\ 71

Forecasts 2014

\ Management Report

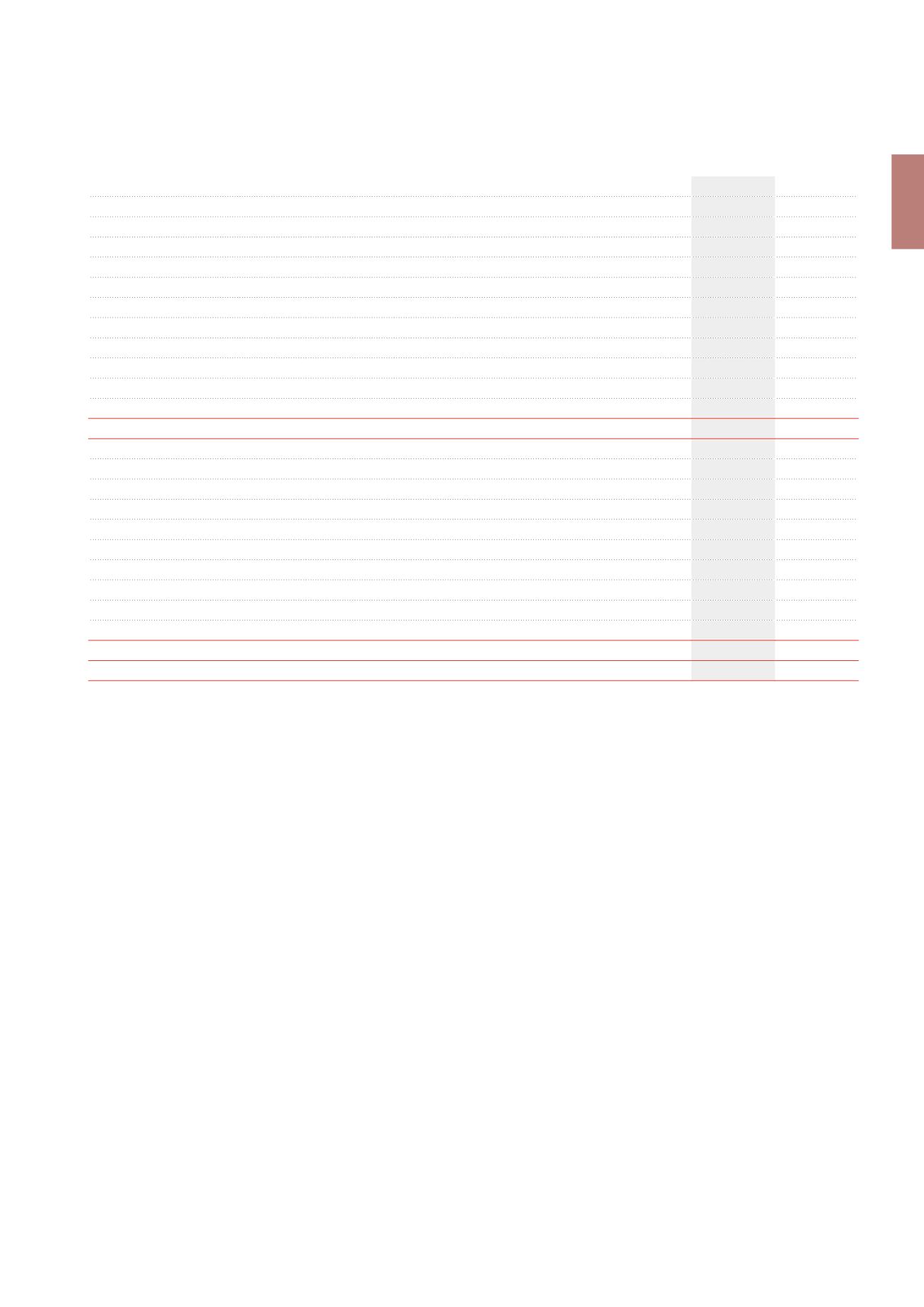

Consolidated balance sheet

(x €1,000)

31.12.2013

31.12.2014

Non-current assets

3,565,180

3,629,605

Goodwill

129,356

129,356

Investment properties

3,338,709

3,395,375

Finance lease receivables

67,449

75,270

Trade receivables and other non-current assets

22,411

22,411

Participations in associated companies and joint ventures

7,255

7,193

Current assets

105,263

100,155

Assets held for sale

8,300

63

Finance lease receivables

1,236

1,236

Cash and cash equivalents

15,969

15,969

Other current assets

79,758

82,887

TOTAL ASSETS

3,670,443

3,729,759

Shareholders’ equity

1,681,462

1,703,554

Shareholders’ equity attributable to shareholders of parent company

1,614,937

1,635,490

Minority interests

66,525

68,064

Liabilities

1,988,980

2,026,205

Non-current liabilities

1,412,904

1,787,404

Non-current financial debts

1,266,665

1,641,165

Other non-current financial liabilities

146,239

146,239

Current liabilities

576,076

238,801

Current financial debts

455,509

114,852

Other current financial liabilities

120,567

123,949

TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES

3,670,443

3,729,759

DEBT RATIO

48.87%

49.05%

Where relevant, the company will comply with the provisions of Article 54 of the Royal Decree of 07.12.2010

1

(also see Note 23, section D).

1

This Article stipulates the obligation to draw up a financial plan accompanied by an execution schedule, detailing the measures taken to prevent the consolidated debt ratio from

exceeding 65% of the consolidated assets. This plan must be submitted to the FSMA.