1

See also our press release dated 12.06.2014, available on

www.cofinimmo.com.In 2014, Cofinimmo raised equity for €32 million through

the distribution of dividends in shares.

Capital markets

Cofinimmo regularly has access to capital markets to finance its investment projects. At 31.12.2014, the funds raised on the capital markets

were made up of:

•

€190 million in the form of non-convertible bonds ;

•

€381.4 million in the form of convertible bonds ;

Following the 2013 dividend distribution of €6.00 per ordinary share, the rights of the holders of convertible bonds issued in 2013 have

been adjusted

1

. Hence, as of 06.06.2014 (settlement date of the 2013 dividend), the conversion price of these bonds stands at €104.231.

Issuer

Par value

(x €1,000,000)

Issue price

Coupon

Issue date

Maturity date

Cofinimmo SA/NV

€140.0

100%

3.598%

26.07.2012

07.02.2020

Cofinimmo SA/NV

€50.0

100%

2.78%

23.10.2013

23.10.2017

Issuer

Par value

(x €1,000,000

Issue price Conversion price

Coupon

Issue date

Maturity date

Cofinimmo SA/NV

€173.3

100%

€116.60

3.125%

28.04.2011

28.04.2016

Cofinimmo SA/NV

€190.8

100%

€104.231

2.00%

20.06.2013

20.06.2018

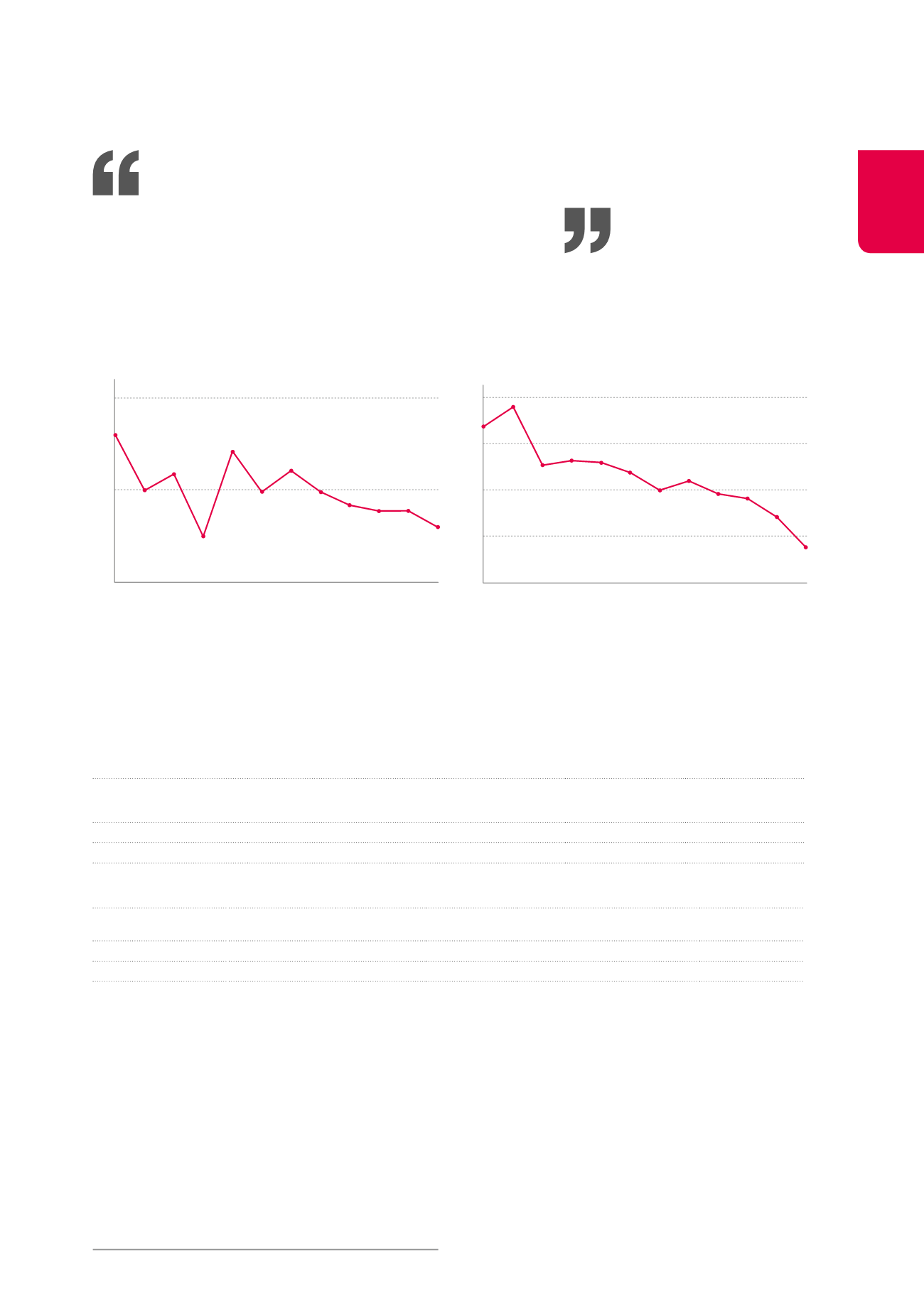

55%

50%

45%

06/2009

12/2009

06/2010

12/2010

06/2011

12/2011

06/2012

12/2012

06/2013

12/2013

06/2014

12/2014

Evolution of the debt ratio (half-yearly)

5%

4.5%

4%

3.5%

3%

06/2009

12/2009

06/2010

12/2010

06/2011

12/2011

06/2012

12/2012

06/2013

12/2013

06/2014

12/2014

Evolution of the average cost of debt (in %)

48.01%

3.39%

4.91%

4.70%

4.33%

4.20%

4.11%

3.92%

52.94%

49.97%

47.50%

49.89% 49.90%

48.87%

71