant on let properties

16,029

13,357

Costs payable by tenants and borne by the landlord on rental damage

and refurbishment at end of lease

-1,539

-1,277

Charges and taxes normally payable by the tenant on let properties

-17,483

-15,225

Property result

138,592

146,593

Technical costs

-2,786

-3,595

Commercial costs

-1,033

-846

Taxes and charges on unlet properties

-3,829

-3,984

Property management costs

-11,071

-11,384

Other property charges

-3

-16

Property charges

-18,722

-19,825

Property operating result

119,870

126,768

Corporate management costs

-6,670

-6,367

Operating result before result on the portfolio

113,200

120,401

Gains or losses on disposals of investment properties

-10,322

-8,144

Gains or losses on disposals of other non-financial assets

-13,181

Change in the fair value of investment properties

-15,799

-26,134

Other result on the portfolio

-804

-1,994

Operating result

73,094

84,129

Financial income

39,320

29,774

Net interest charges

-45,454

-56,073

Other financial charges

-3,021

-2,085

Changes in the fair value of financial assets and liabilities

-116,714

856

Financial result

-125,869

-27,528

Pre-tax result

-52,775

56,601

Corporate tax

-864

579

Exit tax

Taxes

-864

579

NET RESULT OF THE PERIOD

-53,639

57,180

B. OTHER ELEMENTS OF THE GLOBAL RESULT

Impact on the fair value of the estimated transaction costs and transfer duties resulting from the

hypothetical disposal of investment properties

2,599

501

Changes in the effective part of the fair value of authorised cash flow hedging instruments

52,015

57,288

OTHER ELEMENTS OF THE GLOBAL RESULT

54,614

57,789

C. GLOBAL RESULT

975

114,969

Company accounts