For the years 2016 to 2022, Cofinimmo projects to maintain a property

portfolio partially financed through debt. The company will thus owe

an interest flow to be paid, which forms the element covered by the

derivative financial instruments held for trading described above. At

31.12.2015, Cofinimmo’s debt amounted to 1,255 million EUR. Based on

future projections, this debt will be 1,420 million EUR as at 31.12.2016,

1,434 million EUR at the end of 2017 and 1,470 million EUR at the end of

2018.

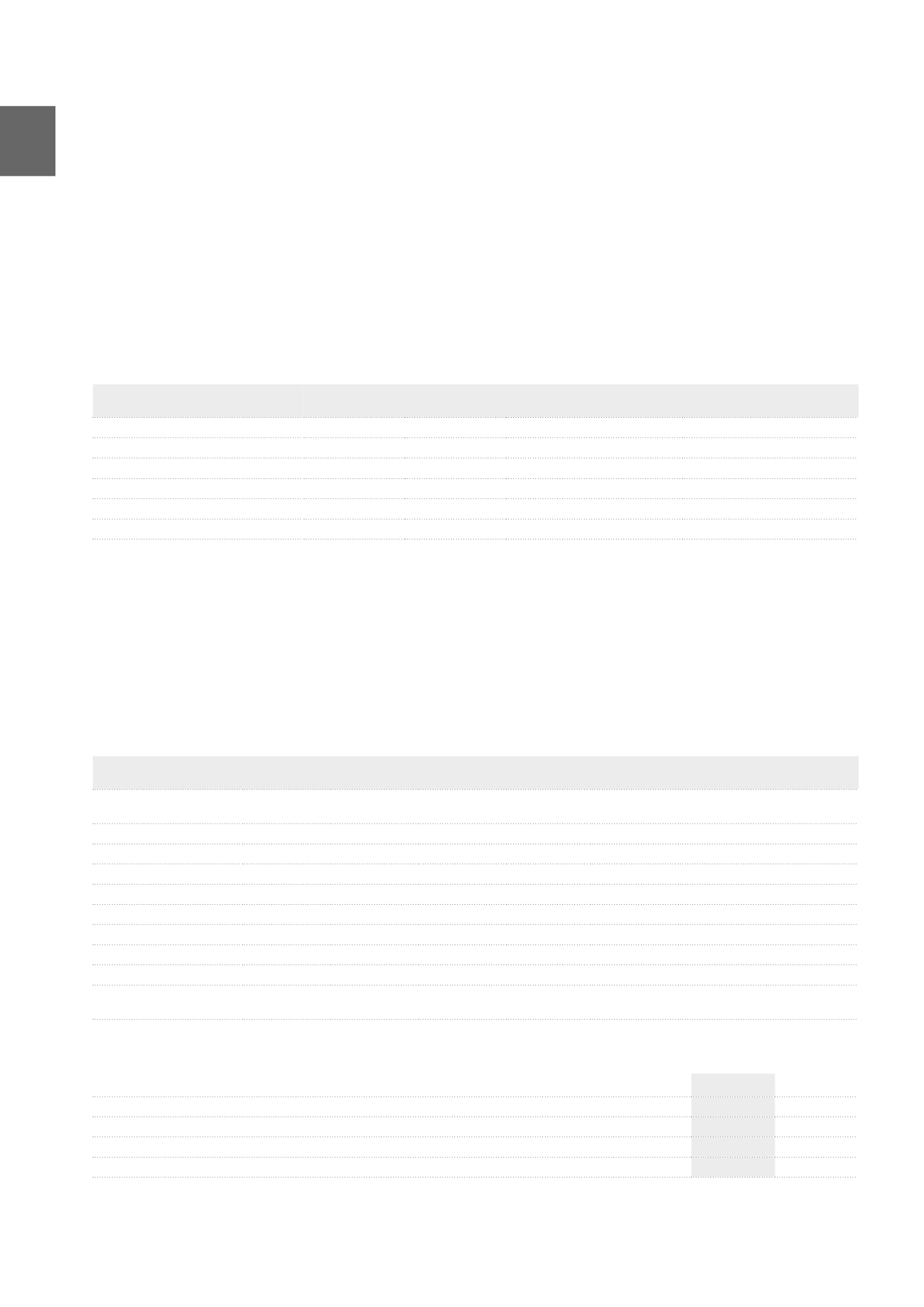

Financial instruments held for trading

The Group contracted a Cancellable Interest Rate Swap. This instru-

ment, recognised as trading, is made up of a classic IRS (here: fixed

payer) and a short position in an option that allows the counterparty

to cancel this Swap as from a certain date. The sale of this option

allowed to reduce the guaranteed fixed rate during the entire period.

Cash flow hedge

Period

Option Exercise price

2015 notional amount

(x 1,000 EUR)

2014 notional amount

(x 1,000 EUR)

2015

CAP bought

4.25%

0

400,000

2016

CAP bought

4.25%

0

400,000

2017

CAP bought

4.25%

0

400,000

2015

FLOOR sold

3.00%

0

400,000

2016

FLOOR sold

3.00%

0

400,000

2017

FLOOR sold

3.00%

0

400,000

At 31.12.2015, Cofinimmo had a floating-rate debt for a notional amount

of 560million EUR. This amount was hedged against interest rate risk

with IRS swaps for a notional amount of 540million EUR. During 2015,

in addition to the hedging positions cancelled in May2014, following

the decline in debt and given the persistence of low interest rates,

Cofinimmo deemed it opportune to cancel the corridor fixed between

3.00% and 4.25%, made up of CAPs purchased and FLOORs sold for

400million EUR. Consequently, the notional amount at 31.12.2015 is nil

(2014: 400million EUR), as detailed in the table below. Therefore, at

