Fair value of financial assets and liabilities

1

After initial recognition, financial instruments are measured at

fair value on the balance sheet. This fair value can be presented

according to three levels (1 to 3). The allocation of the level depends

on the degree of observability of the variables used for the measure-

ment of the instrument, i.e.:

•

The level 1 fair value measurements are those derived from listed

prices (unadjusted) in active markets for similar assets or liabilities;

•

The level 2 fair value measurements are those established using

observable data for the assets or liabilities concerned. These data

may be either “direct” (prices, other than those covered by level 1)

or “indirect” (data derived from prices);

•

The level 3 fair value measurements are those that are not based

on observable market data for the assets or liabilities in question.

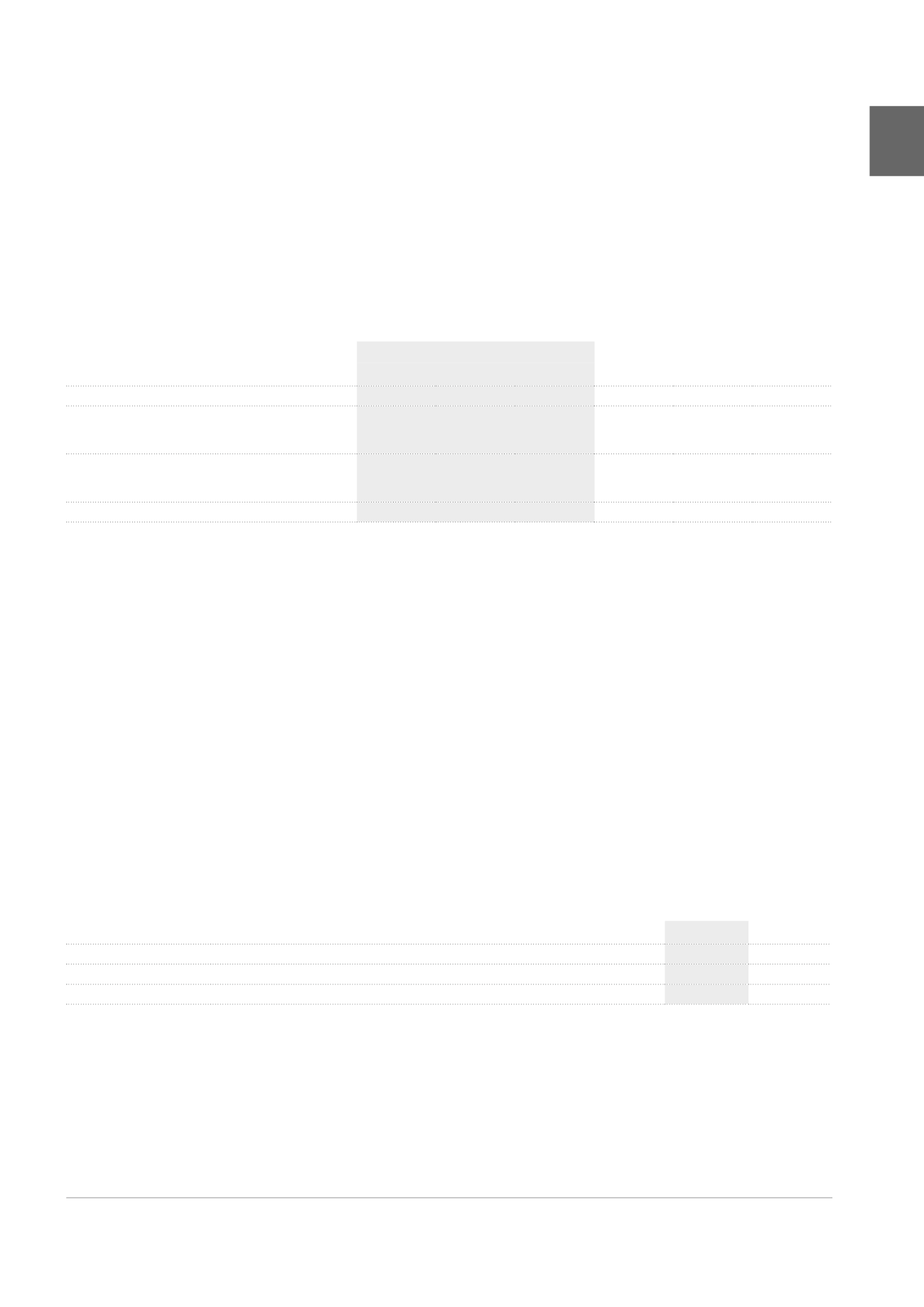

Changes in the fair value of the convertible bonds

(x 1,000 EUR)

2015

2014

Convertible 1 Convertible 2

Total Convertible 1 Convertible 2

Total

AT 01.01

178,675

202,716

381,391

178,072

195,063

373,135

Residual change in fair value attributable to changes

in credit riskof the instrument recognised during the

financial year

-506

9,173

8,667

578

-3,000

-2,422

Change in fair value attributable to changes in market

conditions generating a market risk (interest rate,

share prices) during the financial year

-3,398

890

-2,508

25

10,653

10,678

AT 31.12

174,771

212,779

387,550

178,675

202,716

381,391

Level 1

The convertible bonds issued by Cofinimmo are the subject of a level 1 valuation.

At 31.12.2015, the convertible bonds have a total fair value of

387,550,292 EUR. If the bonds are not converted into shares, the

redemption value will amount to 364,147,180 EUR at final maturity.

Level 2

All other financial assets and liabilities, namely the financial deriva-

tives stated at fair value, are level 2. The fair value of financial assets

and liabilities with standard terms and conditions and negotiated

on active and liquid markets is determined based on stock market

prices. The fair value of “Trade receivables”, “Trade debts”, “Loans

to associated companies” as well as any other floating-rate debt is

close to their book value. Bank debts are primarily in the form of roll-

over credit facilities. The calculation of the fair value of “Finance lease

receivables” and “Swaps” derivatives is based on the discounted

cash flow method, using a yield curve adapted to the duration of the

instruments.

More details on the finance lease receivables can be found in Note 25.

Level 3

Cofinimmo currently does not hold any financial instrument meeting

the definition of level 3.

B. MANAGEMENT OF FINANCIAL RISK

Interest rate risk

Since the Cofinimmo Group owns a (very) long-term property portfolio,

it is highly probable that the borrowings financing this portfolio will

be refinanced upon maturity by other borrowings. Therefore, the

company’s total financial debt is regularly renewed for an indefinite

future period. For reasons of cost efficiency, the group’s financing

policy by debt separates the raising of borrowings (liquidity and

margins on floating rates) from the management of interest rates

risks and charges (fixing and hedging of future floating interest rates).

Generally, funds are borrowed at a floating rate. Some borrowings

contracted at a fixed rate have been converted into a floating rate

through interest rate swaps. The goal of this is to take advantage of

low short-term rates.

1

For more details on the changes that occurred during 2015, and on the composition and conditions of our bonds, we also recommend reading the “Management of Financial

Resources” chapter of this Annual Financial Report.

2

Non-current and current.

Allocation of borrowings

2

at floating rate and at fixed rate (calculated on their nominal values)

(x 1,000 EUR)

2015

2014

Floating-rate borrowings (incl. 100,000 EUR of bonds converted into floating rate)

561,000

1,119,200

Fixed-rate borrowings

653,820

464,283

TOTAL

1,214,820 1,583,483

185