MANAGEMENT REPORT /

Management of financial resources

•

€216.5 million of commercial papers, including €201.5 million for

an initial period of under one year and €15.0 million for an initial

period of over three years;

•

€4.1 million corresponding to the discounted value of the

minimum coupon of the mandatory convertible bonds issued

by Cofinimur I in December 2011.

The bonds which matured in 2014 (€200.0 million) were 100% refi-

nanced by drawing on available credit lines.

Bank facilities

In order to diversify its sources of financing, the Group has access

to credit lines signed with ten first-rate financial institutions. At

31.12.2014, the credit lines were made up of:

•

€812.9 million of bilateral and syndicated medium- and long-

term loans

1

, with original maturity periods of between three and

ten years, contracted from ten banks;

•

€16.6 million of other loans and advances (mainly account

debits and rental guarantees received).

Current financial debt

At 31.12.2014, Cofinimmo’s short-term financial debt alone amounted

to €473.5 million, including:

•

€257.0 million of drawings on credit lines maturing in 2015;

•

€216.5 million of commercial papers with a term of under

one year. The issue of short-term commercial papers is fully

covered by undrawn portions of the confirmed long-term credit

facilities totalling €608.2 million. Cofinimmo thus benefits from

the attractive cost of this short-term financing program, while

securing its refinancing if the placement of new commercial

papers was to become more expensive or impossible.

At the end of 2014, the credit lines maturing in 2015 (€282.0 million)

were 100% refinanced, as well as 35% of the credit lines maturing

in 2016.

Situation of long-term financial

commitments

The average weighed maturity of the Cofinimmo financial commit-

ments remained stable at 3.4 years at 31.12.2014. This calculation

does not take into account the short-term maturities of the com-

mercial papers which are entirely covered by undrawn portions

of the long-term credit facilities. It also excludes the maturities

which refinancing is already in place. The long-term confirmed

financial credit lines (bank lines, bonds, commercial papers of over

one year and term credit facilities), with outstandings totalling

€1,989.5 million at 31.12.2014, display a homogeneously spread

maturity profile up to 2020, with a maximum of 21% of these out-

standings maturing during the same year, 2016.

Interest rate hedging

The average cost of Cofinimmo’s debt, including bank margins,

stood at 3.43% during the financial year 2014, against 3.92% during

the financial year 2013 (also see Note 16).

At 31.12.2014, the majority of the debt was at short-term floating

rate. The convertible bonds of €364.1 million remained at fixed

rate as well as the second withdrawal of €40 million of the private

placement maturing in 2020 and the private placement of €50 mil-

lion maturing in 2017. Consequently, the company is exposed to

the risk of a rise in short-term rates, which could have a negative

impact on its financial result. Therefore, Cofinimmo uses hedging

instruments such as CAPs, generally combined with the sale of

FLOORs, or IRS contracts to partially cover its overall debt (see the

chapter “Risk Factors” of this Annual Financial Report).

In 2009 and 2010, in accordance with its hedging policy and given

the uncertainty as to the evolution of the short-term interest

rates, Cofinimmo partially hedged its floating-rate debt through

the purchase of CAP options (with strikes between 3.75% and 5%)

combined with the sale of FLOOR options (with strikes between

2.75% and 3.25%) for a period until 2017. In May 2014, given the debt

reduction following the sale of the North Galaxy building and given

the continuing low interest rates (Euribor 3 months rate at 0.078%),

Cofinimmo restructured its hedging positions with the following

consequences:

•

FLOOR options with a strike at 3%

2

for a notional amount of

€600 million which extended until (and including) 2017 were

cancelled. This operation resulted in the reduction of the

average cost of debt to 3.43% at 31.12.2014 (against 3.92% at

31.12.2013) and will lead to a decrease in interest charges in the

coming years.

•

This restructuring resulted in an outlay of €56 million, fully

accounted for in the income statement at 31.12.2014

3

as

part of the risk which was hedged by the cancelled hedging

instruments had disappeared.

•

Cofinimmo also contracted new Interest Rate Swaps, over the

same period and for a notional amount of €400 million. The

average rate of these new IRS stands at 0.51%.

In total, at 31.12.2014, at constant debt, the interest rate risk is

hedged at over 70% until 2018.

