Management Report /

Forecasts 2014

70

/

DIVIDEND

The Board of Directors considers that the dividend per share will need to

be reduced starting from the financial year 2014 (dividend payable in

June 2015). It plans to offer the shareholders a gross dividend per ordinary

share of €5.50, better aligned with the cash flow per share forecasted for

the financial year 2014.

The proposed dividend level of €5.50 for the financial year 2014 corre-

sponds to a gross yield of 6.23% against the average share price of the

ordinary share during the financial year 2013, and a gross yield of 5.99%

against the net asset value of the share at 31.12.2013 (in fair value). These

yields remain significantly higher than the average yield of European real

estate companies

2

.

This proposal will be in line with the provisions of Article 27 of the Royal

Decree of 07.12.2010, in that it exceeds the minimal requirement to distrib-

ute 80% of the net income of Cofinimmo SA/NV (unconsolidated) foreseen

for 2014.

CAVEAT

The forecasted consolidated balance sheet and income statement are pro-

jections, the achievement of which depends namely on trends in the prop-

erty and financial markets. They do not constitute a commitment on the

part of the company and have not been certified by the company’s auditor.

Nevertheless, the Auditor, Deloitte Company Auditors SC s.f.d. SCRL/BV

o.v.v.e. CVBA represented by Mr. Franck Verhaegen, has confirmed that the

forecasts have been drawn up properly on the indicated basis and that the

accounting basis used for the purposes of this forecast are compliant with

the accounting methods employed by Cofinimmo SA/NV in preparing its

consolidated accounts using accounting methods in accordance with IFRS

standards as executed by the Belgian Royal Decree of 07.12.2010.

1

Net income excluding gains or losses on disposals of investment properties and other non-financial assets, changes in the fair value of investment properties, the item “Other result on

the portfolio” and the exit tax.

2

The EPRA Euronext index offers a gross dividend yield of 4.51% at 31.12.2013.

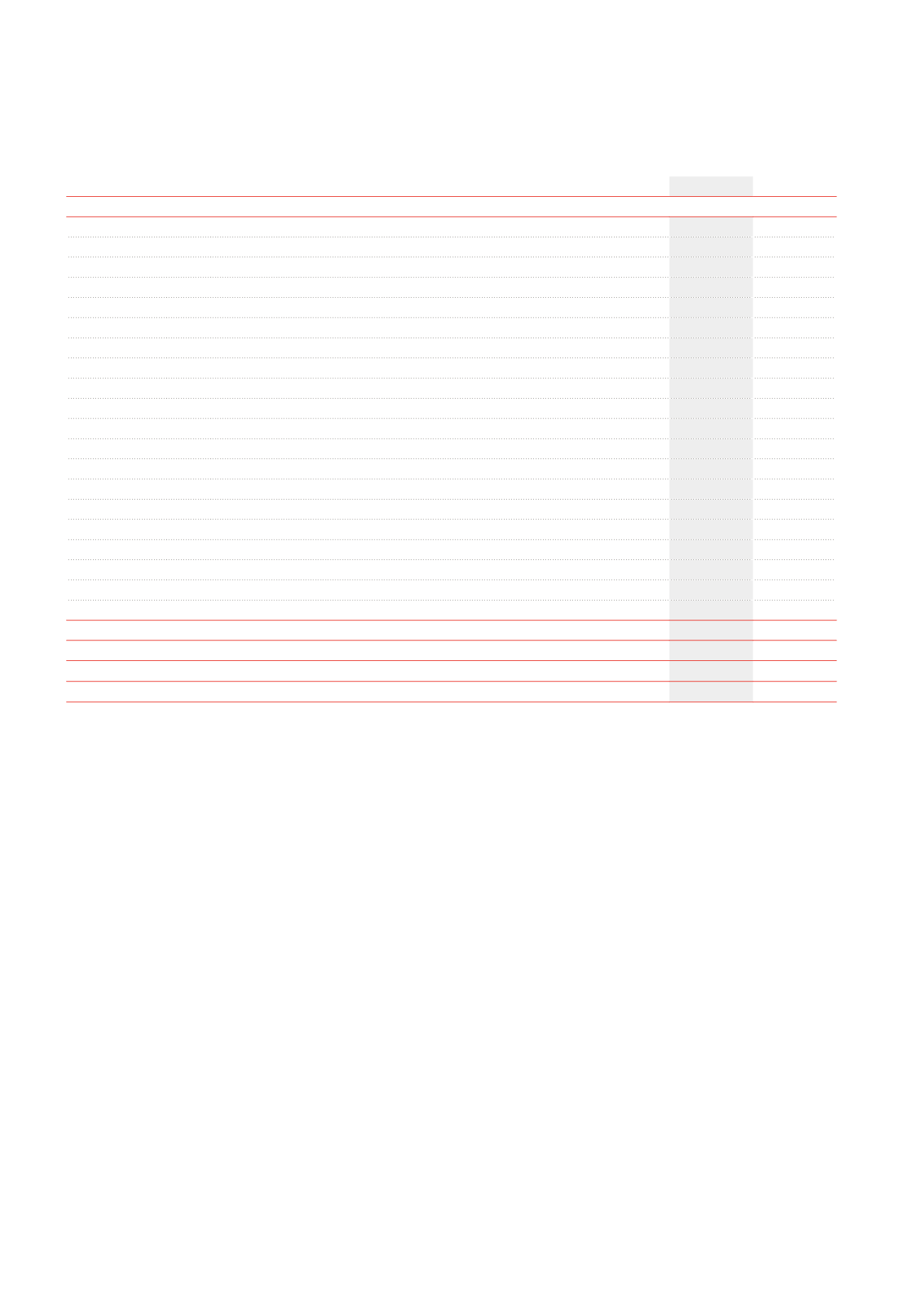

Consolidated income statement – Analytical form

(x €1,000)

2013

2014

NET CURRENT RESULT

Rental income, net of rental-related expenses

195,186

196,457

Writeback of lease payments sold and discounted (non-cash)

25,276

27,627

Taxes and charges on rented properties not recovered

-2,377

-2,624

Redecoration costs, net of tenant compensation for damages

-1,176

-1,350

Property result

216,909

220,110

Technical costs

-5,230

-5,612

Commercial costs

-841

-1,718

Taxes and charges on unlet properties

-4,075

-3,748

Property result after direct property costs

206,763

209,032

Property management costs

-14,257

-14,971

Property operating result

192,506

194,061

Corporate management costs

-6,887

- 7,060

Operating result (before result on the portfolio)

185,619

187,001

Financial income (IAS 39 excluded)

5,723

5,778

Financial charges (IAS 39 excluded)

-66,972

-67,285

Revaluation of derivative financial instruments (IAS 39)

-13,686

Share in the result of associated companies and joint ventures

1,425

1,630

Taxes

-2,179

-3,662

Net current result

1

109,930

123,462

Minority interests

-5,006

-4,519

NET CURRENT RESULT – GROUP SHARE

104,924

118,943

NUMBER OF SHARES ENTITLED TO SHARE IN THE RESULT OF THE PERIOD

17,593,767

17,980,904

NET CURRENT RESULT PER SHARE – GROUP SHARE

(in

€

)

5.96

6.61

NET CURRENT RESULT PER SHARE – GROUP SHARE – EXCLUDING IAS 39 IMPACT

(in

€

)

6.78

6.61