Management Report /

Data according to the EPRA Principles

58

/

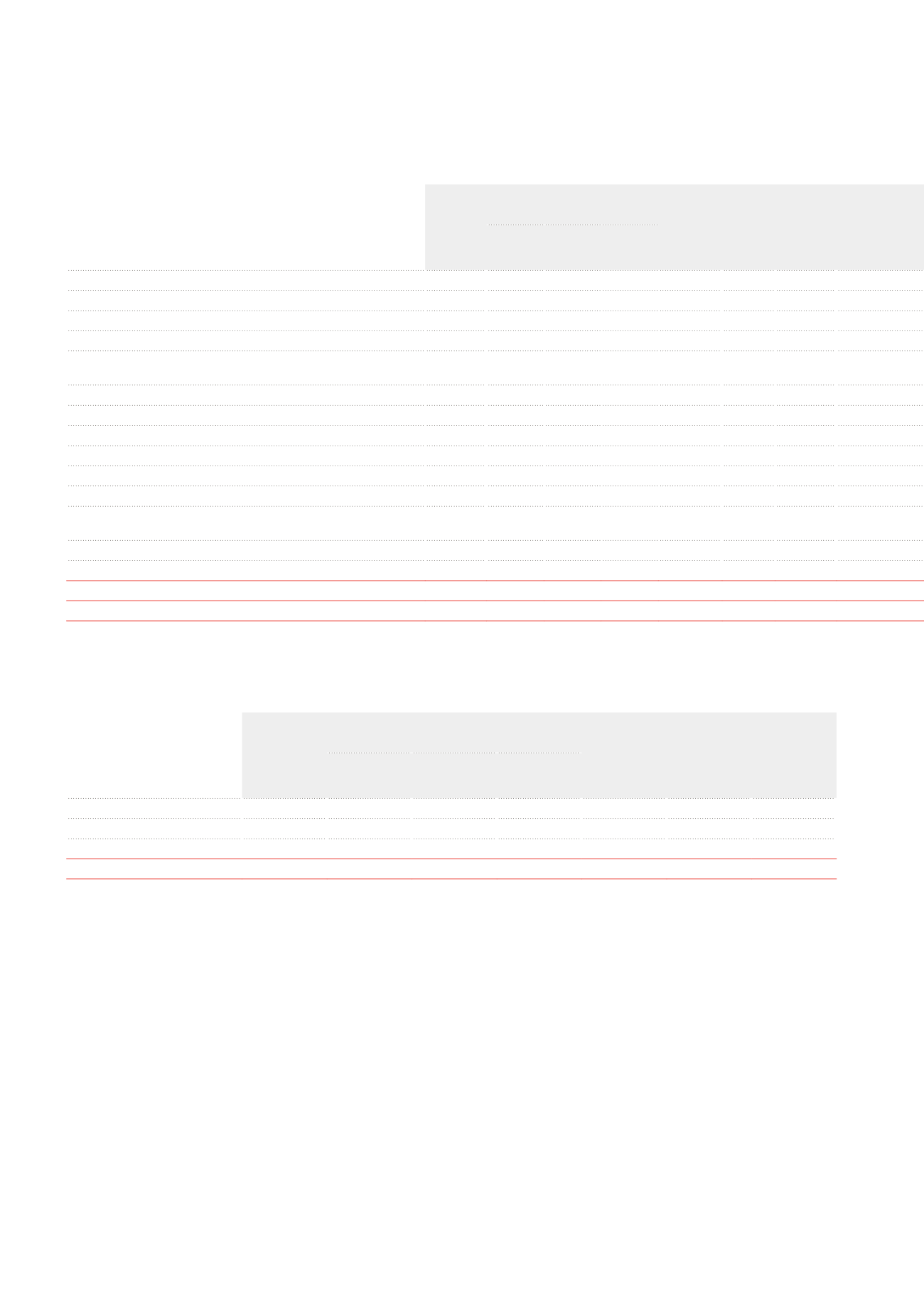

EPRA Net Initial Yield (NIY) and EPRA ‘topped-up’ NIY

(x €1,000)

2013

Offices

Healthcare real estate

Property

of

distribution

networks

Other

TOTAL

Belgium France Netherlands

Investment properties in fair value

1,524,811

791,995 418,130 18,120 532,818 61,135 3,347,009

Assets held for sale

-

-

-7,650

-

-650

-

-8,300

Development projects

-77,707 -44,026

-

-6,870

-

-1,930 -130,533

Properties available for lease

1,447,104 747,969 410,480 11,250 532,168 59,205 3,208,176

Estimated transaction costs resulting from the hypothetical

disposal of investment properties

36,178 19,075 24,697

703 45,695 1,480 127,828

Gross up completed property portfolio valuation

1,483,282 767,044 435,177

11,953 577,863 60,685 3,336,004

Annualised gross rental income

105,216 47,665 27,417

854

38,153 4,285 223,590

Property charges

-15,543

-234

-62

-8

-780

-180 -16,807

Annualised net rental income

89,673 47,431

27,355

846 37,373 4,105 206,783

Rent-free periods expiring within 12 months

and other lease incentives

-1,122

-

-

-

-

-

-1,122

Topped-up net annualised rental income

88,551

47,431

27,355

846 37,373 4,105 205,661

EPRA NIY

6.05% 6.18% 6.29% 7.07% 6.47% 6.76% 6.20%

EPRA ‘TOPPED-UP’ NIY

5.97% 6.18% 6.29% 7.07% 6.47% 6.76% 6.16%

EPRA Vacancy rate

(x €1,000)

2013

Offices

Healthcare real estate

Property

of

distribution

networks

Other

TOTAL

Belgium

France Netherlands

Rental space

763,644

403,636

234,298

5,821

423,042

23,026

1,853,467

ERV

1

of vacant space

10,450

-

560

-

84

-

11,094

ERV

1

of the total portfolio

107,149

44,252

29,007

844

35,472

3,558

220,282

EPRA VACANCY RATE

9.75%

0.00%

1.93%

0.00%

0.24%

0.00%

5.04%

1

ERV = Estimated Rental Value.