the end of 2015, there are no longer derivatives considered cash flow

hedging instruments.

The total cost of this restructuring amounted to 32.1 million EUR.

The cancellation of FLOOR options will result in a decrease in interest

charges paid in the coming years.

Following this restructuring, a charge of 19.0 million EUR has been

booked in 2015 under “Valorisation of financial instruments” of the

income statement.

At the end of 2015, a balance of 17.2 million EUR remains open in the

other elements of the global result, which will be covered in the years

2016-2018. In accordance with the hedging accounting rule, the

conversion of the other elements of the global result in the income

statements will only take place at maturity of the hedging instrument.

The cancellation of the FLOOR options will result in a decrease of the

disbursed interest charges in future years.

(x 1,000 EUR)

Period covered by the IRS

Active /

Forward

Option Exercise price Floating Rate 2015 notional

2014 notional

First option

2008-2018

Assets

Cancellable

IRS

4.10%

3M

140,000

140,000

15.10.2011

2014-2017

Assets

IRS

0.51%

3M

400,000

400,000

2018

Forward

IRS

2.11%

1M

660,000

660,000

2019

Forward

IRS

2.37%

1M

800,000

800,000

2018-2019

Forward

IRS

2.18%

1M

200,000

200,000

2020

Forward

IRS

0.86%

1M

350,000

2021

Forward

IRS

1.00%

1M

150,000

2022

Forward

IRS

1.31%

1M

150,000

2020-2022

Forward

IRS

2.73%

1M

500,000

500,000

2012-2016

(fixed to floating)

Forward

IRS

3.60% 3M+300.5 bps

100,000

100,000

Obligation of liquidity for repayments, related to derivative financial instruments

(x 1,000 EUR)

2015

2014

Between one and two years

-18,098

-37,372

Between two and five years

-56,111

-54,410

Beyond five years

-17,146

-26,114

TOTAL

-91,356

-117,896

188

ANNUAL ACCOUNTS /

Notes to the consolidated accounts