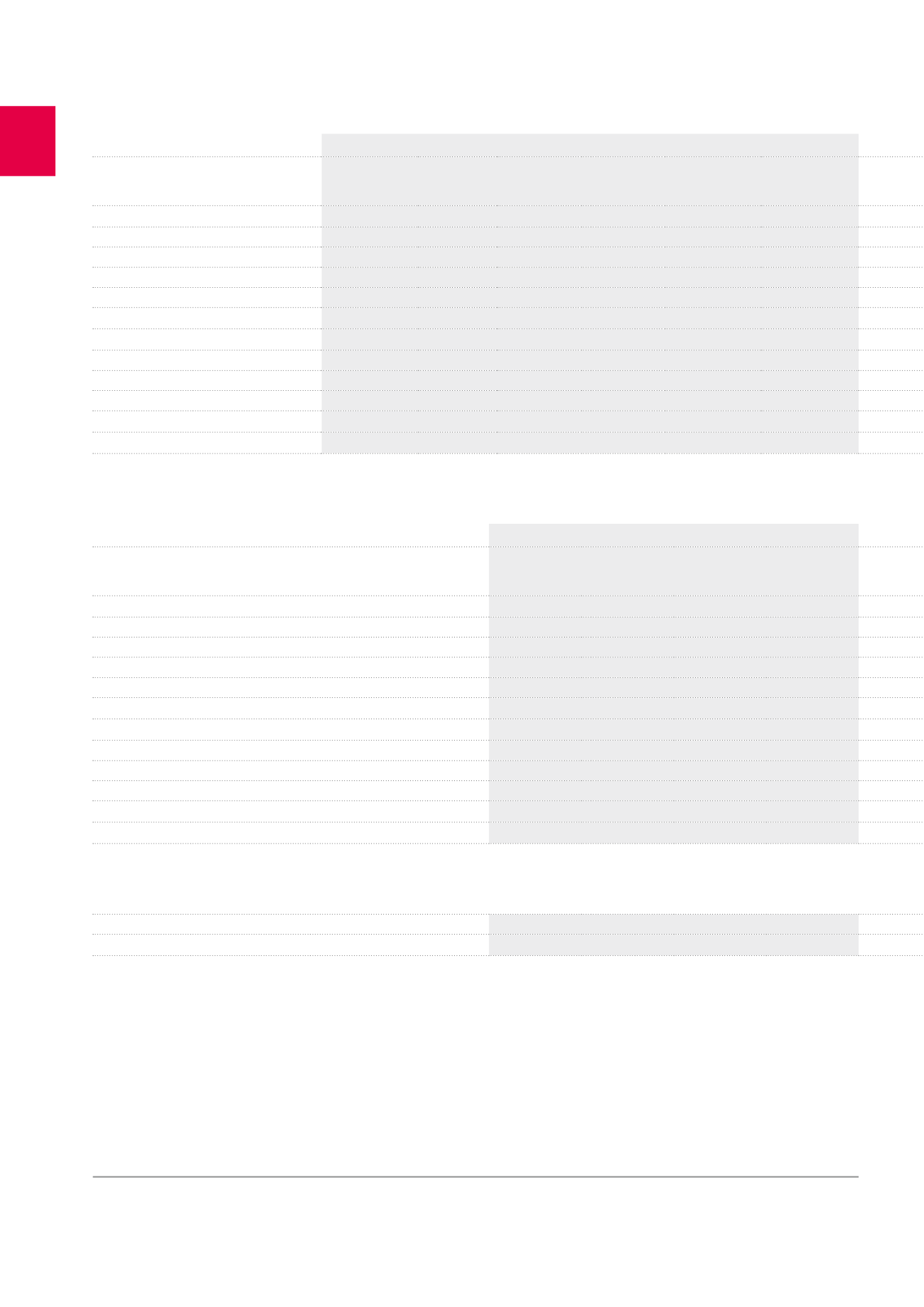

Investment properties - Rental data

1

(x 1,000 EUR)

2015

Segment

Gross rental

income for the

period

2

Net rental

income for

the period

Available

rental space

(in m²)

Passing rent

at the end of

the period

ERV

3

at the end

of the period

Vacancy rate at

the end of the

period

Healthcare real estate

88,942

88,468

660,316

84,752

87,226

0.83%

Healthcare real estate Belgium

54,247

53,786

376,785

48,139

46,519

0.00%

Healthcare real estate France

24,897

24,895

210,544

24,897

29,368

2.38%

Healthcare real estate Netherlands

6,730

6,719

50,253

7,035

6,658

0.31%

Healthcare real estate Germany

3,068

3,068

22,734

4,681

4,681

0.00%

Offices

86,876

83,134

635,787

85,937

92,842

10.66%

Property of distribution networks

37,567

37,566

417,111

37,616

35,620

2.15%

Pubstone Belgium

19,630

19,629

309,557

19,672

18,225

1.49%

Pubstone Netherlands

10,218

10,218

47,953

10,178

9,092

2.60%

Cofinimur I France

7,719

7,719

59,601

7,766

8,303

3.13%

Other

2,031

1,961

15,830

1,915

1,772

0.00%

TOTAL PORTFOLIO

215,416

211,129 1,729,044

210,220

217,460

5.23%

Investment properties - valuation data

4

(x 1,000 EUR)

2015

Segment

Fair value of

the portfolio

Changes in the

fair value over

the period

EPRA Net

Initial Yield

Changes in fair

value over the

period (%)

Healthcare real estate Belgium

1,315,567

20,485

6.16%

1.59%

Healthcare real estate Belgium

770,419

10,733

6.05%

1.41%

Healthcare real estate France

378,825

3,354

6.14%

0.89%

Healthcare real estate Netherlands

99,242

4,258

6.84%

4.50%

Healthcare real estate Germany

67,081

2,140

6.51%

3.43%

Offices

1,195,625

-30,201

5.65%

-2.46%

Property of distribution networks

536,476

1,229

6.25%

0.23%

Pubstone Belgium

273,326

-418

6.28%

-0.15%

Pubstone Netherlands

147,117

-2,783

6.31%

-1.86%

Cofinimur I France

116,033

4,430

6.12%

3.97%

Other

25,141

655

6.29%

2.67%

TOTAL PORTFOLIO

3,072,809

-7,832

5.98%

-0.25%

Reconciliation with IFRS consolidated income statement

Investment properties under development

61,544

-788

TOTAL

3,134,353

-8,620

1

For more details on the rental data, refer to the property report on page 97.

2

Writeback of lease payments sold and discounted included.

3

ERV = estimated rental value.

4

For more details on the valuation data, refer to the management report in the “Healthcare Real Estate” section on page 48, the “Offices” section on page 58 and the “Property of

Distribution Networks” section on page 66.

144

Data according to the EPRA Principles