Withholding tax

Since 01.01.2016, the applicable withholding tax on distributed dividends amounts to 27%.

However, Belgian law provides for exemptions. In order to be eligible for them, the beneficiaries of dividends must meet certain conditions.

Moreover, the agreements to prevent double taxation provide for reductions of withholdings at source on dividends.

ISIN BE0003593044

2015

2014

2013

Stock price (in EUR)

Highest

110.83

97.83

93.50

Lowest

90.15

84.74

82.23

At close

98.41

95.97

89.75

Average

99.52

89.76

88.26

Dividend yield

1

5.5%

6.7%

7.4%

Gross return

2

(over 12 months)

11.2%

14.3%

7.5%

Dividend

3

(in EUR)

Gross

5.50

4

5.50

6.00

Net

4.02

4

4.13

4.50

Volume

Average daily volume

46,900

33,883

37,975

Annual volume

12,006,493

8,844,025

9,911,464

Number of shares entitled to share in the consolidated results of the financial year

20,344,378 17,339,423 16,954,002

Market capitalisation at the end of the period (x 1,000 EUR)

2,002,090 1,664,064 1,521,570

Free float zone

5

90.0%

90.0%

90.0%

Velocity

5

59.0%

49.0%

58.5%

Adjusted velocity

5

65.6%

56.7%

65.0%

Pay-out ratio

6

85.1%

82.1%

88.5%

1

Gross dividend on the average annual share price.

2

Appreciation of the share price + dividend yield.

3

Dividends are subject to a 27% withholding tax.

4

Forecast.

5

According to the Euronext method.

6

In the net current result - Group share, excluding IAS 39 impact.

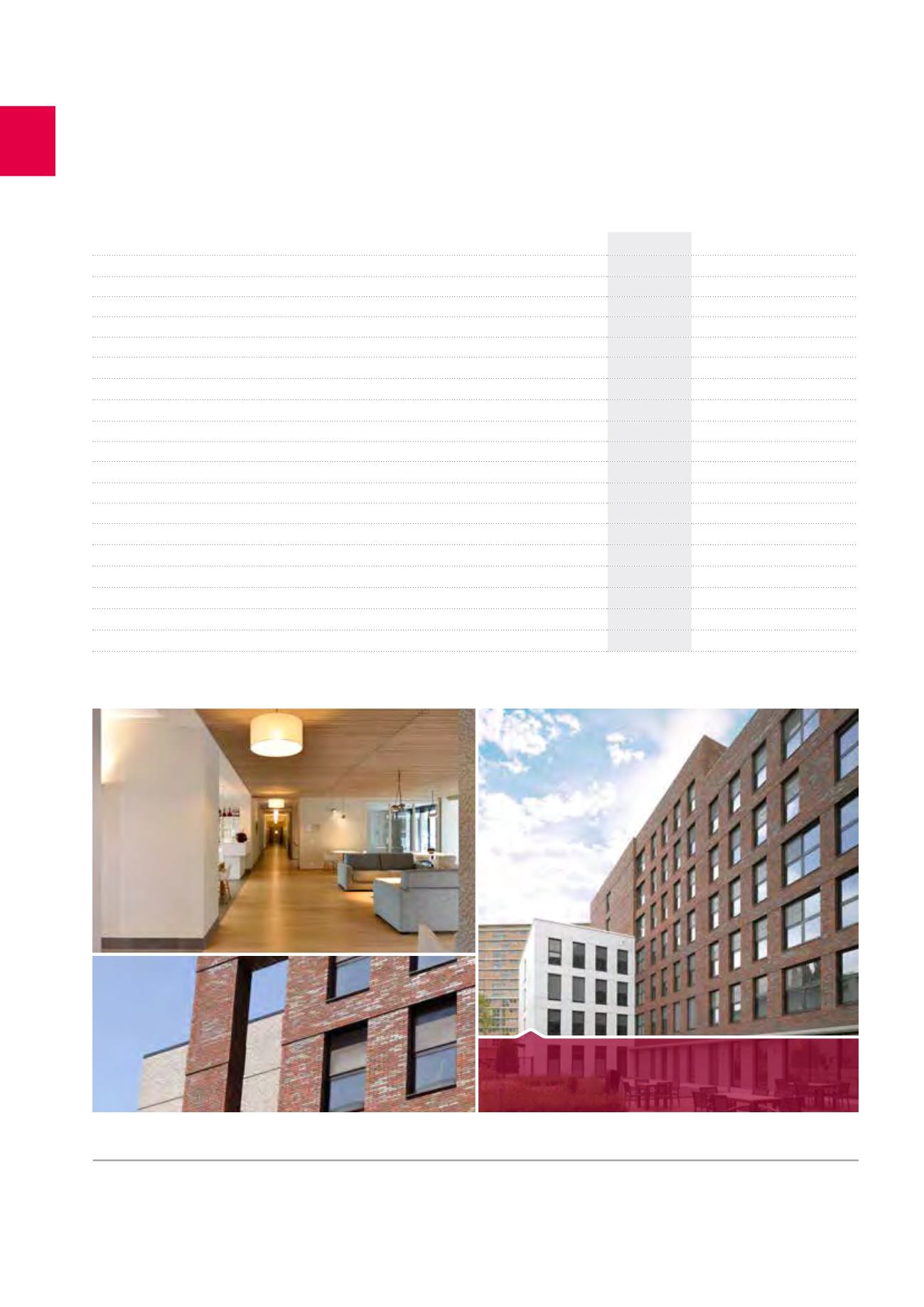

Henri Dunant nursing home - Brussels (BE)

134

Cofinimmo on the stock market /

ORDINARY SHARE