4.5%

4.0%

3.5%

3.0%

2.5%

2.0%

2014 2015 2016 2017 2018 2019 2020 2021

2022

FINANCIAL RATING

In February 2013, the rating agency Standard & Poor’s revised Cofinimmo’s

financial rating to BBB- for the long-term debt and A-3 for the short-term

debt. The reasons for this are a higher debt ratio than the sector’s average

and the lack of transactions on the Brussels office market.

Since then, Cofinimmo’s debt ratio has decreased thanks to the sale of

treasury shares, while less than 50% of the 2012 dividend was paid in

cash, the remaining (52.7%) being paid in the form of new ordinary shares.

2.36%

1,000M

2.33%

1,000M

4.0%

3.5%

3.0%

2.5%

2014

2015

2016

2017

3.00%

1,000M

3.00%

1,000M

3.00%

1,000M

3.00%

1,000M

4.5%

4.0%

3.5%

3.0%

2014

2015

2016

2017

4.25%

1,200M

4.25%

1,200M

4.25%

1,000M

4.25%

1,000M

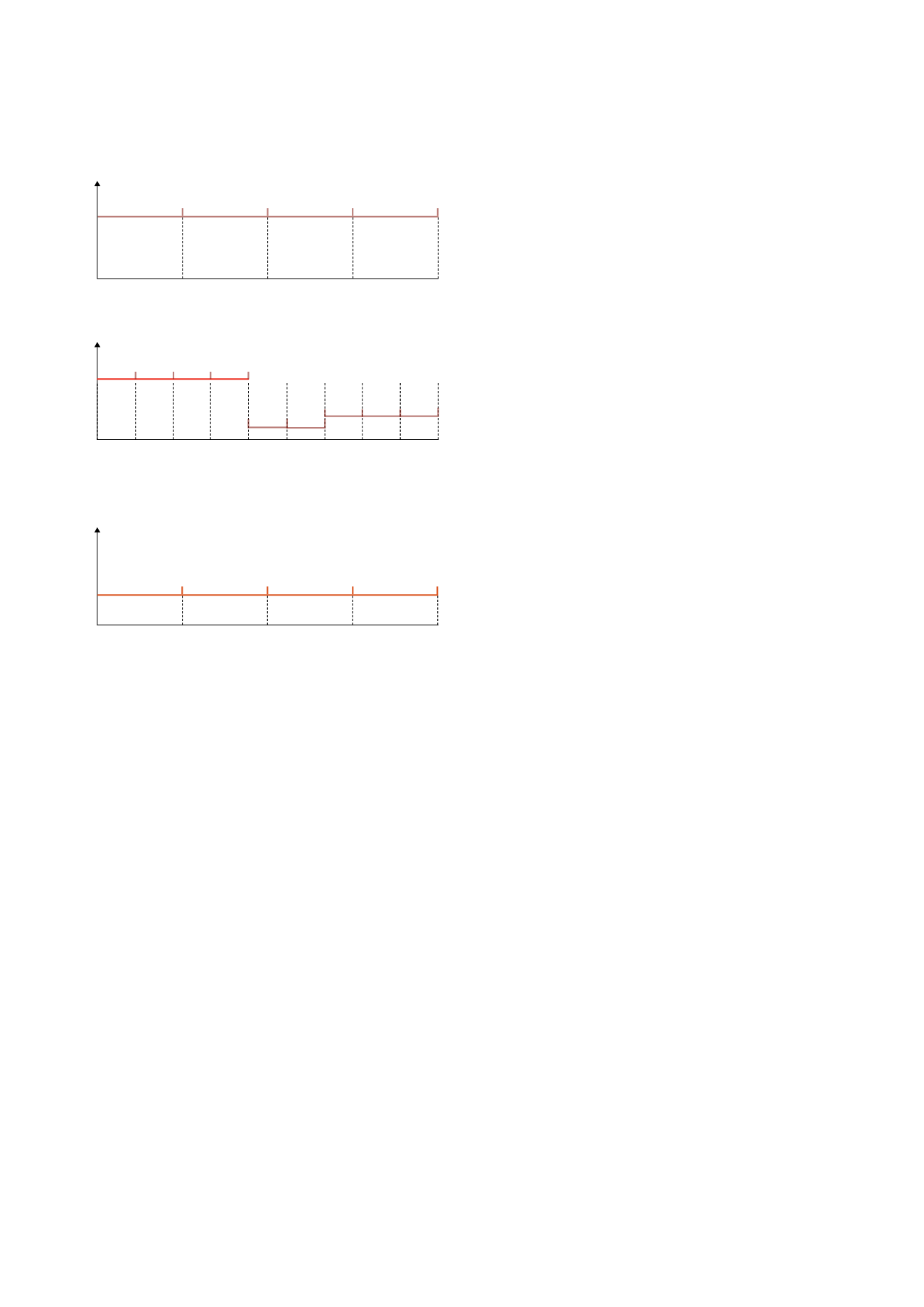

CAP options bought

(x €1,000,000)

IRS

(x €1,000,000)

FLOOR options sold

(x €1,000,000)

DEPLOYMENT OF THE DEBT FINANCING

STRATEGY DURING THE FINANCIAL YEAR 2013

In 2013, Cofinimmo took a number of measures to gather financial

resources in order to meet its investment commitments and bolster its

balance sheet structure. Accordingly, since the beginning of 2013, the

company has successively proceeded to the following actions:

ISSUE OF A CONVERTIBLE BOND FOR €190.8 MILLION

On 20.06.2013, Cofinimmo issued a second convertible bond for a nominal

amount of €190.8 million and a five-year maturity.

This bond has a 2% coupon payable on June 20th each year. The first pay-

ment will be due on 20.06.2014.

PRIVATE PLACEMENT OF BONDS FOR €50.0 MILLION

On 23.10.2013, Cofinimmo successfully placed a bond loan with a term

of four years maturing on 23.10.2017 for a total amount of €50.0 million.

The bond offers a fixed coupon of 2.78% of the nominal value, payable

annually on October 23rd. The bonds were placed with a limited number

of institutional investors.

RENEWAL OF FIVE CREDIT LINES FOR A TOTAL AMOUNT OF

€270.0 MILLION

At the start of February 2013, Cofinimmo signed two new credit lines

to replace two existing maturing credit lines. The new lines, each for

€50.0 million, have a maturity of three years and five years respectively.

In July 2013, Cofinimmo signed three other credit lines: two lines, for an

amount of €50.0 million each, maturing in 2018 and in 2019 respectively,

and one line, for an amount of €70.0 million, maturing in March 2018 and

replacing a credit line maturing in March 2014.

NET AVAILABILITY OF CREDIT

These different transactions, together with the available funding from

Cofinimmo’s confirmed credit lines, amounted to €607.0 million at

31.12.2013. After deducting the full hedging of outstanding short-term

treasury bills (€103.2million), the refinancing of the credit lines maturing in

2014 (€140.0 million) and the bonds to be reimbursed in 2014 (€200.0 mil-

lion) is thus fully covered.

4.10%

140M

4.10%

140M

4.10%

140M

4.10%

140M

2.73%

500M

2.73%

500M

2.73%

500M

Management Report /

Management of Financial Resources

54

/