The group insurance takes the form of a life policy and “1 year term

life” cover. This is recalculated annually and guarantees a death

benefit equal to, at the choice of the beneficiary, 0, 0.5, 1, 1.8, 2.7, 3.6

or 4.5 times the reference remuneration (i.e. the total sum of the fixed

remuneration allocated regularly plus an end-of-year bonus). The

overall annual budget is firstly assigned to the “Death” component and

the outstanding amount to the “Retirement” component. Liquidation at

term may take place, at the discretion of the beneficiary, in the form of

a lump sum or annuity.

In addition, the members of the Executive Committee have access to

an “Individual pension commitment” insurance plan intended exclu-

sively to pay a life insurance benefit or death benefit.

Other benefits

The annual costs of medical cover come to 4,107 EUR for the CEO

and 7,037 EUR for the other members of the Executive Committee.

Cofinimmo provides them with a company vehicle whose annual cost

for the company does not exceed 15000 EUR (excluding fuel). The

company reimburses them for all professional expenses they incur in

the context of their function. The members of the Executive Committee

also have a mobile phone at their disposal. The remuneration allocated

in this way to the members of the Executive Committee covers all the

benefits received within the Cofinimmo Group.

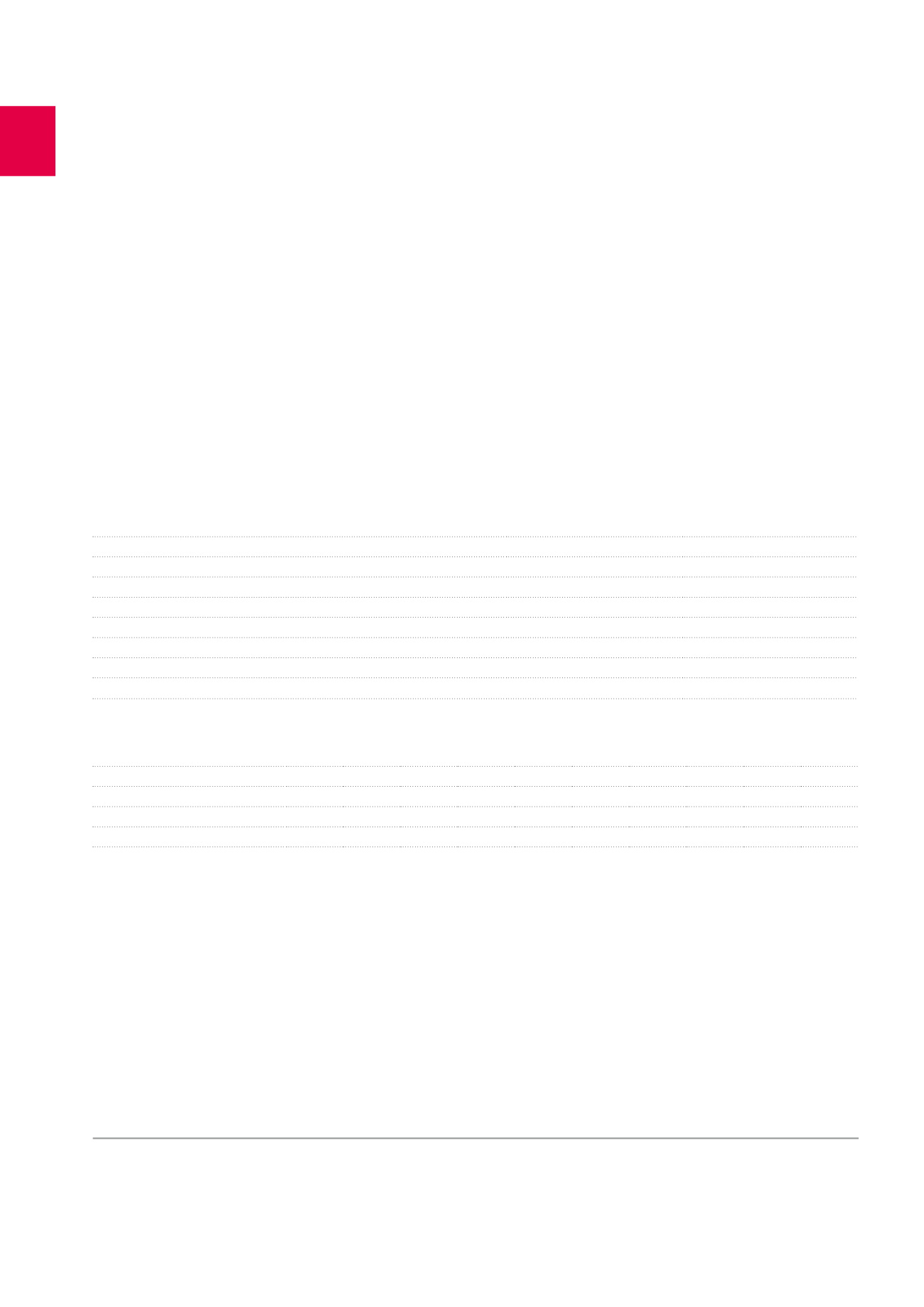

Remuneration of the Executive

Directors for financial year 2015

(in EUR)

CEO

1

Other members of the

Executive Committee

2

Fixed remuneration

349,300

760,000

Variable remuneration for the financial year

Total amount

209,580

468,000

in cash/in pension promises

104,790

234,000

in stock units

104,790

234,000

Savings and provident scheme

62,000

186,000

Other benefits

3

30,676

92,560

TOTAL REMUNERATION

651,556

1,506,560

Stock options granted

and accepted

4

Plan

2015

Plan

2014

Plan

2013

Plan

2012

Plan

2011

Plan

2010

Plan

2009

Plan

2008

Plan

2007

Plan

2006

Jean-Edouard Carbonnelle

2,050 2,050

1,600

1,600

1,350

1,350

1,350

1,350

1,350 1 ,350

Xavier Denis

0

0

0

-/-

-/-

-/-

-/-

-/-

-/-

-/-

Jérôme Descamps

1,600

-/-

-/-

-/-

-/-

-/-

-/-

-/-

-/-

-/-

Françoise Roels

1,600

0

0

1,600

1,350

1,000

1,000

1,000

1,000 1,000

1

-/- indicates that the concerned person being not any more, or not yet, member of the Executive Committee on the day of granting of the bonus shares.

2

The fair value of the ordinary share as at the provisional allocation date of 04.02.2016 being 96.53 EUR.

3

The fair value of the ordinary share as at the provisional allocation date of 05.02.2015 being 104.74 EUR, and the fair value of the ordinary share as at the final allocation date of

01.03.2016, being 97.70 EUR; the 2016 payable amount is increased with the gross dividend attributed since the provisional allocation date.

4

The fair value of the ordinary share at the provisional allocation date of 06.02.2014 being 87.28 EUR. and the fair value of the ordinary share as at the final allocation dates of 01.03.2015

and 01.03.2016 being respectively 109.16 EUR and 97.70 EUR. The in 2015 and 2016 payable amounts are increased with the gross dividend attributed since the provisional allocation

date.

5

Beginning 01.10.2014.

126

Corporate governance statement /

REMUNERATION REPORT