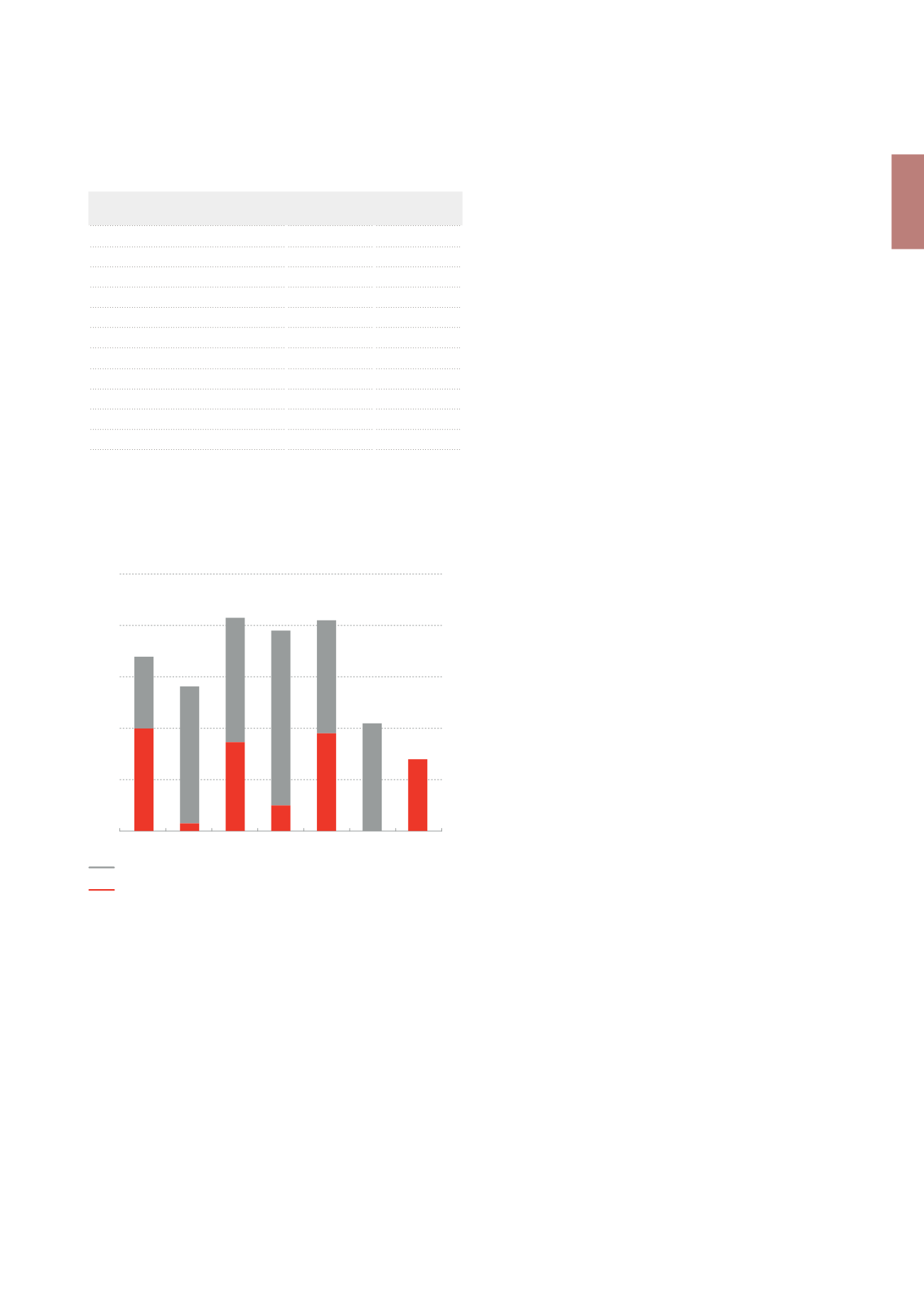

500

400

300

200

100

0

2014

2015

2016

2017

2018

2019

2020

50

0

100

200

300

400

500

200

173.3

190.8

15

140

140

242.4

220

210

341

267

Bank facilities

Capital markets

Financial debt

(x €1,000,000)

Financial

debt

Long-term

commitments

Capital markets

Bonds

394.4

390.0

Convertible bonds

373.1

364.1

Long-term commercial papers

15.0

15.0

Short-term commercial papers

103.2

Other

4.2

4.2

Bank facilities

Revolving credits

705.0

1,319.4

Term credits

111.9

111.9

Other

15.4

8.0

Total

1,722.2

2,212.6

STRENGHTENING OF EQUITY

Cofinimmo regularly taps into the capital markets to strengthen its finan-

cial resources. During the past ten years, the company has raised equity

at an average annual amount of €85.9 million in various forms: issue of

shares as part of a contribution in kind, sale of treasury shares, issue of

preference shares, dividends payable in shares.

During 2013, Cofinimmo strengthened its equity in two ways:

•

the sale of treasury shares for €91.7 million

During the first half of 2013, Cofinimmo sold 1,056,283 own ordinary

shares for an average net price of €86.78 per share (average gross

price of €87.69 per share), thereby strengthening its equity by

€91.7 million. Of these 1,056,283 own ordinary shares, 989,413 were

sold via an accelerated bookbuilding offering at a gross price of

€87.50 per share

1

, and the balance on the stock market.

•

the distribution of dividends in new shares for €43.9 million gross

The shareholders’ equity was increased by €43.9 million, further to a

decision by the shareholders of Cofinimmo to reinvest 52.7%

2

of their

2012 dividends in new ordinary shares. The subscription price of the

new ordinary shares was €82.875

3

, i.e. a 4.48% discount versus the

average share price during the considered period.

Repayment schedule for long-term financial commitments -

€2,189.5million

(x €1,000,000)

1

See also our press releases dated 25.03.2013 and 26.03.2013, available on the website

www.cofinimmo.com.2

Against 40.8% for the 2011 dividend.

3

See also our press releases dated 08.05.2013 and 06.06.2013, available on the website

www.cofinimmo.com.

\ 55

Management of Financial Resources

\ Management Report