Management Report /

Data according to the EPRA Principles

56

/

DATA ACCORDING TO

THE EPRA PRINCIPLES

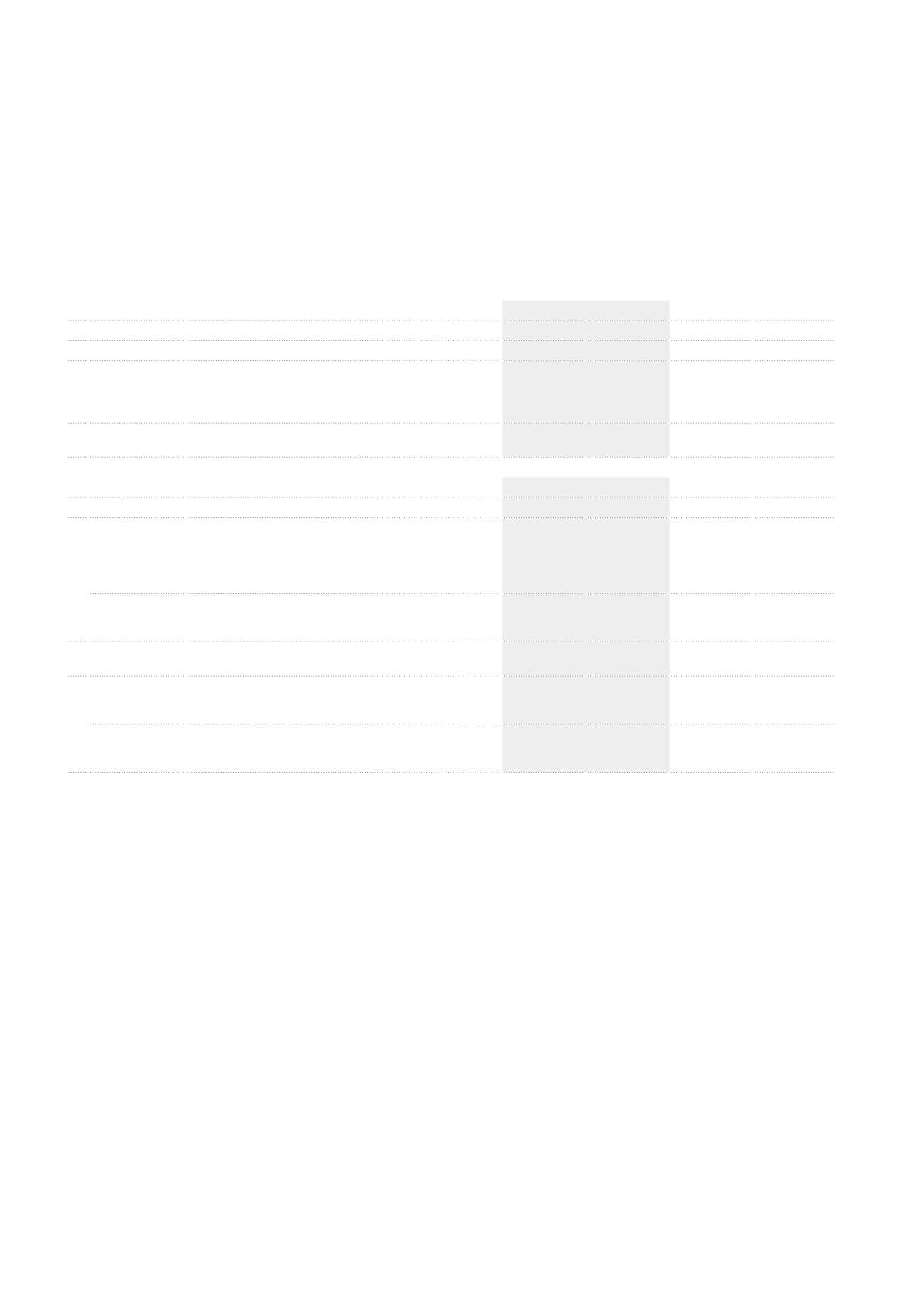

EPRA PERFORMANCE INDICATORS

2013

2012

Definitions

(x €1,000)

in €/share

(x €1,000)

in €/share

1

EPRA Earnings

Current result from core operational activities.

119,209

6.78

121,830

7.61

2

2 EPRA NAV

Net Asset Value (NAV) adjusted to include the investment

properties at their fair value and to exclude certain items not

expected to crystallize in a long-term investment property

business model.

2,036,176

98.85

1,845,391

102.04

2

3 EPRA NNNAV

EPRA NAV adjusted to include the fair value of (i) financial

instruments, (ii) debt and (iii) deferred taxes.

1,972,284

95.74

1,706,777

94.38

2

2013

2012

Definitions

in %

in %

4 EPRA Net Initial

Yield (NIY)

Annualised gross rental income based on the passing rents at

the closing date, less property charges, divided by the market

value of the portfolio, increased with estimated transaction

costs resulting from the hypothetical disposal of investment

properties.

6.20%

6.19%

EPRA

‘topped-up’ NIY

This measure incorporates an adjustment to the EPRA NIY

in respect of the expiration of rent-free periods and other

incentives.

6.16%

6.10%

5 EPRA

Vacancy rate

Estimated Rental Value (ERV) of vacant space divided by the

ERV of the total portfolio.

5.04%

4.70%

6 EPRA Cost ratio

(direct vacancy

costs included)

Administrative/operational expenses per IFRS income

statement, including the direct costs of vacant buildings,

divided by the gross rental income, less ground rent costs.

18.87%

18.69%

EPRA Cost ratio

(direct vacancy

costs excluded)

Administrative/operational expenses per IFRS income

statement, less the direct costs of vacant buildings, divided by

the gross rental income, less ground rent costs.

16.01%

16.17%

1

These data are not compulsory according to the Sicafi/Bevak regulation and are not subject to a verification by public authorities. The auditor verified whether the “EPRA Earnings”,

“EPRA NAV”, “EPRA NNNAV” and “EPRA Cost ratios” are calculated according to the definitions included in the 2013 “EPRA Best Practices Recommendations” and if the financial data used

in the calculation of these ratios comply with the accounting data included in the audited consolidated financial statements.

2

Takes into account the sale of 8,000 treasury shares in January2013.

1