Management Report /

Forecasts 2014

68

/

ASSUMPTIONS

1

VALUATION OF ASSETS

The fair value, i.e. the investment value of the properties of which

transaction costs are deducted, is included in the consolidated bal-

ance sheet. For the 2014 provisional balance sheet, this valuation is

entered as an overall figure for the entire portfolio, increased by major

renovation expenses.

MAINTENANCE AND REPAIRS – MAJOR RENOVATION WORKS

2

The forecasts by building include both the repairs and maintenance costs,

which are entered under operating expenses, and the large-scale renova-

tion costs, which are capitalised and met from self-financing or borrowing.

The large-scale renovation expenses taken into account in the forecast

amount respectively to €44.4 million for the office buildings and €3.3 mil-

lion for the cafés/restaurants.

INVESTMENTS AND DIVESTMENTS

2

The forecast takes into account the following investment and divestment

projects:

•

the acquisition of nursing homes in Belgium and in France for a

total of €31.3 million resulting from the delivery of new units or the

extension of existing units;

•

the disposal in France of nursing homes for €8.3 million and of

MAAF insurance branches for €0.1 million, corresponding to firm

commitments. Moreover, assumptions were made with regard to

the disposal of the apartments of the Livingstone I and Woluwe 34

buildings.

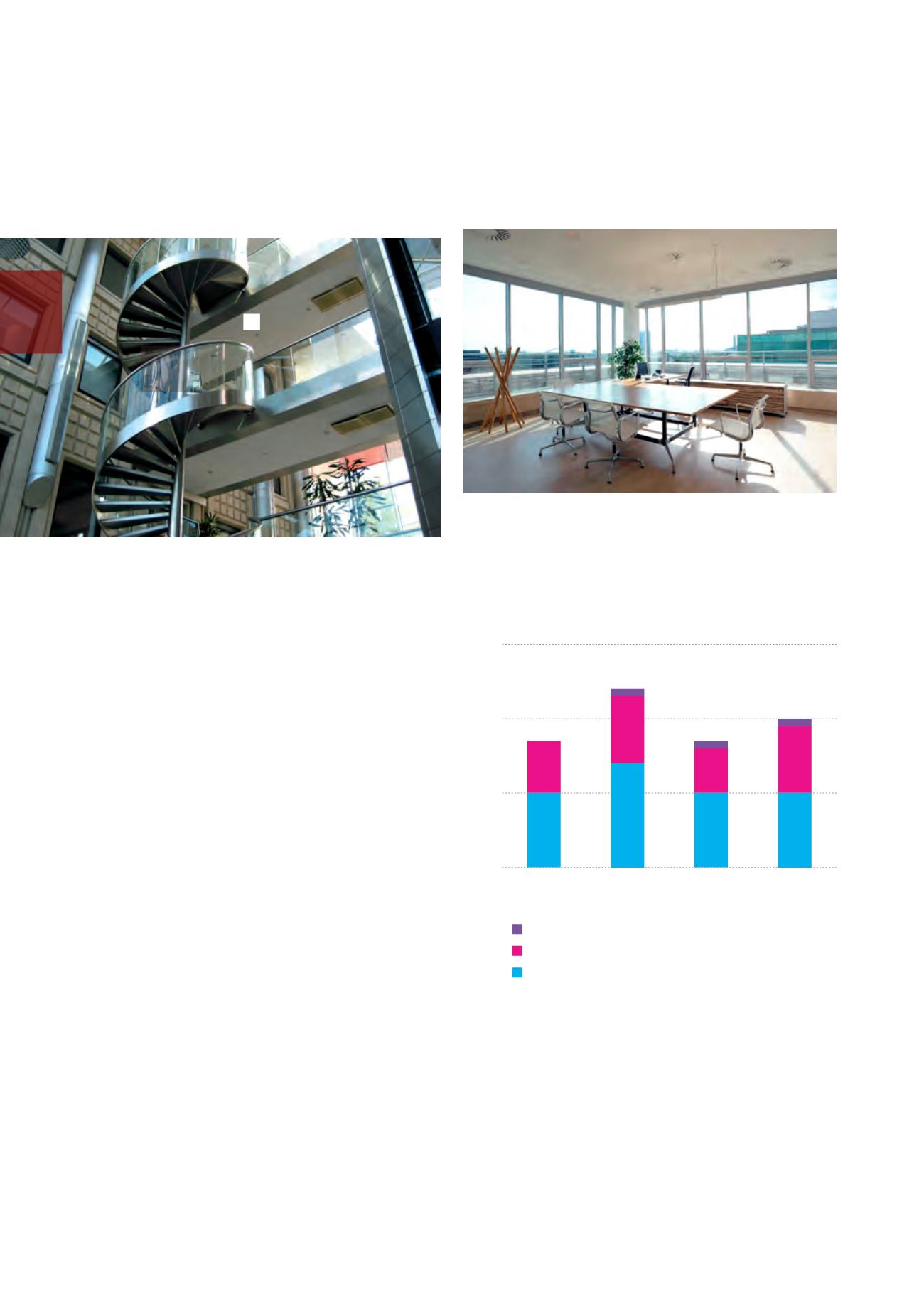

FORECASTS 2014

30,00

20,00

10,00

0,00

Q1

2014

Q2

2014

Q3

2014

Q4

2014

Renovations property of distribution networks

Acquisitions and extensions healthcare real estate

Renovations offices

1

Management has no influence on the assumptions used for the portfolio valuation and the inflation.

2

This assumption is under the company’s control, pursuant to Regulation 809/2004 of the European Commission.

Woluwe 106-108 – Brussels

Loi/Wet 56 – Brussels

2014 Investment programme

(in € millions)