At the time of the writing of this Annual Financial Report, the

hedging rate of the interest rate risk, assuming constant debt, is

over 70% until the end of 2018 and over 65% until the end of 2019.

Cofinimmo’s result nevertheless remains sensitive to interest rate

fluctuations (see the chapter “Risk Factors” of this Annual Financial

Report).

Financial rating

Since 2001, Cofinimmo has a long- and short-term financial rating

awarded by the rating agency Standard&Poors.

At the time of writing of this Annual Financial Report, this rating was

BBB- for the long term and A-3 for the short term.

Deployment of the debt

financing strategy during

the financial year 2014

In 2014, Cofinimmo took a number of measures to gather financial

resources in order to meet its investment commitments and bolster

its balance sheet structure. Accordingly, since the beginning of

2014, the company has successively proceeded to the following

actions:

Renewal of four credit lines for a

total amount of €252 million

In July 2014, two credit lines maturing on 31.08.2014 were extended

for five years. The amount of these credit lines stands at €100 mil-

lion and €40 million respectively.

In January 2015, two additional credit lines were extended: a line of

€50 million, expiring in 2018, was extended for five years, and a line

of €62 million, expiring in 2016, was extended for seven years.

Net credit availabilities

The available funding from Cofinimmo’s confirmed credit lines

hence amounted to €608.2 million at 31.12.2014. After deducting the

full coverage of outstanding short-term treasury bills (€201.5 mil-

lion), the refinancing of the credit lines maturing in 2015 (€267 mil-

lion) and the long-term commercial papers to be reimbursed in 2015

(€15 million) is thus fully covered.

Strenghtening of equity for

€32.1 million

Cofinimmo regularly taps into the capital markets to strengthen its

financial resources. During the past ten years, the company has

raised equity at an average annual amount of €70 million in various

forms: shares issued as part of a contribution in kind, sale of treas-

ury shares, issuing of preference shares and dividends in shares.

In 2014, the shareholders of Cofinimmo decided to reinvest 41.2%

of their 2013 dividends in new ordinary shares. The shareholders’

equity was thus increased by €32.8 million. The subscription price

of the new ordinary shares stood at €85.50

1

.

Financial

debt

Long-term

commit-

ments

Capital markets

Bonds

190

190

Convertible bonds

381.4

364.1

Long-term commercial

papers

15

15

Short-term commercial

papers

201.5

/

Other

4.1

4.1

Bank facilities

Revolving credits

701.7

1,319.4

Term credits

111.2

111.2

Other

16.6

5.1

TOTAL

1,621.5

2,008.9

Financial debt (x €1,000,000)

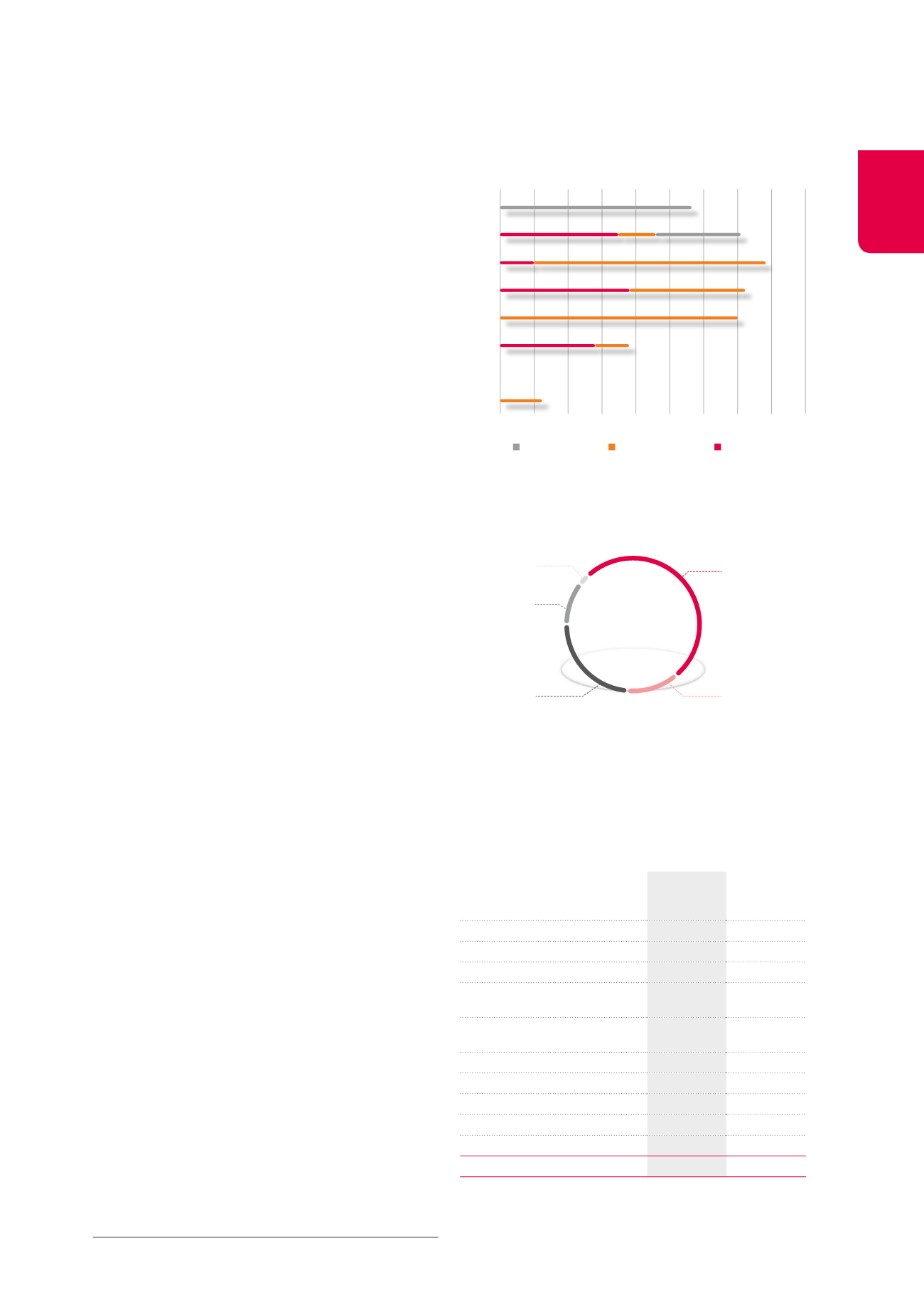

Maturities of long-term financial commitments -

€1,989.1 million (x €1,000,000)

0 50 100 150 200 250 300 350 400 450

173

55

50

50

140

62

191

341

170

350

125

282

2015

2016

2017

2018

2019

2020

2021

2022

Refinanced

Bank facilities

Capital markets

Convertible

bonds

381

Other

21

Commercial

paper

202

Bank debt

813

Bonds and

long-term loans

205

Breakdown of debt (x €1,000,000)

1

See also our press releases dated 14.05.2014 and 05.06.2014, available on

www.cofinimmo.com.

73