\ 9

Is the financial crisis still impacting your ability to raise funds

for financing?

Jean-Edouard Carbonnelle:

No. In 2013, we raised new financial resources,

including both shareholders’ equity and borrowed capital. First of all,

the optional dividend in shares was a growing success among our

shareholders. A total of 53% of the coupons for the 2012 financial year

(2012: 41% of the coupon for the financial year 2011) was reinvested in new

shares, representing a €44 million capital increase.

André Bergen:

We sincerely thank our shareholders for the confidence they

continue to show us.We also sold almost all of our own shares on the stock

market for €93 million. Altogether, €137 million in additional shareholders’

equity was gathered. In addition, we issued a five-year convertible bond

of €191 million, a four-year non-convertible bond of €50 million, and we

contracted new bank credit lines for a total of €270 million, which allows

us to cover all of our planned refinancing and investment needs until mid

2015.

The gross dividend for the 2013 financial year (payable in 2014) was

reduced by €0.50 per ordinary share (-7.7%). What will happen to the

gross dividend in the coming financial year?

Jean-Edouard Carbonnelle:

The evolution of our current results is still

affected by the low rental levels in the office market. Moreover, some

office buildings have been vacated and require a large-scale renovation

or a reconstruction. It is important therefore to adapt, according to our

recurring income, the level of dividend distribution and to provide for the

appropriation of a significant share of the result to the reserves

1

. However,

in accordance with what was proposed in the past, we wish to remunerate

our shareholders on a regular basis and propose a gross dividend of €6.00

for the financial year 2013, i.e. 6.5% of the net asset value of the Cofinimmo

share at 31.12.2013 (and 6.8% of the average share price over the year).

André Bergen:

For the 2014 financial year (dividend payable in 2015), our

objective is to have a net current result per share of €6.61 and a gross

dividend per ordinary share of €5.50, i.e. a pay-out ratio of 83.2%

2

, barring,

of course, any unforeseen events that may arise throughout the year.

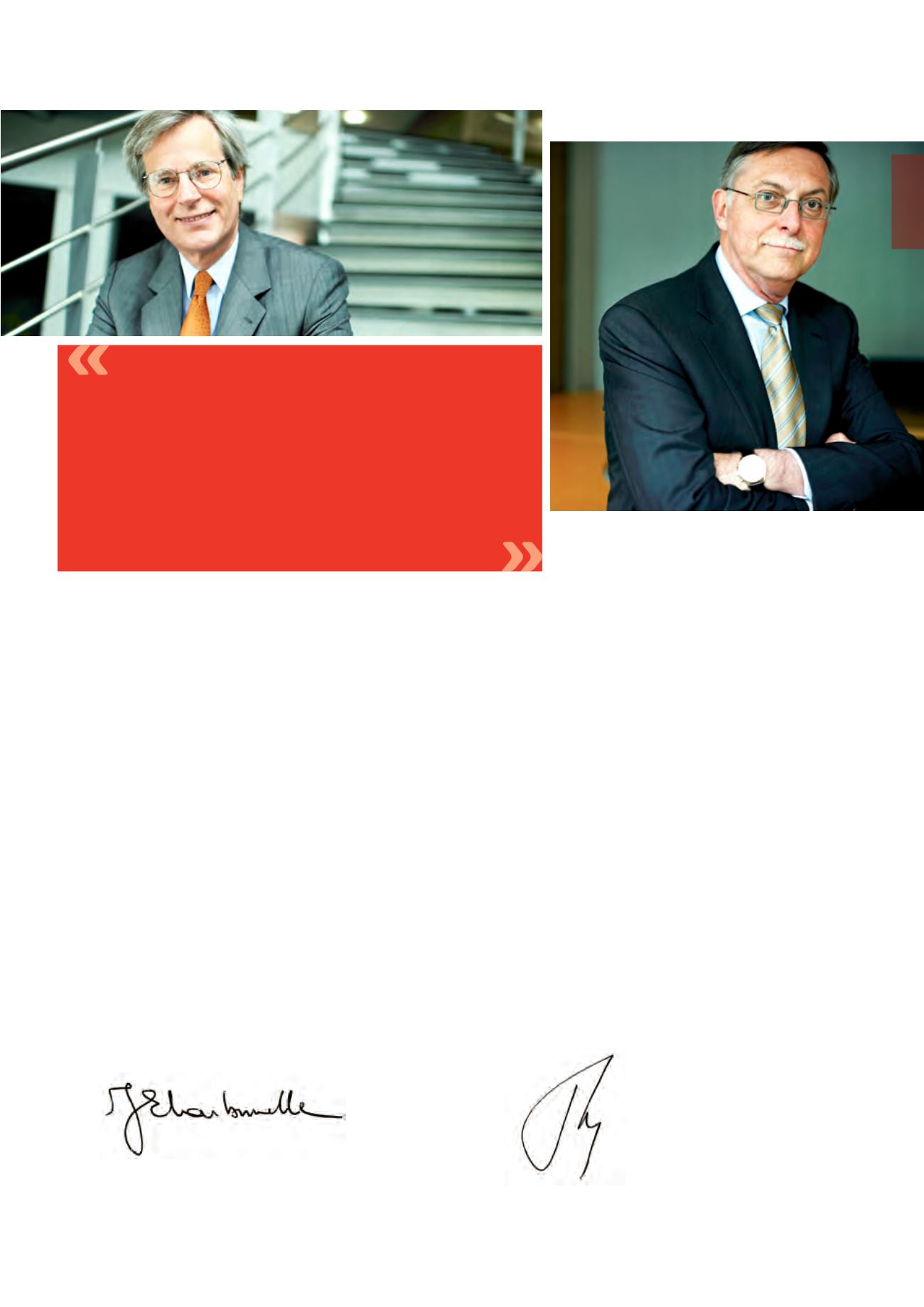

Jean-Edouard Carbonnelle

André Bergen

Chief Executive Officer

Chairman of the Board of Directors

Message to the Shareholders \

Management Report

1

Because resources were used to reduce the debt, the company has no legal obligation to distribute a dividend according to the Sicafi/bevak legislation. See also the chapters

“Appropriation of Company Results” and “Company Accounts” of this Annual Financial Report.

2

Vs. 88.5% at 31.12.2013.

In 2013, we raised €44 million in

shareholders’ equity following the

reinvestment of 53% of the 2012 dividend

in new shares. We sincerely thank our

shareholders for the confidence they

have shown us.

Jean-Edouard Carbonnelle

Chief Executive Officer

André Bergen

Chairman of the Board of Directors