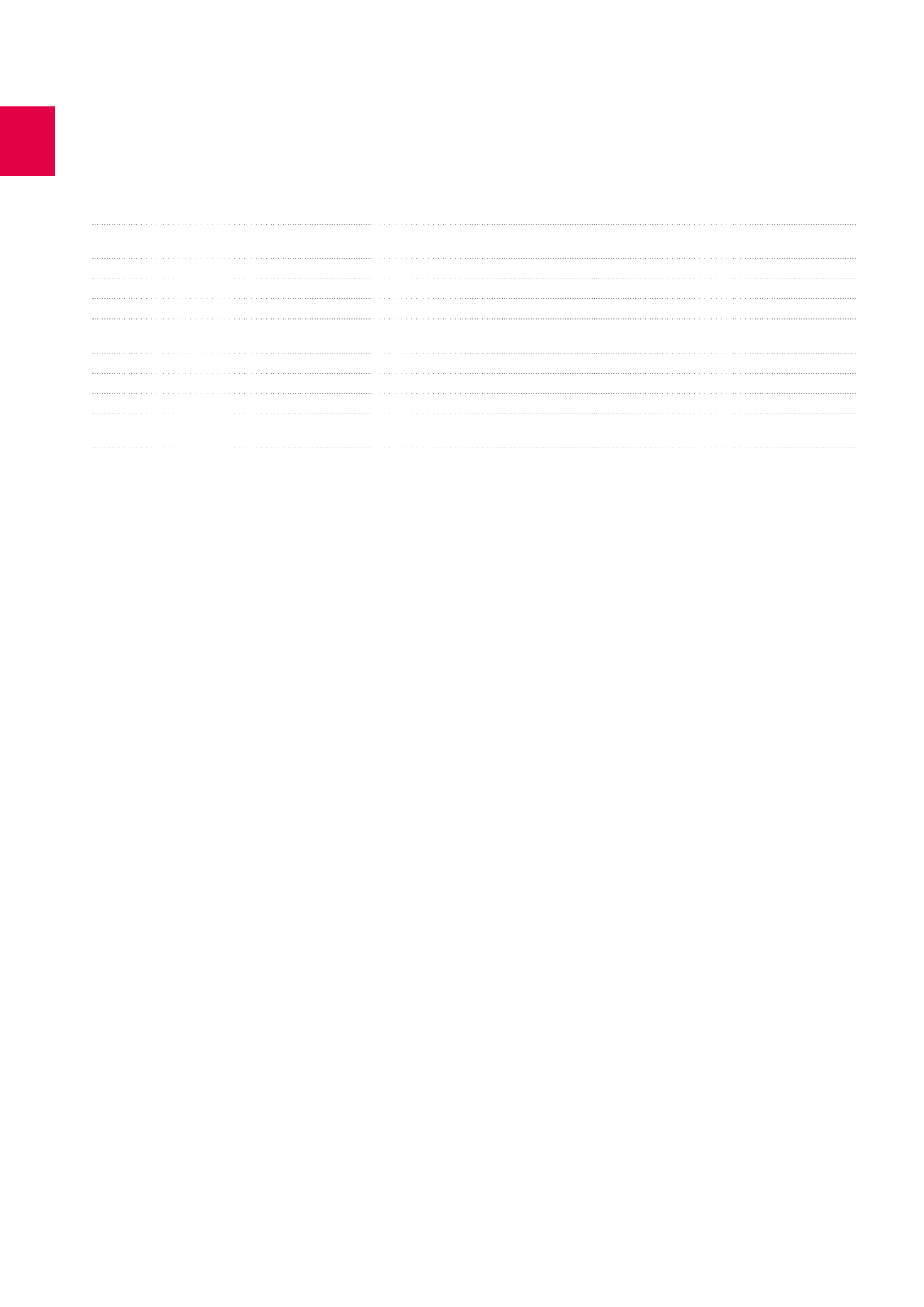

Attendance and remuneration of the non-executive Directors

Attendance at

Board meetings

Attendance at

Nomination,

Remuneration

and Corporate

Governance

Committee meetings

Attendance

at Audit

Committee

meetings

Total remuneration

(in EUR)

Number of shares

held at 31.12.2015

André Bergen

8/8

4/4

3/5

100,000

(fixed remuneration)

0

Christophe Demain

4/8

-/-

-/-

30,000

0

Xavier de Walque

8/8

-/-

5/5

56,000

0

Chevalier Vincent Doumier

8/8

-/-

5/5

49,750

257

Robert Franssen

(end of term on 13.05.2015)

2/4

-/-

-/-

15,000

350

Gaëtan Hannecart

6/8

4/4

-/-

50,300

0

Inès Reinmann-Toper

7/8

-/-

5/5

47,250

0

Alain Schockert

6/8

-/-

-/-

35,000

0

Kathleen Van den Eynde

(start of term on 13.05.2015)

4/4

-/-

-/-

21,666

0

Baudouin Velge

8/8

4/4

-/-

49,050

0

Remuneration and Corporate Governance Committee. In principle, “tar-

get” variable remuneration is 50% of the fixed annual remuneration, but

can be higher without ever exceeding 75%. The variable remuneration

is only paid once the budget has been attained up to at least 80%.

The verification of the degree of achievement of the financial criteria

is done on the basis of accounting and financial data analysed by

the Audit Committee. The Nomination, Remuneration and Corporate

Governance Committee calculates what the variable remuneration

could be on the basis of the degree of achievement of the goals. This

calculation only serves as a guide for the definitive setting of the vari-

able remuneration. Indeed, this will also take into account the specific

situation of the company and of the market in general. The Nomination,

Remuneration and Corporate Governance Committee then draws

up a variable remuneration proposal and submits it to the Board of

Directors, which in turn assesses the work of the Executive Committee,

and definitively determines the amount of the variable remuneration to

be granted.

There are no provisions concerning the recovery right of variable

remunerations paid based on inexact financial data other than civil law

provisions, being the application of the principle of undue payment.

For financial year 2015, the performance assessment criteria were:

•

net current result per share (25%);

•

debt management (20%);

•

operational management of large projects (15%);

•

office portfolio occupancy rate (10%);

•

cost/income ratio (10%);

•

other (20%).

Remuneration of the Executive

Directors

The remuneration package of the members of the Executive

Committee comprises the following elements:

•

fixed remuneration;

•

variable compensation, including variable remuneration in cash, and

the bonus share plan;

•

the stock options plan;

•

the savings and provident scheme, the pension promises and other

benefits.

Fixed remuneration

The fixed remuneration of the members of the Executive Committee is

determined according to their individual duties and skills. It is allocated

independently of any result and is not indexed. It covers their services

as members of the Board of Directors and their attendance at the

various committee meetings. Mr. Jean-Edouard Carbonnelle, Mr. Xavier

Denis, Mr. Jérôme Descamps and Mrs. Françoise Roels attend meetings

of the Audit Committee, and Françoise Roels attends meetings of the

Nomination, Remuneration and Corporate Governance Committee,

although they are not members of those committees.

Variable remuneration

The variable remuneration is intended to remunerate the collective and

individual contribution of the members of the Executive Committee.

Its amount is determined on the basis of the actual achievement of

financial and quality objectives set and assessed annually by the

Board of Directors on the proposal of the Nomination, Remuneration

and Corporate Governance Committee. These objectives are set

according to criteria, weighted depending upon their importance,

approved by the Board of Directors on the proposal of the Nomination,

124

Corporate governance statement /

REMUNERATION REPORT