6

8

4

2

0

2006 2007 2008 2009 2010 2011

2012 2013 2014 2015

Shareholders/Investor’s profile

Cofinimmo has a wide range of investors with varied profiles. They

include individual shareholders, located mainly in Belgium, and a broad

base of institutional investors particularly in Belgium, Germany, France,

Luxembourg, the Netherlands, the United Kingdom, Switzerland and

North America.

At 31.12.2015, no shareholder crossed the holding threshold of 5%

requiring notification of crossing the threshold.

Liquidity of the Cofinimmo share

In 2015, Cofinimmo continued its efforts to enhance the liquidity of its

share. The company participated in approximately 30 roadshows and

conferences throughout the year. Cofinimmo also invested in cam-

paigns aimed at strengthening its reputation among both institutional

and individual investors.

With a market capitalisation of its ordinary shares standing at

2.0 billion EUR and an average daily volume of 4.7 million EUR or just

over 46,900 shares, Cofinimmo’s liquidity level is sufficient to capture

the attention of major institutional investors.

Dividend

At the Ordinary General Shareholders’ Meeting of 11.05.2016, the Board

of Directors will propose a dividend in line with the forecast published

in the 2014 Annual Financial Report, i.e. 5.50 EUR gross per ordinary

share. This dividend corresponds to a gross yield of 5.5% in relation to

the average share price of the ordinary share during financial year 2015

(vs. a gross yield of 6.1% in 2014).

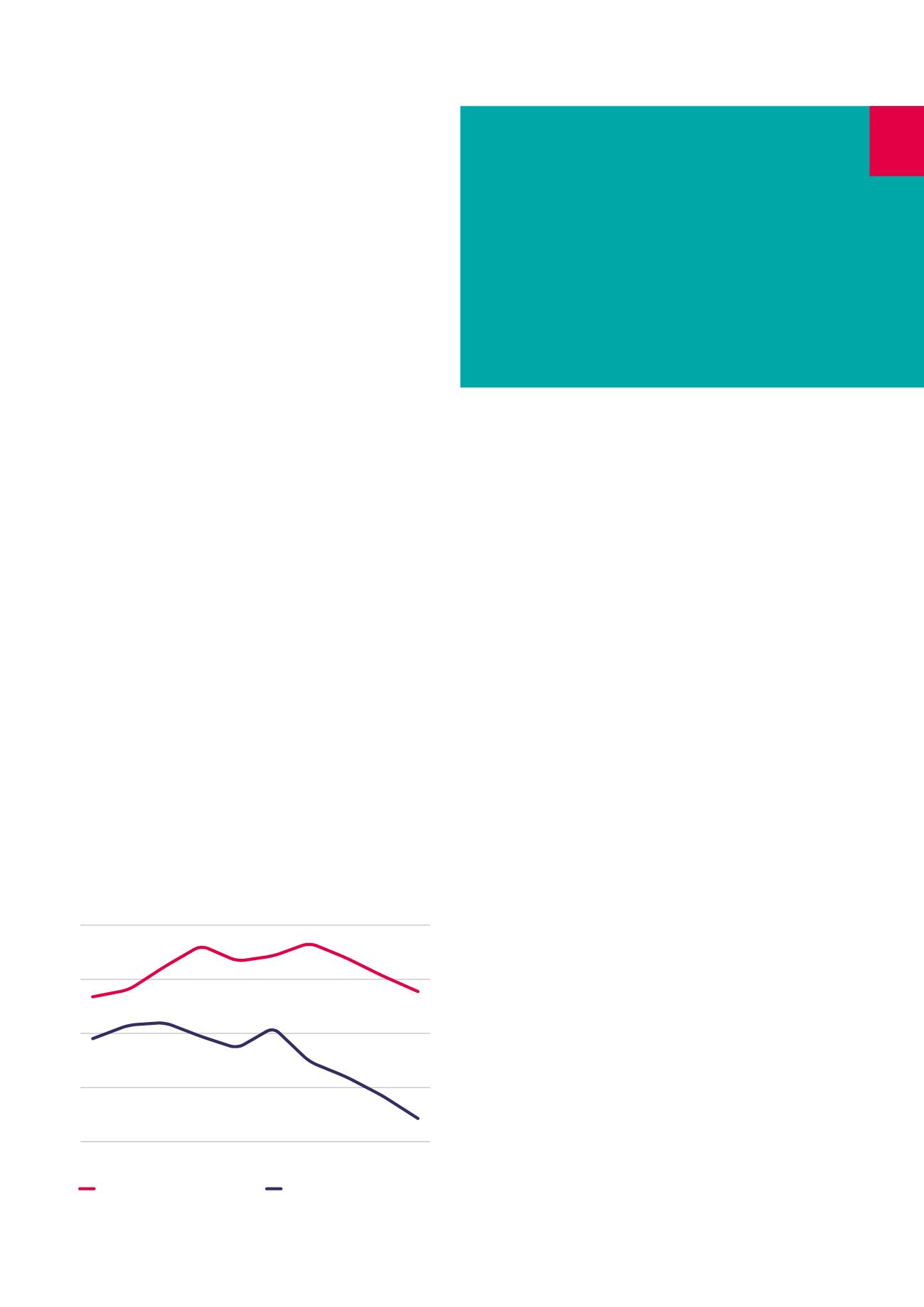

The graph below illustrates the dividend yield of the Cofinimmo share

compared with the 10-year OLO rate during the past 10 years. Over this

period, the Cofinimmo share offered an average dividend yield of 6.4%

versus an average 10-year OLO rate of 3.2%.

• Listed on the stock market

since 1994

• Market capitalisation of

2.0 billion EUR at 31.12.2015

• Average daily volume of

46,900 securities

Increase of capital

In May 2015, Cofinimmo carried out a capital increase of 285 mil-

lion EUR, with preferential subscription rights in the proportion of one

new share for six existing shares. It was highly successful with a

take-up rate of 84.5% among existing shareholders. The remaining

balance has been placed using a bookbuilding procedure with institu-

tional investors.

The issued price of the new shares was 95 EUR, i.e. a 7% discount to

the market price , the night just before the operation was launched,

being corrected to allow any variance with the date from which atten-

dant rights come into effect between existing and new securities.

An optional stock dividend has not been proposed to the shareholders.

Dividend yield

Yield on 10-year Belgian

government bonds

Comparison of dividend yield and OLO rate over 10 years (in %)

133