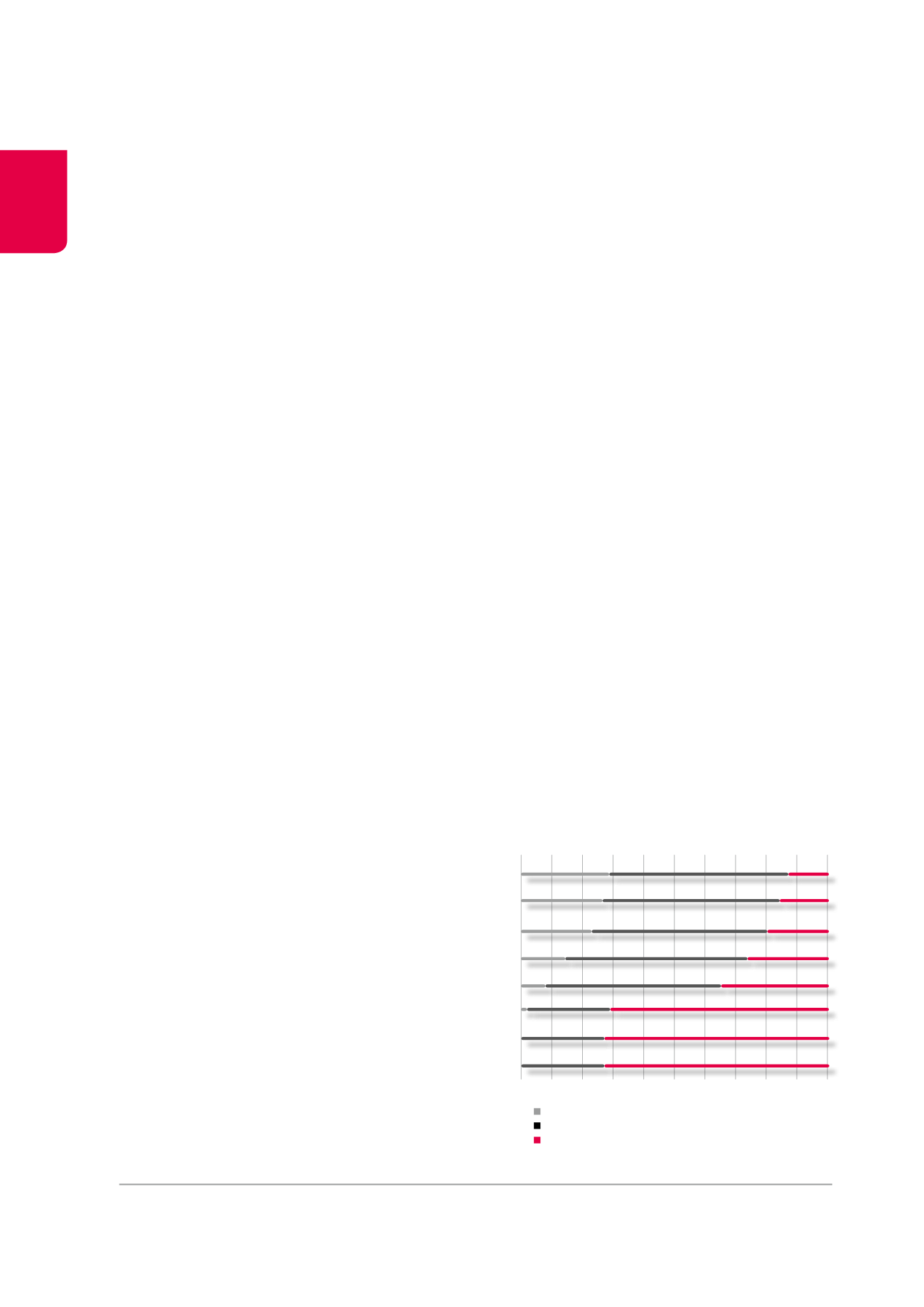

The situation at 31.12.2014 of the interest rate hedging for future

years is set out in Note 24.

1

Including a Schuldschein or debt certificate entered into with two German banks.

2

The Euribor 3 months rate stood at 0.078% at 31.12.2014.

3

Under the item “Changes in fair value of financial assets and liabilities” of the

global result according to the Royal Decree of 13.07.2014 and under the item

“Revaluation of derivative financial instruments (IAS 39)” of the income statement

- analytical format.

4

This situation takes into account the cancellation in January 2015 of FLOOR

options.

Hedging of the interest rate risk for future years

4

(in %)

28.7

13.2

58.1

26.5

16.0

57.5

22.9

20.1

57.0

14.4

26.4

59.1

8.4

34.9

56.7

73.0

27.0

72.5

27.5

2.2

70.8

27.0

2015

2016

2017

2018

2019

2020

2021

2022

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Average fixed debt

Average hedged debt

Average floating debt

72