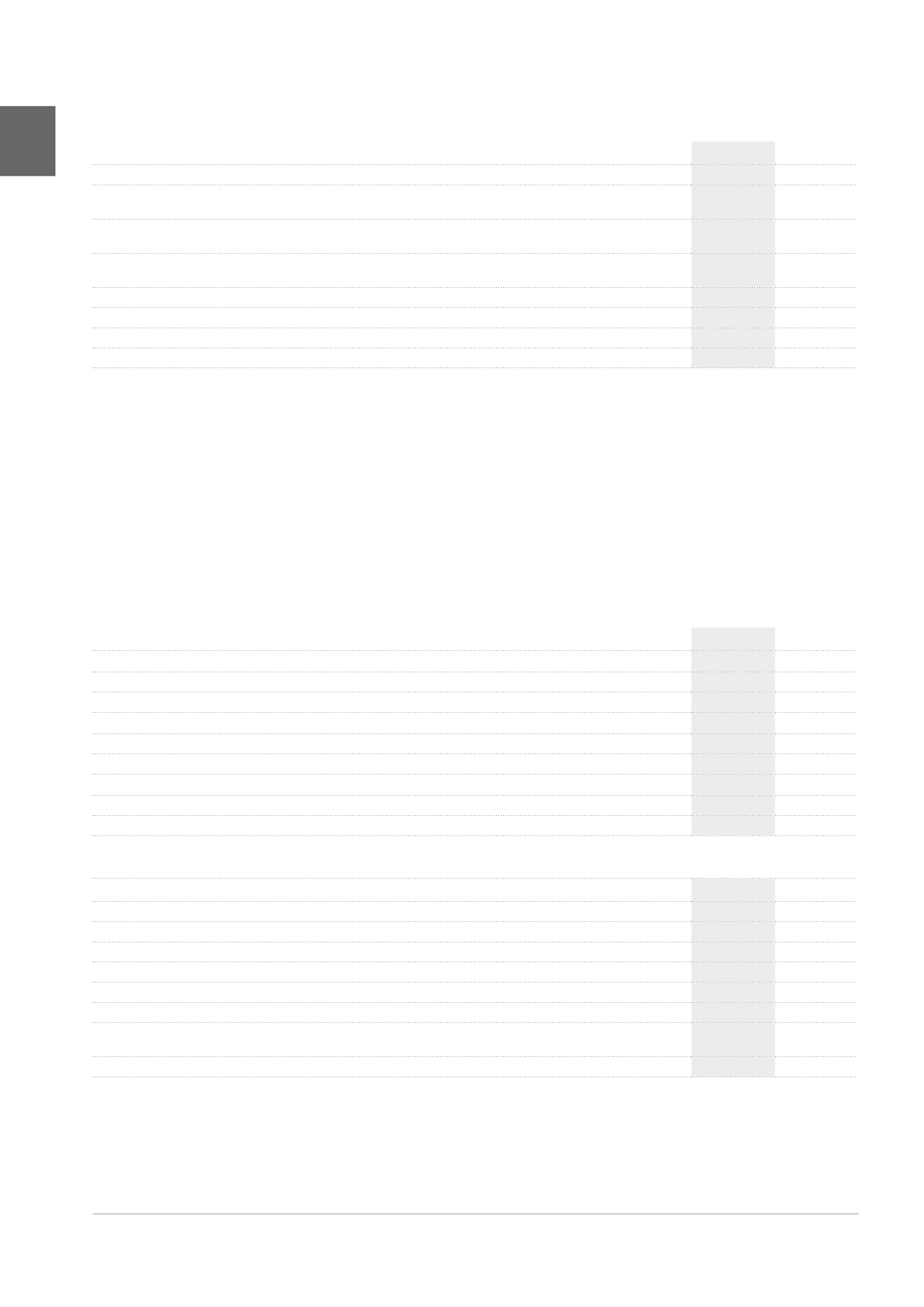

NOTE 31. RESERVES

(x 1,000 EUR)

2015

2014

Reserve for the balance of changes in the fair value of investment properties

-175,817

-127,851

Reserve for the estimated transaction costs and transfer duties resulting from the hypothetical disposal of

investment properties

-71,725

-73,694

Reserve for the balance of changes in the fair value of authorised hedging instruments qualifying for hedge

accounting as defined under IFRS

-9,673

-32,370

Reserve for the balance of changes in the fair value of authorised hedging instruments not qualifying for hedge

accounting as defined under IFRS

-85,175

-13,851

Other

469,987

495,328

Non-distributable reserves

5,212

5,053

Distributable reserves

464,775

490,275

TOTAL

127,597

247,562

The reserves are presented before appropriation of the result of the financial year. The drop of reserves in 2015 is mainly explained by the appro-

priation of the 2014 result and the dividends paid for the financial year 2014.

NOTE 32. RESULT PER SHARE

The calculation of the result per share at balance sheet date is based

on the net current result/net result attributable to ordinary and prefer-

ence shareholders of 97,706 K EUR (2014: -115,655 K EUR)/103,967 K EUR

(2014: -52,671 K EUR) and a number of ordinary and preference shares

outstanding and entitled to share in the result of the period ended

31.12.2015 of 19,888,379 (2014: 17,971,494).

The net current result excluding IAS 39 impact stands at 128,518 K EUR

for the financial year 2015. Per share, this result amounts to 6.46 EUR.

The diluted result per share takes into account the impact of a theoret-

ical conversion of the convertible bonds issued by Cofinimmo, of the

mandatory convertible bonds issued by Cofinimur I and of the stock

options.

1

In accordance with IAS 33, the convertible bonds are excluded from the calculation of the diluted net result of 2014, as they would have an accretive impact on the diluted result

per share. The 2011 convertible bond is taken into account in the calculation of the diluted net result in 2015.

Result attributable to the ordinary and preference shares

(x 1,000 EUR)

2015

2014

Net current result attributable to ordinary and preference shares

97,706

-15,655

Net current result for the period

102,955

-11,146

Minority interests

-5,248

-4,509

Result on portfolio attributable to ordinary and preference shares

6,261

-37,016

Result on portfolio for the period

5,495

-38,147

Minority interests

766

1,131

Net result attributable to ordinary and preference shares

103,967

-52,671

Net result for the period

108,449

-49,293

Minority interests

-4,482

-3,378

Diluted result per share

(in EUR)

2015

2014

Net result - Group share

103,966,729 -52,670,758

Number of ordinary and preference shares entitled to share in the result of the period

19,888,379

17,971,494

Net current result per share - Group share

4.91

-0.87

Result on portfolio per share - Group share

0.32

-2.06

Net result per share - Group share

5.23

-2.93

Diluted current result - Group share

101,109,109 -57,043,668

Number of ordinary and preference shares entitled to share in the result of the period taking into account the

theoretical conversion of the Mandatory Convertiblke Bonds (MCB) and the stock options

20,759,209

1

17,285,009

1

Diluted net result per share - Group share

4.87

1

-3.30

1

194

ANNUAL ACCOUNTS /

Notes to the consolidated accounts