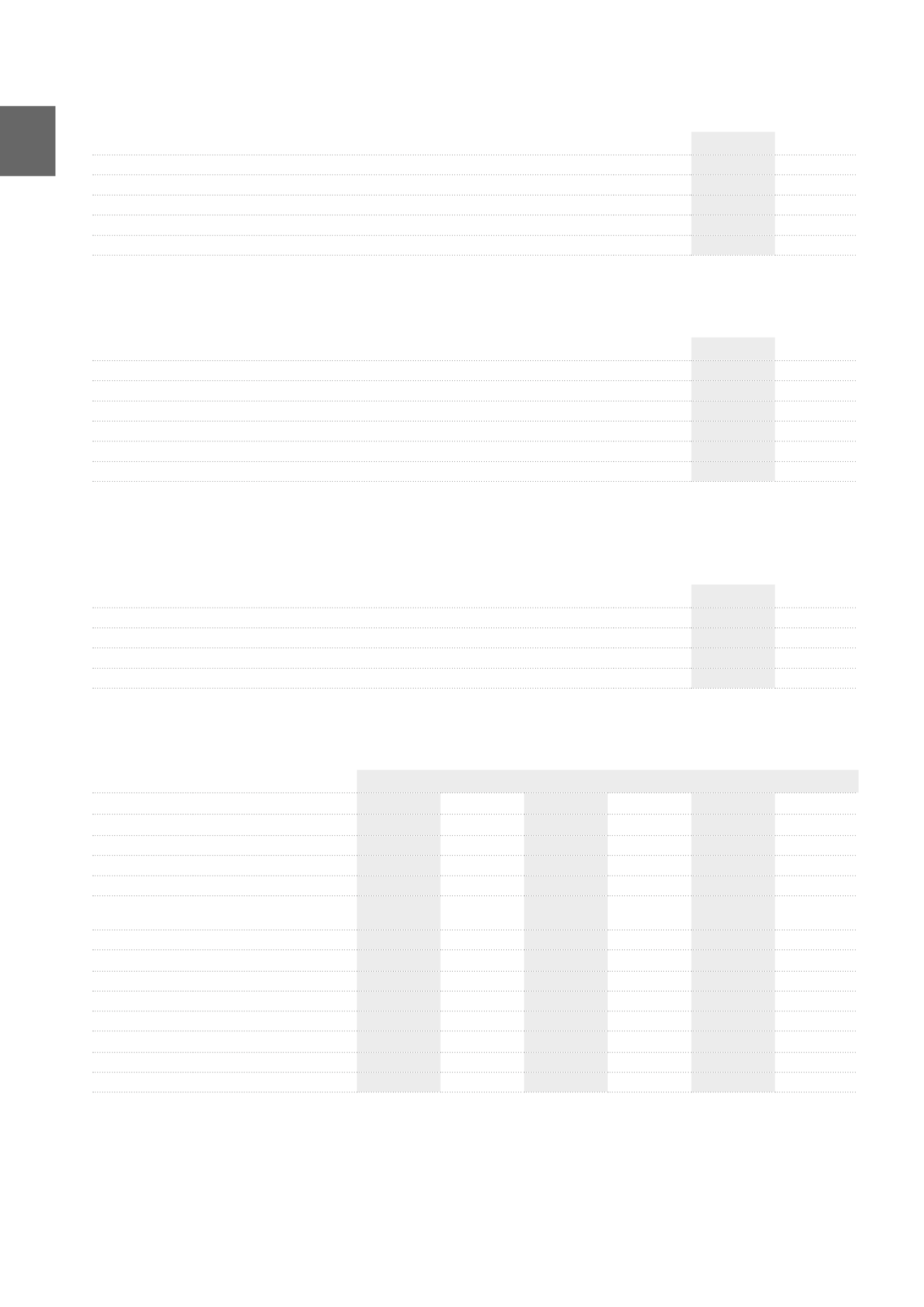

NOTE 28. TAX RECEIVABLES AND OTHER CURRENT ASSETS

(x 1,000 EUR)

2015

2014

Taxes

11,401

13,556

Taxes

1,983

2,394

Regional taxes

2,149

1,444

Withholding taxes

7,269

9,718

Others

5,962

3,949

TOTAL

17,363

17,505

The other current assets are mainly taxes and withholding taxes to be billed back to the tenants.

NOTE 29. DEFERRED CHARGES AND ACCRUED INCOME

(x 1,000 EUR)

2015

2014

Rent-free periods and incentives granted to tenants to be spread

1,473

1,740

Prepaid property charges

15,951

16,938

Prepaid interests and other financial charges

5,898

5,355

TOTAL

23,322

24,033

NOTE 30. SHARE CAPITAL AND SHARE PREMIUMS

(in number)

Ordinary shares

Convertible preference shares

Total

2015

2014

2015

2014

2015

2014

Number of shares (A)

AT 01.01

17,339,423 16,954,002

686,485

688,682 18,025,908 17,642,684

Issued as a result of the optional dividend

383,224

383,224

Capital increase

3,004,318

3,004,318

Conversion of preference shares into ordinary

shares

637

2,197

-637

-2,197

AT 31.12

20,344,378 17,339,423

685,848

686,485 21,030,226 18,025,908

Own shares held by the Group (B)

AT 01.01

54,414

48,917

54,414

48,917

Own shares sold/(purchased) - net

-4,300

5,497

-4,300

5,497

AT 31.12

50,114

54,414

50,114

54,414

Number of outstanding shares (A-B)

AT 01.01

17,285,009 16,905,085

686,485

688,682 17,971,494 17,593,767

AT 31.12

20,294,264 17,285,009

685,848

686,485 20,980,112 17,971,494

Provisions for impairment of receivables

(x 1,000 EUR)

2015

2014

AT 01.01

317

353

Use

-92

-39

Provisions charged to the income statement

1,220

44

Provision writebacks credited to income statement

-41

AT 31.12

1,445

317

192

ANNUAL ACCOUNTS /

Notes to the consolidated accounts