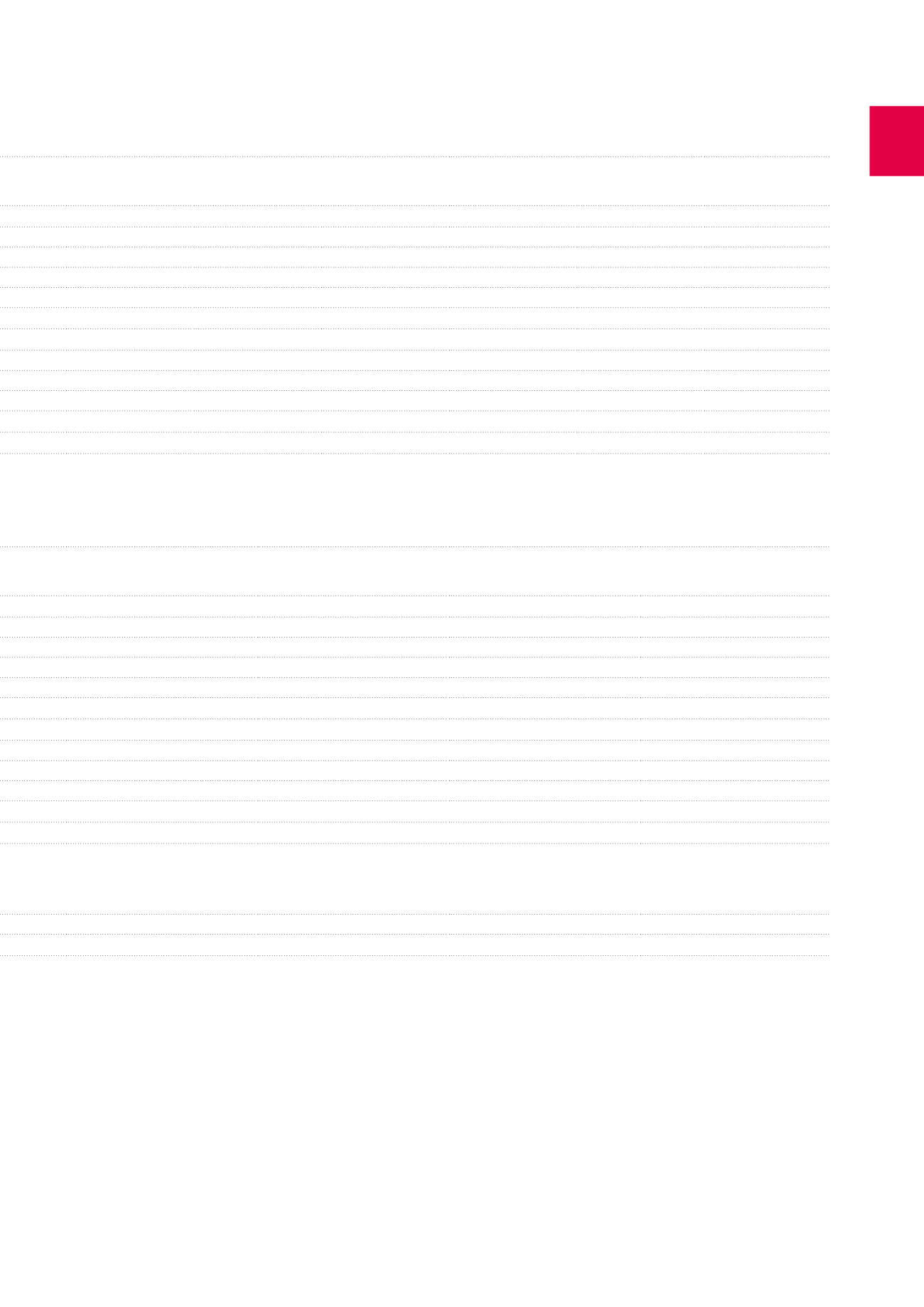

2014

Gross rental income

for the period

2

Net rental income for

the period

Available rental

space (in m²)

Passing rent at the

end of the period

ERV

3

at the end of

the period

Vacancy rate at the

end of the period

77,253

77,220

682,461

82,257

83,351

0.86%

48,926

48,894

429,087

50,950

49,152

0.00%

26,796

26,795

210,544

24,880

28,112

2.49%

1,462

1,462

38,193

5,594

5,254

0.39%

69

69

4,637

833

833

0.00%

93,763

90,355

654,115

87,814

94,130

9.96%

38,084

38,084

420,755

37,585

35,717

1.71%

19,856

19,856

312,811

19,583

18,229

1.06%

10,255

10,255

48,076

10,271

9,177

1.29%

7,973

7,973

59,868

7,731

8,311

3.60%

4,502

4,452

23,026

4,411

4,237

0.18%

213,602

210,111

1,780,357

212,065

217,435

4.93%

2014

Fair value of the portfolio

Changes in the fair value

over the period

EPRA Net Initial Yield

Changes in fair value

over the period (%)

1,267,662

9,748

6.22%

0.78%

804,955

6,672

6.14%

0.84%

375,417

454

6.20%

0.12%

75,890

1,754

7.15%

2.37%

11,400

868

6.95%

8.25%

1,246,275

-12,826

5.75%

-1.02%

533,338

-1,270

6.31%

-0.24%

272,202

-508

6.30%

-0.19%

149,396

-1,899

6.27%

-1.26%

111,740

1,137

6.41%

1.03%

62,943

3,727

6.38%

6.29%

3,110,218

-621

6.06%

-0.02%

88,965

-4,834

3,199,183

-5,455

145