141

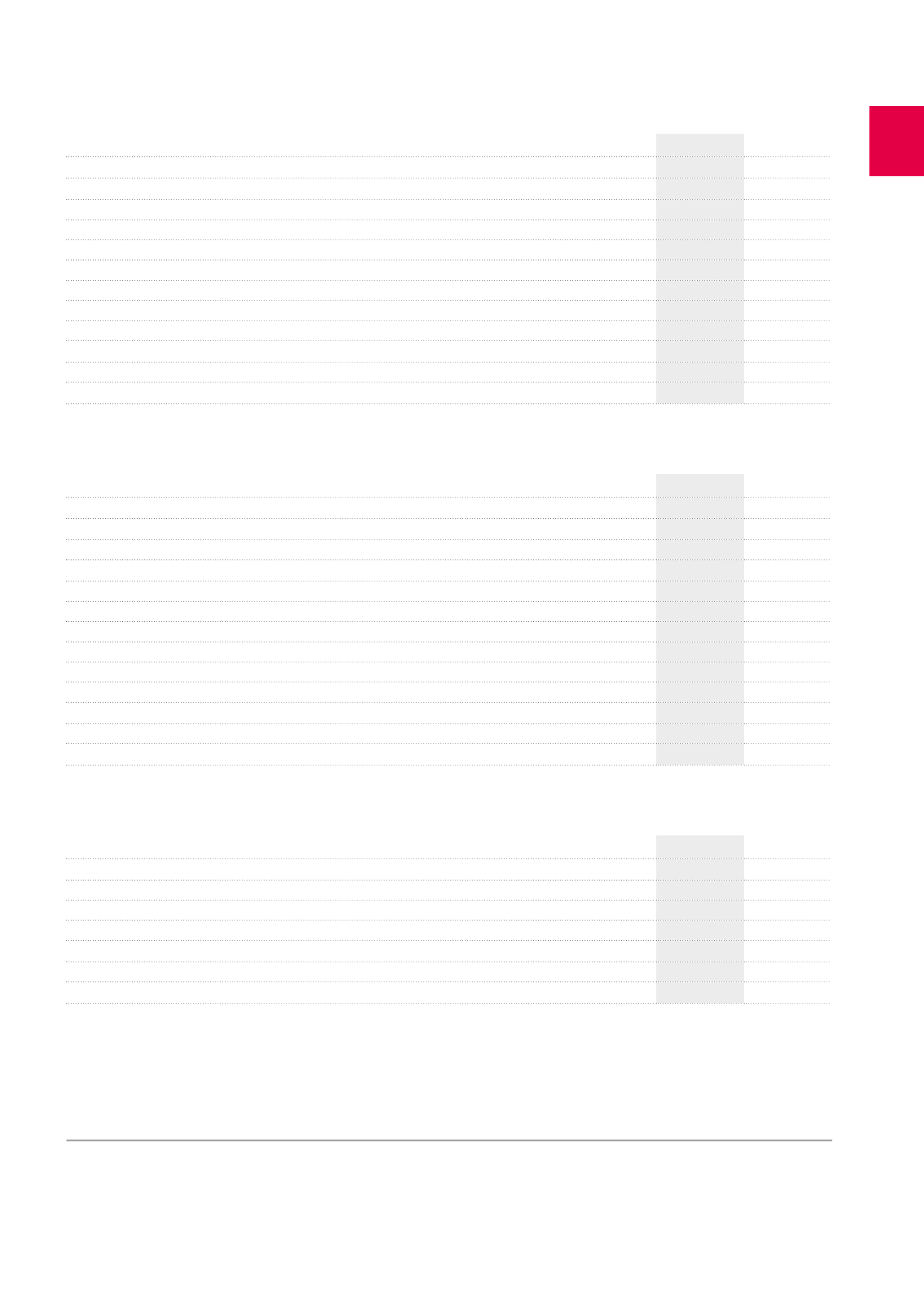

EPRA Earnings and EPRA Earnings per share

1

(x 1,000 EUR)

2015

2014

IFRS earnings per financial statements

103,967

-52,671

Adjustments to calculate EPRA Earnings, to exclude:

24,551

173,150

(i) Changes in fair value of investment properties and properties held for sale

8,620

5,455

(ii) Gains or losses on disposal of investment properties

-22,424

22,441

(v) Goodwill impairment

7,100

11,000

(vi) Changes in fair value of financial instruments (IAS 39)

30,403

136,143

(vii) Costs & interest on acquisitions and joint ventures

1,458

176

(viii) Deferred taxes in respect of EPRA adjustments

-248

-926

(x) Minority interests in respect of the above adjustments

-357

-1,140

EPRA Earnings

128,518

120,479

Number of shares

19,888,379

17,971,494

EPRA EARNINGS PER SHARE (IN EUR)

6.46

2

6.70

2

EPRA Net Asset Value (NAV)

(x 1,000 EUR)

2015

2014

NAV per financial statements

1,860,098

1,541,972

NAV per share per financial statements

88.66

85.80

Effect of the exercise of options, convertible debts or other equity instruments

0

3

0

3

Diluted NAV, after the exercise of options, convertible debts and other equity instruments

1,860,098

1,541,972

To include:

(i) Revaluation at fair value of finance lease receivables

4

50,030

53,387

To exclude:

(i) Fair value of the financial instruments

85,097

125,164

(ii) Deferred taxes

35,900

36,149

(iii) Goodwill as a result of deferred taxes

-70,348

-72,648

EPRA NAV

1,960,777

1,684,024

Number of shares

21,006,682

3

17,993,679

3

EPRA NAV PER SHARE (IN EUR)

34

2

59

2

EPRA Triple Net Asset Value (NNNAV)

(x 1,000 EUR)

2015

2014

EPRA NAV

1,960,777

1,684,024

To include:

(i) Fair value of the financial instruments

-85,097

-125,164

(iii) Deferred taxes

34,448

36,498

EPRA NNNAV

1,910,128

1,595,358

Number of shares

21,006,682

3

17,993,679

3

EPRA NNNAV PER SHARE (IN EUR)

90.93

88.66

1

The summary and the comments on the consolidated income statements are on page 22 and 23 of the currect Annual Financial Report.

2

The EPRA diluted Result per share amounts to 6.46 EUR in 2015 and to 6.70 in 2014. Indeed, in accordance with the “EPRA Best Practices Recommendations”, the bonds redeemable in

shares issued in 2011 and the convertible bonds issued in 2011 and 2013 being out-of-the-money at 31.12.2015 and at 31.12.2014, are not taken into account in the calculation of the EPRA

diluted Result of 2015 and 2014.

3

In accordance with the “EPRA Best Practices Recommendations”, the bonds redeemable in shares issued in 2011 and the convertible bonds issued in 2011 and 2013 being out-of-the-

money at 31.12.2015 and at 31.12.2014, are not taken into account in the calculation of the EPRA VAN and VANNN at these dates.

4

The EPRA VAN and VANNN calculation has been reviewed at the end of 2015, in order to consider the fair value of the receivables from finance leases, in accordance with the “EPRA Best

Practices Recommendations”. The EPRA VAN and VANNN on 31.12.2014 have been calculated, in order to take this element into account.