23

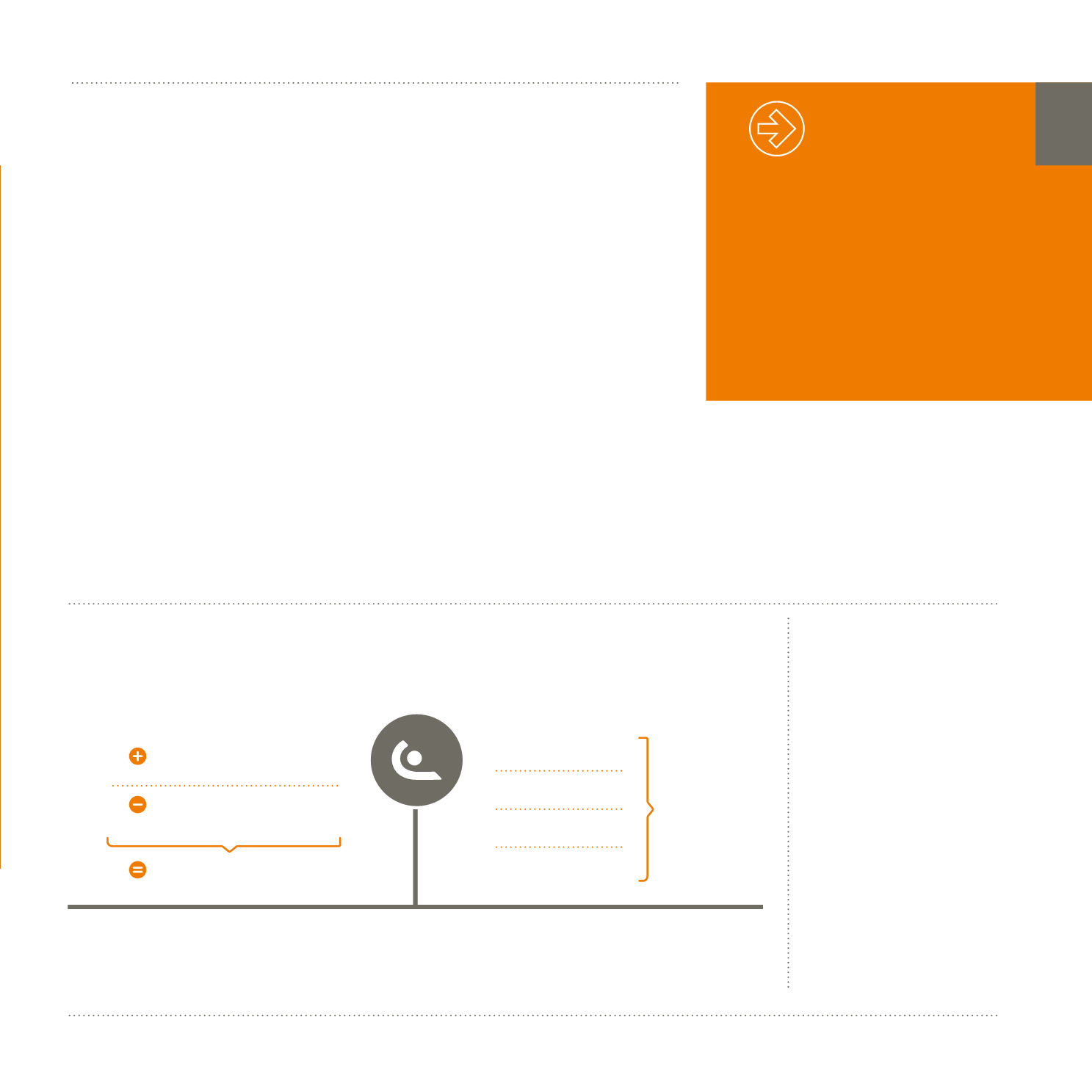

Total economic

value distributed

-168,185 EUR

Clients

230,063EUR

Suppliers of goods and services

-23,910EUR

Value added

206,153EUR

Economic value generated

Human resources

-15,310EUR

Shareholders

-103,530EUR

Financial expenditure

-42,970EUR

Public sector

-6,375EUR

Economic value distributed

Economic value retained within the Group

2016 Objectives

The raised funds will be devoted to:

• improving the sustainability of the portfolio

through the renovation and redevelopment

of technically obsolete office buildings;

• pursing investments in healthcare real

estate while diversifying by country, by

operator, and by care specialty.

The target dividend for financial year 2016

(payable in 2017) is 5.50 EUR gross per

ordinary share.

Performance

indicators

Shareholders’ equity

By investing in Cofinimmo shares on the stock market,

shareholders support the company’s development

despite the upward or downward economic fluctuations

which may occur.

Cofinimmo does its utmost to maintain a moderate risk

profile corresponding to its shareholders’ expectations.

Therefore it has adopted a long-term income generation

strategy through the following actions:

•

diversification of the real estate portfolio in order to

find new guaranteed long-term income sources ;

•

property portfolio arbitrage, involving the sale of the

riskiest assets in favour of more stable assets;

•

conversion of buildings: from offices to residential or

other uses, taking into account market demand;

•

cost monitoring by a team of professionals.

Furthermore, Cofinimmo’s status as a RREC (Regulated

Real Estate Company) limits the authorised amount of

risk-taking and guarantees the compulsory distribution

of at least 80 % of the net income to shareholders.

Borrowed capital

The borrowed capital can be a cheaper source of

financing than shareholders’ equity. Short and long-term

financial commitments require active management.

The Treasury department, consisting of three people, is

responsable for managing this debt. It also implements

the company’s hedging policy to limit the risk of changes

in interest rates on borrowed capital and as such

optimise its cost.

Cofinimmo seeks to diversify its funding sources in

order to achieve the right balance between the cost and

sustainability of funding sources.

2015 achievements

Cofinimmo took advantage of a favourable economic

environment and significantly strengthened its debt

structure, as reflected by:

•

a capital increase with preferential subscription rights

for 285.4 million EUR;

•

a private bond placement of 190 million EUR;

•

the renewal of nearly 750 million EUR in credit lines.

Net current result

(IAS39 excluded) per share

6.46

EUR

Net asset value per share

(in fair value)

88.66

EUR

2015 dividend

per ordinary share

5.50

EUR

Average cost of debt

2.9

%

Direct economic value generated and distributed for 2015 (x 1,000 EUR)

37,968

EUR

At the end of these operations, Cofinimmo’s market

capitalisation was 2.1 billion EUR, and the average cost of

debt decreased (2.9% versus 3.4% in 2014).