Management Report /

Quarterly Consolidated Accounts

64

/

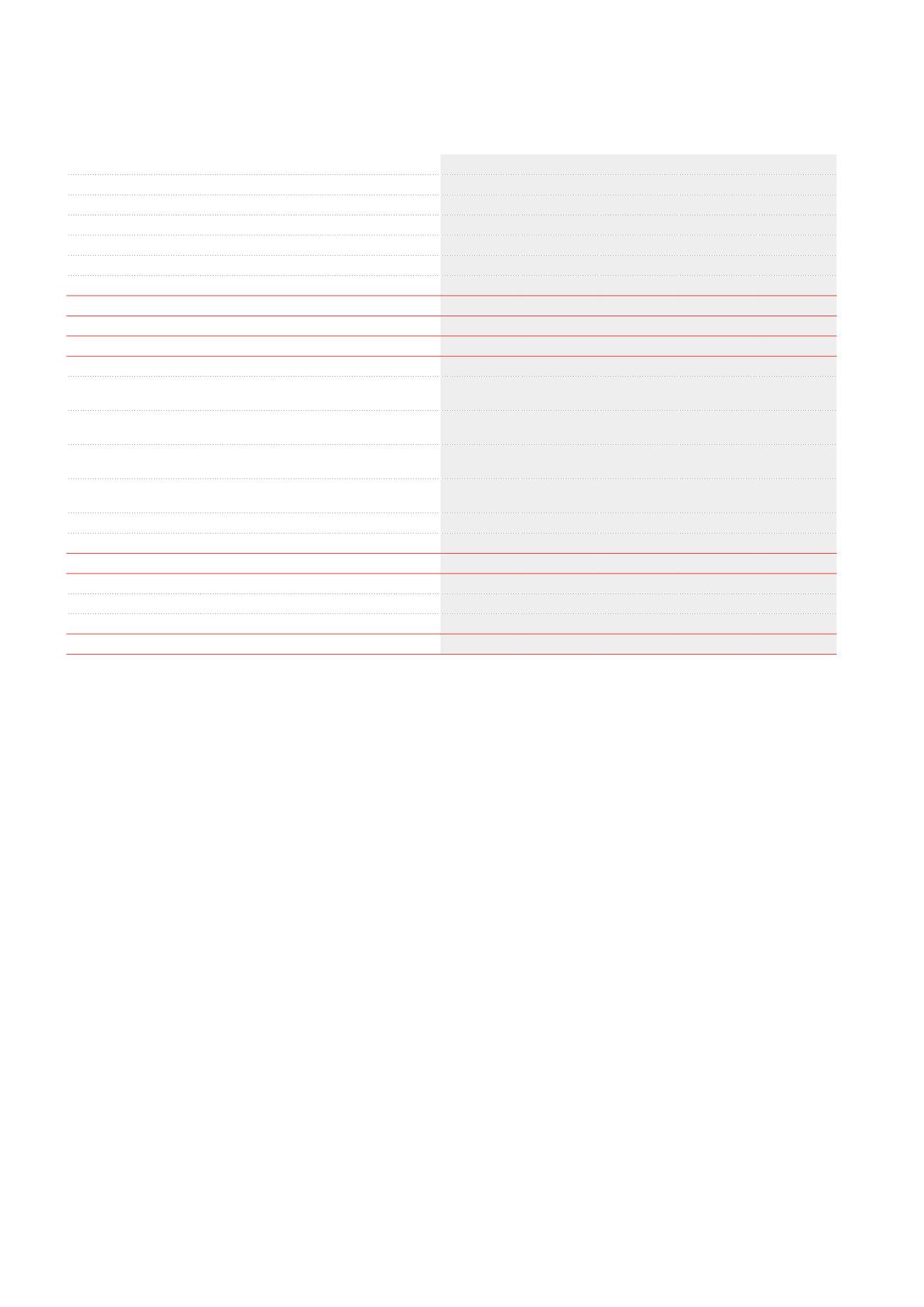

(x €1,000)

Q1 2013

Q2 2013

Q3 2013

Q4 2013

2013

1

Pre-tax result

23,935

15,948

23,064

478

63,425

Corporate tax

-183

-530

-959

-507

-2,179

Exit tax

39

92

109

378

618

Taxes

-144

-438

-850

-129

-1,561

Net result of the period

23,791

15,510

22,214

349

61,864

Minority interests

-1,310

-1,463

-1,096

742

-3,127

NET RESULT - GROUP SHARE

22,481

14,047

21,118

1,091

58,737

NET CURRENT RESULT - GROUP SHARE

28,941

20,292

29,840

25,851

104,924

RESULT ON THE PORTFOLIO - GROUP SHARE

-6,460

-6,245

-8,722

-24,760

-46,187

B. OTHER ELEMENTS OF THE GLOBAL RESULT RECYCLABLE IN THE INCOME

STATEMENT

Impact on the fair value of estimated transaction costs

resulting from the hypothetical disposal of investment properties

-106

-523

-213

-619

-1,461

Changes in the effective part of the fair value of authorised cash flow

hedge instruments

13,308

12,496

8,489

2,494

36,787

Restructuring of the hedging instruments of which the relationship has

been terminated

15,206

5,295

20,501

Other elements of the global result

13,302

27,179

8,276

7,170

55,827

Minority interests

5

9

21

35

OTHER ELEMENTS OF THE GLOBAL RESULT - GROUP SHARE

13,202

27,184

8,285

7,191

55,862

C. GLOBAL RESULT

36,993

42,689

30,490

7,519

117,691

Minority interests

-1,310

-1,458

-1,087

763

-3,092

GLOBAL RESULT - GROUP SHARE

35,683

41,231

29,403

8,282

114,599

1

The half-year and annual figures are verified by the Auditor Deloitte, Company Auditors.