140

160

120

100

80

60

31.12.2005 31.12.2006 31.12.2007

31.12.2008 31.12.2009 31.12.2010

31.12.2011

31.12.2012

31.12.2013

31.12.2014

31.12.2015

150

200

100

50

0

31.12.2005 31.12.2006 31.12.2007

31.12.2008

31.12.2015

31.12.2009 31.12.2010

31.12.2011

31.12.2012

31.12.2013

31.12.2014

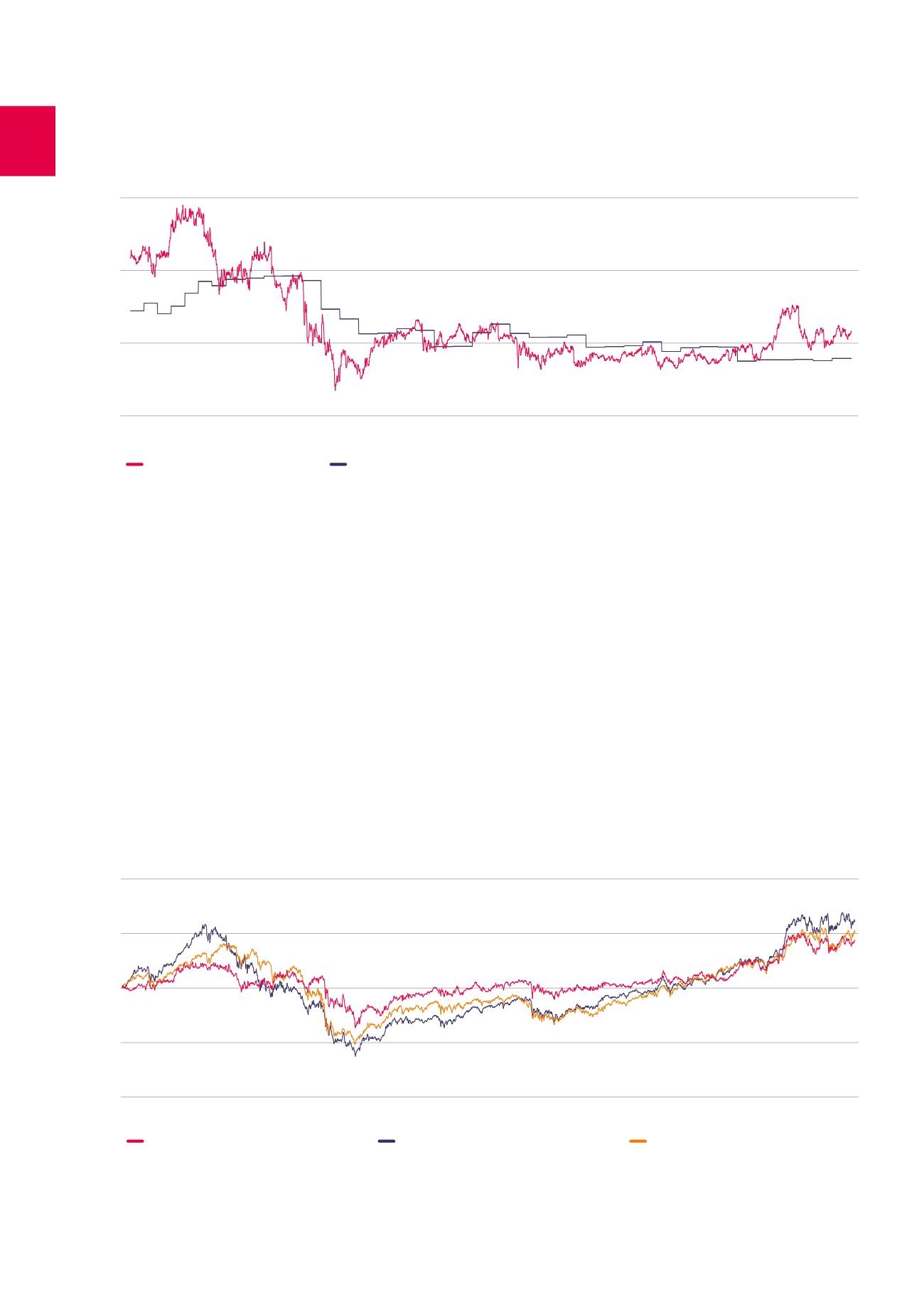

The graph below shows the market price of the Cofinimmo share in relation to its intrinsic value (in fair value) over the last 10 years. The share

shows an average premium of 1.3% over 10 years and an average premium of 15.9% over 2015.

Total return (in %)

The total return for the shareholder is measured by reference to

the evolution of the share price and includes the distribution of the

dividend or any other distribution realised or paid by the company.

Assuming the reinvestment of the 2014 dividend made available for

payment in June 2015, the Cofinimmo share posted a total return of

11.2% over 2015.

The graph below illustrates the stock market performances of the

Cofinimmo share compared with the BEL20 and EPRA Europe indexes

over the past 10 years, dividend return included. During this period,

the Cofinimmo share generated a total return of 43.1%, i.e. an annual

average return of 4.3%. The BEL20 and EPRA Europe indexes posted

total variations of 50.6% and 61.0% respectively, which corresponds to

average annual yields of 5.1% and 6.1%.

Comparison of share price vs. revalued net assets per share (in EUR)

Cofinimmo share price

Net asset value (in fair value)

Total yields (base 100 at 31.12.2005)

Cofinimmo total yield

EPRA Europe index total yield

BEL20 index total yield

132

Cofinimmo on the stock market /

ORDINARY SHARE