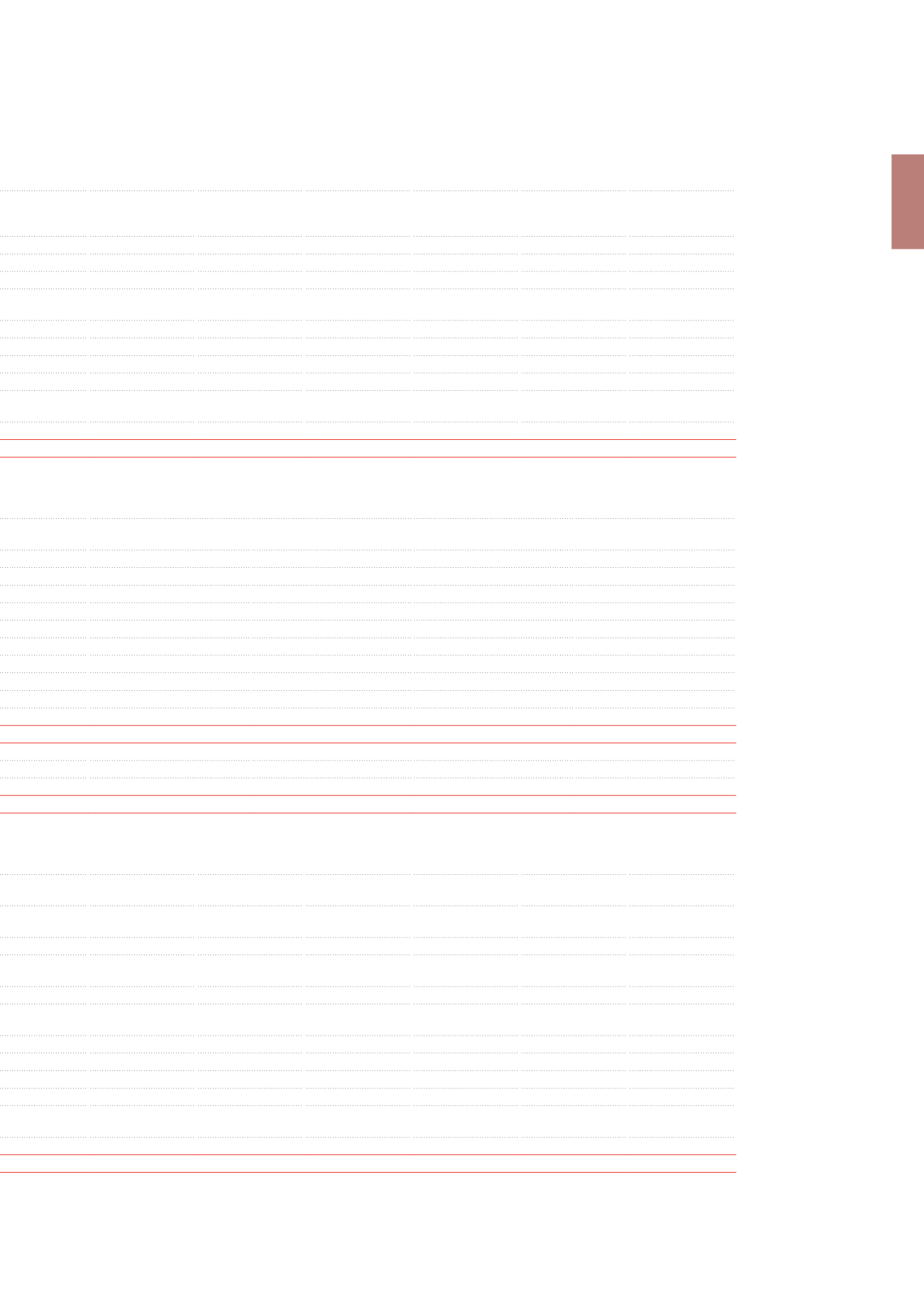

\ 61

Data according to the EPRA Principles

\ Management Report

2012

Gross rental

income of the

period

1

Net rental income

of the period

Available rental

space (in m

2

)

Passing rent at the

end of the period

ERV

2

at the end of

the period

Vacancy rate

at the end

of the period

102,510

100,067

786,066

106,530

108,758

9.24%

42,502

42,472

381,158

43,754

41,666

0.00%

28,358

28,358

235,770

28,497

28,276

0.00%

208

208

5,821

830

830

0.00%

71,068

71,038

622,749

73,081

70,772

0.00%

19,777

19,777

316,996

19,978

18,417

0.00%

9,790

9,790

47,493

7,822

8,244

0.00%

7,765

7,765

60,686

9,995

8,923

2.97%

37,332

37,332

425,175

37,795

35,584

0.69%

4,298

4,292

31,537

4,621

3,883

0.00%

215,208

212,729

1,865,527

222,027

218,997

4.70%

2012

Fair value of the portfolio

Changes in the fair value

over the period

EPRA Net

Initial Yield

Changes in the fair value

over the period

1,475,184

-21,497

6.05%

-1.44%

692,761

25,559

6.11%

3.83%

410,755

9,565

6.36%

2.38%

11,226

393

6.94%

3.62%

1,114,742

35,517

6.22%

3.29%

270,147

11,781

6.51%

4.56%

149,686

-153

6.11%

-0.10%

109,425

4,846

6.62%

4.63%

529,258

16,474

6.42%

3.21%

57,529

3,080

7.03%

5.66%

3,176,713

33,574

6.19%

1.07%

131,857

-21,377

3,308,570

12,197

Lease figures according to their revision date (break)

Passing rents of the leases subject to revision in

ERV

2

of the leases subject to revision in

Year 1

Year 2

Years 3-5

Year 1

Year 2

Years 3-5

9,485

8,814

44,007

8,371

7,952

39,674

-

-

-

-

-

-

537

-

600

700

-

580

-

-

-

-

-

-

537

-

600

700

-

580

-

-

-

-

-

-

-

-

-

-

-

-

1,024

-

203

1,073

-

212

1,024

-

203

1,073

-

212

-

-

569

-

-

-

11,046

8,814

45,379

10,144

7,952

40,855

1

Writeback of lease payments sold and discounted included.

2

ERV = Estimated Rental Value.