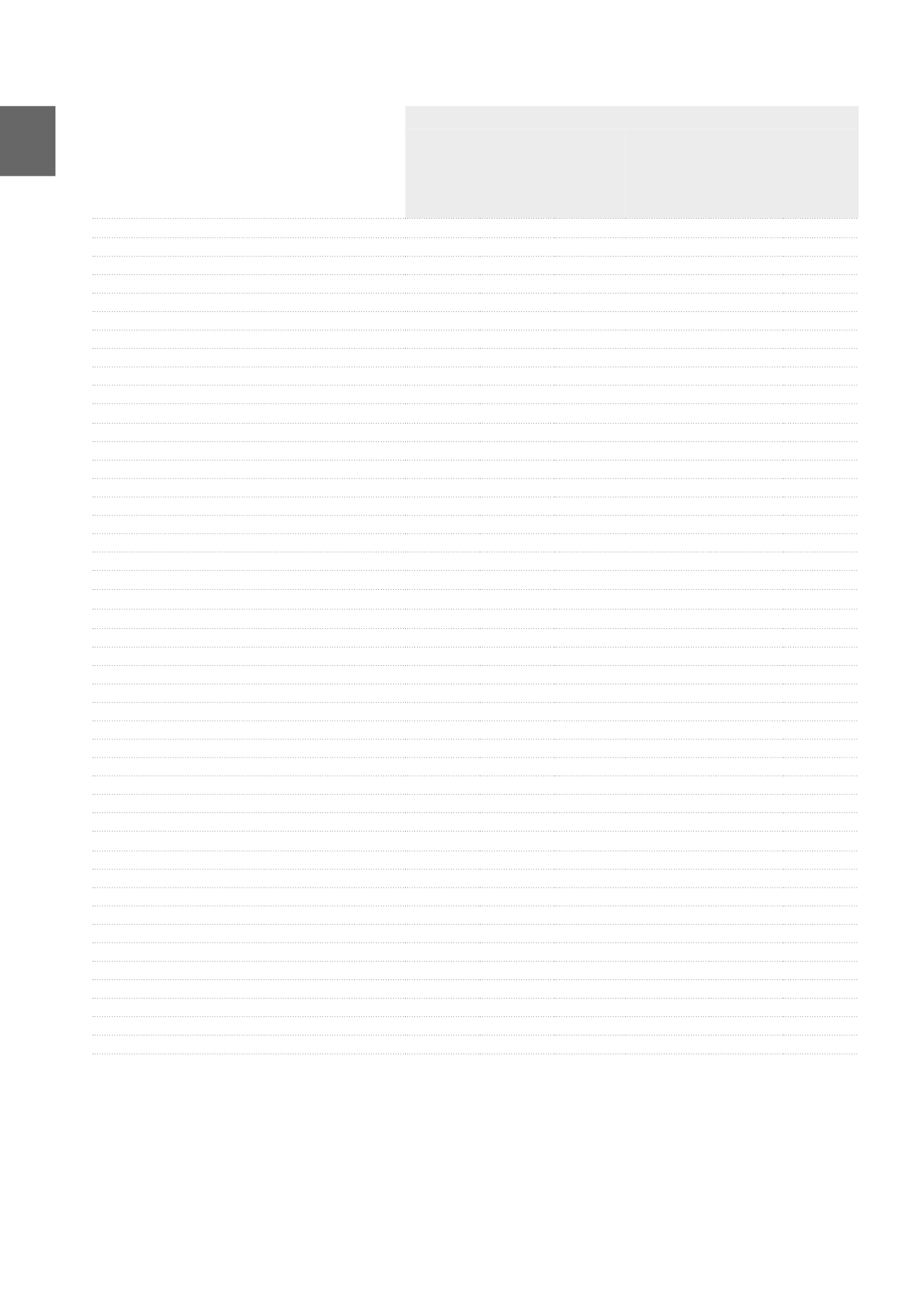

(x 1,000 EUR)

31.12.2014

Designated

in a hedging

relationship

Designated

at fair value

through the

net result

Held for

trading

Loans,

receivables

and financial

liabilities at

amortised

cost

Fair value Fair value

qualifica-

tion

Non-current financial assets

1,000

2

93,849 147,153

Hedging instruments

1,000

2

1,002

CAPs

1,000

2

1,002

Level 2

FLOORs

IRS

Credits and receivables

93,849

146,151

Non-current finance lease receivables

78,018

130,320

Level 2

Trade receivables and other non-current assets

38

38

Level 2

Participations in associated companies and joint ventures

5,862

5,862

Level 2

Other

9,931

9,931

Level 2

Current financial assets

498

43,516

45,099

Hedging instruments

498

498

CAPs

FLOORs

IRS

498

498

Level 2

Credits and receivables

26,399

27,484

Current finance lease receivables

1,618

2,703

Level 2

Trade receivables

24,781

24,781

Level 2

Cash and cash equivalents

17,117

17,117

Level 2

TOTAL

1,000

500

137,365 192,252

Non-current financial liabilities

35,941

385,454 66,024

762,644 1,250,063

Non-current financial debts

385,454

762,569 1,148,023

Bonds

190,000

190,000

Level 2

(Mandatory) convertible bonds

385,454

385,454

Level 1

Bank debts

565,420

565,420

Level 2

Rental guarantees received

5,140

5,140

Level 2

Other

2,009

2,009

Level 2

Other non-current financial liabilities

35,941

66,024

101,965

CAPs

390

390

Level 2

FLOORs

35,551

35,551

Level 2

IRS

66,024

66,024

Level 2

Other

75

75

Level 2

Current financial liabilities

480

24,218

533,349

558,047

Current financial debts

473,499

473,499

Commercial papers - fixed rate

15,000

15,000

Level 2

Commercial papers - floating rate

201,500

201,500

Level 2

Bank debts

256,969

256,969

Level 2

Other

30

30

Level 2

Other current financial liabilities

480

24,218

24,698

CAPs

FLOORs

480

480

Level 2

IRS

24,218

24,218

Level 2

Trade debts and other current debts

59,850

59,850

Level 2

TOTAL

36,421

385,454 90,242 1,295,993 1,808,111

184

ANNUAL ACCOUNTS /

Notes to the consolidated accounts