Management Report /

Data according to the EPRA Principles

60

/

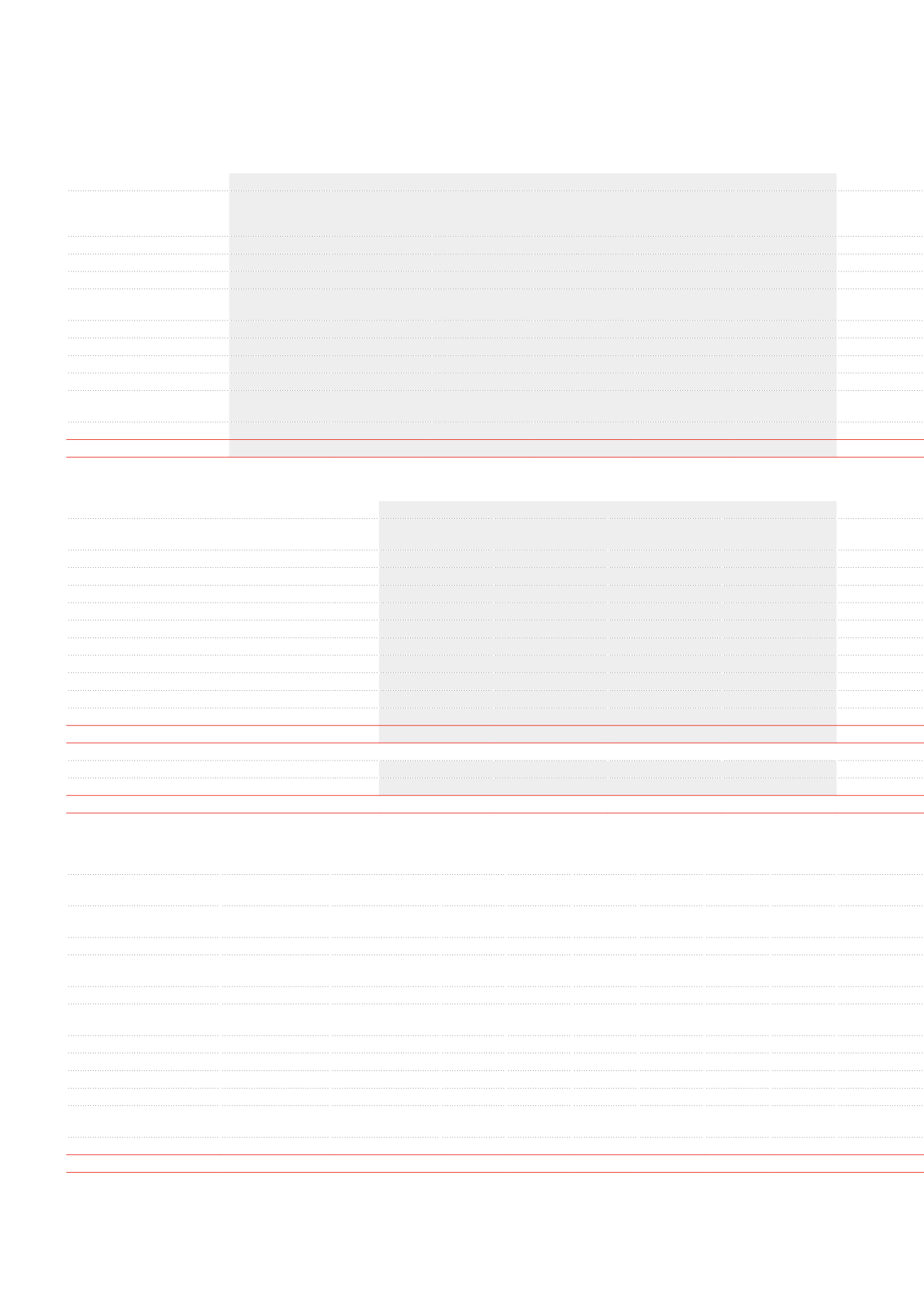

Investment properties – Rental data

(x €1,000)

2013

SEGMENT

Gross rental

income of the

period

1

Net rental income

of the period

Available rental

space (in m

2

)

Passing rent at

the end of

the period

ERV

2

at the end

ofthe period

Vacancy rate at

the end of

the period

Offices

104,652

101,582

763,644

105,228

107,149

9.75%

Healthcare real estate Belgium

46,432

46,401

403,636

47,689

44,252

0.00%

Healthcare real estate France

28,476

28,477

234,298

28,066

29,007

1.93%

Healthcare real estate

Netherlands

835

835

5,821

854

844

0.00%

Healthcare real estate

75,743

75,713

643,755

76,609

74,103

0.00%

Pubstone - Belgium

20,002

20,002

316,268

19,963

18,373

0.00%

Pubstone - Netherlands

10,054

10,054

47,203

7,892

8,932

0.00%

Cofinimur I - France

7,747

7,747

59,572

10,299

8,167

1.03%

Property of distribution

networks

37,803

37,803

423,042

38,153

35,472

0.24%

Other

4,527

4,515

23,026

4,395

3,558

0.00%

TOTAL PORTFOLIO

222,724

219,613

1,853,467

224,385

220,282

5.04%

Investment properties – Valuation data

(x €1,000)

2013

SEGMENT

Fair value

of the portfolio

Changes in the fair

value over the period

EPRA Net

Initial Yield

Changes in the fair

value over the period

Offices

1,447,104

-22,332

6.05%

-1.52%

Healthcare real estate Belgium

747,969

5,982

6.18%

0.81%

Healthcare real estate France

418,130

2,906

6.29%

0.70%

Healthcare real estate Netherlands

11,250

-136

7.07%

-1.18%

Healthcare real estate

1,177,349

8,754

6.23%

0.75%

Pubstone - Belgium

272,243

886

6.43%

0.33%

Pubstone - Netherlands

150,650

386

6.46%

0.26%

Cofinimur I - France

109,925

1,333

6.57%

1.23%

Property of distribution networks

532,818

2,605

6.47%

0.49%

Other

59,205

1,040

6.76%

1.79%

TOTAL PORTFOLIO

3,216,476

-9,933

6.20%

-0.31%

Reconciliation with IFRS consolidated income statement

Investment properties under development

130,533

-16,327

TOTAL

3,347,009

-26,260

1

Writeback of lease payments sold and discounted included.

2

ERV = Estimated Rental Value.

3

First break option for the tenant.

Investment properties – Lease data

(x €1,000)

Figures depending on the lease ends

Segment

Average lease length (in years)

Passing rents of the leases

maturing in:

ERV

2

of the leases maturing in:

Until the break

3

Until the end

of the lease

Year 1

Year 2 Years 3-5

Year 1

Year 2 Years 3-5

Offices

6.9

7.7

7,229

3,138 35,984

6,151

2,882

31,151

Healthcare real estate

Belgium

21.7

21.7

-

-

-

-

-

-

Healthcare real estate France

7.0

7.0

537

-

-

700

-

-

Healthcare real estate

Netherlands

13.7

13.7

-

-

-

-

-

-

Healthcare real estate

16.3

16.3

537

-

-

700

-

-

Pubstone - Belgium

16.8

20.8

-

-

-

-

-

-

Pubstone - Netherlands

16.8

20.8

-

-

-

-

-

-

Cofinimur I - France

7.8

7.8

1,024

-

203

1,073

-

212

Property of distribution

networks

15.0

18.1

1,024

-

203

1,073

-

212

Other

13.0

14.2

-

-

-

-

-

-

TOTAL PORTFOLIO

11.6

12.5

8,790

3,138

36,187

7,924

2,882

31,363